Events & Promotions

| Last visit was: 24 Apr 2024, 22:55 |

It is currently 24 Apr 2024, 22:55 |

Customized

for You

Track

Your Progress

Practice

Pays

10:00 AM EDT

-10:30 AM EDT

10:00 AM PDT

-11:00 AM PDT

10:00 AM IST

-11:00 AM IST

09:55 AM PDT

-11:00 AM PDT

02:00 PM EDT

-03:00 PM EDT

03:00 PM PDT

-04:00 PM PDT

03:00 PM IST

-04:00 PM IST

07:00 PM PDT

-08:00 PM PDT

10:00 AM PDT

-12:00 PM PDT

| FROM Tuck Admissions Blog: Energy 101 |

By Owen Jones T'19 On Friday, October 13, 2017, Tuck’s first-year students enjoyed their first class-less Friday of business school. Many made the most of it by hiking, apple-picking, traveling, brunching, or simply by sleeping in late. Yet, sixteen of us were huddled in a classroom that day to take Energy 101, a one-day course on the basics of the natural gas and power markets in the United States. We were joined by two Thayer School of Engineering graduate students, one professor, one librarian, and two Revers Center for Energy staff members. Sponsored by the Revers Center for Energy, the course was taught by John Ferrare, CEO of Enerdynamics, a company specializing in energy education. Mr. Ferrare, an erstwhile actor turned gas and power guru, has over twenty years of experience in energy industry marketing and communications. His teaching method was energetic and engaging. He moved the course from the basics of energy in the U.S.—how our energy is produced (oil vs. natural gas vs. coal vs. renewables, etc.) and how we consume it (transportation, residential, commercial, or industrial)—to a deep dive into the American natural gas and power (electricity) markets. We learned the basics of natural gas production and why fracking has played such a vital role in cheap gas prices throughout the U.S. We learned about the American natural gas distribution system, and why we should not expect to have a natural gas pipeline to Hanover anytime soon. We learned about different power plants common in the U.S. and the electrical power transmission infrastructure, and why Texas really could be a completely different country (it has its own power infrastructure). Finally, we learned what is actually meant by the term “deregulation” and why it allowed Enron to bankrupt the state of California. Our learning experience was additionally enriched by the wealth of knowledge shared by all of us, the participants ourselves. Many (yours truly included) brought previous industry experience into the classroom and did not hesitate to share, resulting in revelations that surprised even our erudite instructor. On the whole, we were well compensated for sacrificing eight hours of our first Friday off. Despite the constant social-media reminders, delivered via SnapChat by our fellow first-years, of the beautiful autumn weather we were missing, we were happy to have the opportunity to attend Energy 101 and left the classroom that afternoon (perhaps to join our classmates in their fall adventures) with an improved understanding of an industry that impacts nearly every facet of our modern lives. |

| FROM Tuck Admissions Blog: The Value of the MBA Case Competition |

By Stephiney Foley T'18 My first MBA admissions encounter was with Senior Associate Director of Admissions Amy Mitson at Tuck’s Palo Alto reception in 2015. I sat in a roomful of eager Tuck hopefuls trying to decipher whether Hanover could be my home away from home for the next two years. At the end of the presentation Amy paused for questions. I probingly inquired, “In the event that Tuck doesn’t have a club or event of my interest, will the administration support my endeavors to create one and what resources will be allocated to support student initiatives?” Without hesitation Amy responded with, “Absolutely! If you can think it, we can get it done.” And just like that, Tuck became the dream program I pursued. Prior to Tuck I spent seven and a half years in the Army as an active duty logistics officer serving in various leadership roles from managing teams of five in Afghanistan to commanding a company of 350 soldier linguists at the Defense Language Institute in California. Despite my leadership experiences, I had little clue what it meant to be a leader in finance, marketing, or consulting. Tuck’s integrated core curriculum helped me build a comprehensive business foundation on subjects such as financial accounting, statistics, and capital markets. I then used case competitions as a means of testing the knowledge gained during my studies, as well as a way to explore the various careers available in business. During my first year, I competed in five case competitions ranging from stock pitches to market entry strategy to product design. I learned a great deal about how to solve problems in various industries and had a remarkable time with some of my best friends. At the end of my first year I was selected to lead the case competition club. Three things were at the top of my mind as I headed into the final year of business school: 1.) How do I give back to Tuck in a meaningful way? 2.) How do I share the wonderful experiences I had with case competitions? 3.) Why do we not have an intercollegiate MBA case competition and share the beautiful campus with others? I resolved all these questions when I met April Salas, the executive director of the Revers Center for Energy. April and I met several times prior to leaving for my summer internship at Tesla. Her enthusiasm and support gave me the confidence to move forward with planning and executing the event.  In addition to participating teams from business schools including Wharton, Darden, Sloan, Haas, and Switzerland’s IMD, there was a waitlist of another half-dozen schools for Tuck's inaugural case competition. On September 22, 2017, Amy Mitson’s words came true. After months of work with the school administration and faculty, Tuck hosted its first intercollegiate MBA case competition partnered with one of the tech industry’s most mystifying companies, Tesla Inc. For one day, the Upper Valley transformed into Silicon Valley. Aspiring techies from over 11 MBA programs around the world flocked to Dartmouth to solve a hypothetical business problem posed by the company. The event was a great success thanks to those who we endearingly label as the Tuck fabric; especially thanks to the Revers Center for Energy, the MBA Program Office, the Career Development Office, and the Communications Office who helped make the case competition a reality.  Stephiney Foley T’18, a fellow with the Center for Private Equity and Entrepreneurship, conceived and organized a case competition at Tuck in the fall that presented a theoretical Tesla business challenge to teams of MBAs. |

