Nevernevergiveup wrote:

Even I got confused by the meaning of D. Can someone explain what is pretax price and how does it impact the conclusion.

Hello,

Nevernevergiveup and

ankitatlnmIt was always helpful to me to rephrase the argument in more simple words for better understanding.

IMHO, in this case, it will be really useful to imagine yourself in this situation:

We are two businessmen. We have a drink and I tell you a story about my business:

"Look, buddy. My sales in 2015 year have fallen by 1%. But still, It was the good business.

But now, in the beginning of 2016, a tax was increased by 0,08 cents and we already lost 10%.

What a bastards work in government: they destroy my business by the tax increasing."

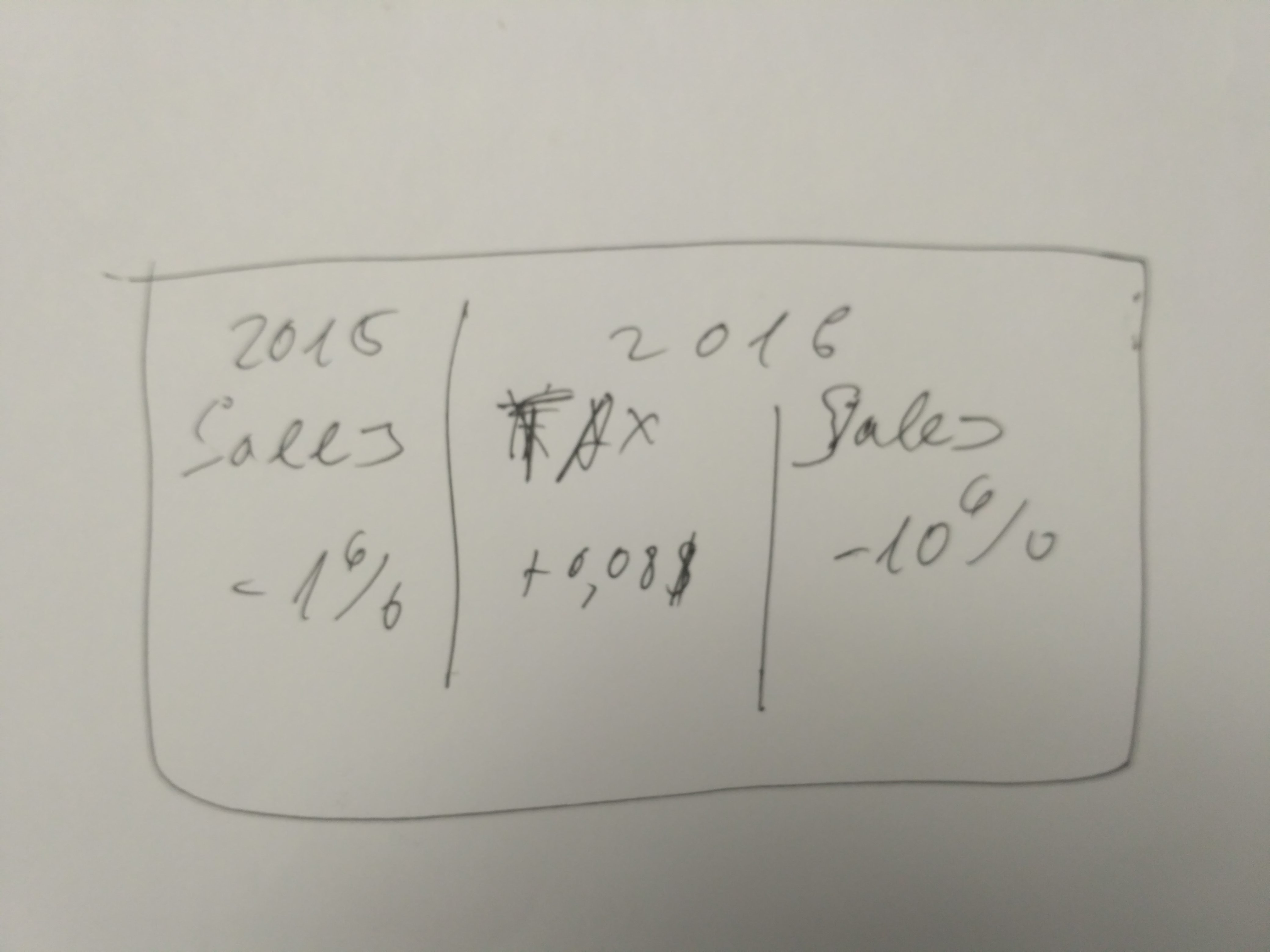

(I also wrote a scheme on the napkin to buttress my words:

Attachment:

2016-07-28 01.01.38.jpg [ 434.79 KiB | Viewed 47807 times ]

2016-07-28 01.01.38.jpg [ 434.79 KiB | Viewed 47807 times ]

Does my speech ring a bell in your mind? As a usual bad businessman, I see the problems only outside and not inside of me.

Sure thing the first questions from you will be:

1) Are you sure that only tax increase is the reason of losing your sales?

2) Or maybe you raised a price on cigarettes at the beginning of 2016 year and because of this, you lost sales?

3) Or maybe your competitors decrease prices on the same cigarettes and you didn't react on this?

4) Or maybe you decide to lower quality of cigarettes and lost your customers because of this

or maybe...

So, we have a link in the businessman's mind: "I lost sales

only because of tax increasing."

We should do something with this link: strengthen, weaken or find an assumption. It doesn't matter. The key is to find a link and work with it.

So, we should find a confirmation that all our four questions about other reasons are wrong and the tax is the

only reason why sales were lost.

Let's analyze answers:

A. During the year following the tax increase, the pretax price of a pack of cigarettes did not increase by as much as it had during the year prior to the tax increase. It looks like a strong contender but here is the example why this is the wrong answer:

2015 - the price of one pack equal to $10 and was increased to $15 .

1% of smokers decide that $15 is too much and stop buying this type of cigarettes.

2016 - tax increase $0,08 and price increase $4,99.

Final price $20,07 - 10% of smokers switch to another type of cigarettes.

This is quite obvious that the main reason for losing sales is not the tax but price increasing.

B. The one percent fall in cigarette sales in the year prior to tax increase was due to a smaller tax increase. It can be true, but what if the price of cigarettes was increased by 10 dollars in 2016?

2015 - the price of one pack equal to $10. 1% of smokers stop buying this type of cigarettes.

2016 - the tax increase $0,08 and price increase by $10.

Who is the guilty? Definitely not the tax.

C. The pretax price of a pack of cigarettes gradually decreased throughout the year before and the year after the tax increase. This answer makes this question very doubtful and maybe this is not a really GMAT Prep question.

I think, authors of this question wanted to say that price was increased

between the years and because of it this answer is wrong.

D. For the year following the tax increase, the pretax price of a pack if cigarettes were not eight or more cents lower than it had been the previous year. Let's negate this one:

2015 - price of pack equal to $1

2016 - tax increase $0,08 and price was lowered on $0,07

The final price equal to 1,01$.

So the businessman did all he can do (he decreased price) but the tax is killed his sales.

E. As the after-tax price of a pack of cigarettes rises, the pretax price also rises.In this case, the price can be the reason why sales were lost.

P.S. During pre-analysing of the question we made questions about quality, competitors and so on.

But when we read the answers we find only variants about prices so we should drop all our ideas about other reasons and focus on prices only.

85%

(hard)

85%

(hard)

49%

(02:28)

wrong

49%

(02:28)

wrong  based on 4289

sessions

based on 4289

sessions