| FROM Tuck Admissions Blog: 5 Questions with Alex Kranitzky T’13, VP of Power & Utilities, Barclays Investment Bank |

Alex Kranitzky T’13 is a vice president in power and utilities in Barclay’s investment banking division. He was kind enough to answer a few questions about his experience after Tuck. As told to Pooja Yadav T’18 What was the most important part of your Tuck experience that you’ve taken with you to your job and/or life? I came to business school with a background in accounting and finance, so my goal was to expand my capabilities as a leader. Therefore, the most important parts of my experience were the opportunities to lead teams, observe others leading teams, and engage with a rich set of classmates who were also expanding their sense of leadership, both inside and outside of the classroom. What are some of the biggest challenges that your clients face in the power and utilities space and how are you working to solve those? As the world becomes more energy efficient, our utility clients face limited load growth, which has pressured organic growth plans. As a result, they’re looking for opportunities to fill that void that are outside of their core regulated activities. We’ve helped our clients expand their focus into energy infrastructure more broadly, including renewables and midstream assets. This shift is most readily apparent in the increasing number of electric utilities buying into the natural gas infrastructure space, both transmission and distribution. Additionally, we’re helping our clients as they focus on non-traditional investments in technology, like storage and distributed generation, to help them address structural changes to the grid and grow in this new energy economy. How do you expect the type of transactions to change, if at all, in the energy space? From a utility perspective, M&A (mergers & acquisitions) have been really robust over the last few years, and that trend will likely continue as companies look to inorganic growth to replace earnings lost to energy efficiency, etc. However, as rates rise and leverage levels increase, there will likely be a shift away from the debt-funded, all-cash acquisitions we’ve seen recently to an environment where stock-for-stock mergers of equals become more common. This could be hastened if corporate tax reform affects the tax deductibility of interest, as is reflected in some of the current proposals. What advice would you give to current students interested in working in energy? I had no experience in the energy sector prior to Tuck, and as a student I felt that it would make for a very difficult transition. However, I find energy to be incredibly interesting, because it touches every aspect of the economy. Working in a sector that focuses on a pure commodity, where brand doesn’t matter, is particularly compelling in an intellectual sense. Additionally, the complexities of the process of removing natural resources from the ground and converting them to usable products provides a wealth of opportunities to keep you learning every day. My advice for students who don’t have a background that’s energy specific is to take advantage of the many opportunities at Tuck to help get ahead of the learning curve. The complexities of energy can seem intimidating, but by taking energy electives and/or working with the Revers Center for Energy, there are many ways to familiarize yourself with the space. Favorite place in the Upper Valley? It’s a tossup between Killington and Murphy’s, with a slight edge towards Murphy’s. Whenever my wife and I are back in Hanover, we stop by Murphy’s and they still know our names and our drinks. It feels like home. |

| FROM Tuck Admissions Blog: 5 Questions with Alex Kranitzky T’13, VP of Power & Utilities, Barclays Investment Bank |

Alex Kranitzky T’13 is a vice president in power and utilities in Barclay’s investment banking division. He was kind enough to answer a few questions about his experience after Tuck. As told to Pooja Yadav T’18 What was the most important part of your Tuck experience that you’ve taken with you to your job and/or life? I came to business school with a background in accounting and finance, so my goal was to expand my capabilities as a leader. Therefore, the most important parts of my experience were the opportunities to lead teams, observe others leading teams, and engage with a rich set of classmates who were also expanding their sense of leadership, both inside and outside of the classroom. What are some of the biggest challenges that your clients face in the power and utilities space and how are you working to solve those? As the world becomes more energy efficient, our utility clients face limited load growth, which has pressured organic growth plans. As a result, they’re looking for opportunities to fill that void that are outside of their core regulated activities. We’ve helped our clients expand their focus into energy infrastructure more broadly, including renewables and midstream assets. This shift is most readily apparent in the increasing number of electric utilities buying into the natural gas infrastructure space, both transmission and distribution. Additionally, we’re helping our clients as they focus on non-traditional investments in technology, like storage and distributed generation, to help them address structural changes to the grid and grow in this new energy economy. How do you expect the type of transactions to change, if at all, in the energy space? From a utility perspective, M&A (mergers & acquisitions) have been really robust over the last few years, and that trend will likely continue as companies look to inorganic growth to replace earnings lost to energy efficiency, etc. However, as rates rise and leverage levels increase, there will likely be a shift away from the debt-funded, all-cash acquisitions we’ve seen recently to an environment where stock-for-stock mergers of equals become more common. This could be hastened if corporate tax reform affects the tax deductibility of interest, as is reflected in some of the current proposals. What advice would you give to current students interested in working in energy? I had no experience in the energy sector prior to Tuck, and as a student I felt that it would make for a very difficult transition. However, I find energy to be incredibly interesting, because it touches every aspect of the economy. Working in a sector that focuses on a pure commodity, where brand doesn’t matter, is particularly compelling in an intellectual sense. Additionally, the complexities of the process of removing natural resources from the ground and converting them to usable products provides a wealth of opportunities to keep you learning every day. My advice for students who don’t have a background that’s energy specific is to take advantage of the many opportunities at Tuck to help get ahead of the learning curve. The complexities of energy can seem intimidating, but by taking energy electives and/or working with the Revers Center for Energy, there are many ways to familiarize yourself with the space. Favorite place in the Upper Valley? It’s a tossup between Killington and Murphy’s, with a slight edge towards Murphy’s. Whenever my wife and I are back in Hanover, we stop by Murphy’s and they still know our names and our drinks. It feels like home. |

| FROM Tuck Admissions Blog: Borealis Ventures: Venture Capital in Downtown Hanover |

By Erica Toews T’18 When Phil Ferneau D’84, T’96 reflected on co-founding Borealis Ventures, he said, “How do you stay in the Upper Valley after Tuck? You get entrepreneurial.” The Entrepreneurship Club met Managing Director Ferneau and Associate Emily Snyder T’17 at the venture capital firm in downtown Hanover. Borealis launched its first fund in 2002 and raised two additional funds since then. The firm made 40 investments in 15 years and typically invests in the range of $250,000 to $750,000. Two-thirds of investments are in companies based in northern New England. Borealis invests in seed or series A rounds and has gained a reputation as the trusted and local early-stage investor. Borealis plays a crucial role in helping Dartmouth and other local entrepreneurs build their companies. Ferneau said, “There’s good stuff coming out of the broader Dartmouth network. That’s my fishing hole. It’s fine to find your fishing hole, but make sure it has good fish.” In the small, non-traditional market of the Upper Valley, Ferneau leads the firm’s healthcare investing, which entails biotechnology, digital health, and medical technology. Sometimes, the firm identifies an unmet need and builds a team, which is common in life sciences. One lesson Ferneau shared is that, you might think you can do something cheap and exit at a low value, but you need a buyer for the lower price. It can be difficult to get big healthcare companies to do smaller deals. Looking ahead, Ferneau plans to expand geographically and become sector-specific. Borealis is beginning to invest in more companies based in New York and California. Although the first three funds were generalist, the expertise of the Managing Directors gives the firm a competitive advantage in information technology and life sciences. Ferneau believes raising sector-focused funds will increase the quality of inbound deals. For those of us looking to join a startup, Ferneau’s advice is to look for something that captures our enthusiasm, establish rapport with the founder, and make sure we have value to add as a Tuckie. |

| FROM Tuck Admissions Blog: Q&A with Tuck Student Ambassador: Enrique Curiel |

Tuck Student Ambassadors collaborate with the Admissions Office to share their Tuck experience with prospective students. Part of this group is structured to represent eight geographical regions, with a Regional Captain leading each. In the coming months, we'll introduce you these student leaders! Today, meet Enrique Curiel, T'18 and Europe Captain. Please reach out to Enrique, or any other Student Ambassador using this website. They love to connect with future Tuckies! Tell us a little bit about yourself. I am from Zaragoza, Spain. I did my undergrad in Business Management at the University of Zaragoza in my hometown, where I also finished a 1-year Master’s program in Financial Markets and Banking Management. Right after graduating from my Master’s, I joined the Capital Markets and Treasury team of Ibercaja, a mid-sized Spanish bank based in Zaragoza. At Ibercaja, my focus was on institutional funding and liquidity management. More specifically, raising debt from institutional investors for the bank’s balance sheet, managing those institutional liabilities, and hedging structured products with derivatives. During my summer at Tuck, I interned at Prudential Retirement, where I worked on Corporate Finance for their Pension Risk Transfer team, highlighting the value of buyout transactions for their clients from a corporate finance perspective. I enjoyed working in finance, and my plan post-Tuck is to join a finance leadership program or a strategy group at a multinational corporation, where I can get a better understanding of all the moving and interconnected pieces in a large global company from a financial and a strategic point of view. Why Tuck? Unsurprisingly, community and location were my top reasons to come to Tuck. On one hand, I had witnessed during the application process how helpful and supportive current students and alumni were when it came to answering questions about Tuck, and I strongly believed that if that was how they treated prospective students, being a current student would find even greater support from the entire Tuck family, and as an international student who was living and working outside of his hometown for the first time of his life, a supportive network was what I was looking for. On the other hand, the Upper Valley offered an environment that i) I had never experienced before and ii) I will likely not be able to experience after an MBA, since the vast majority of us will find jobs in or around major cities. Living in the Upper Valley greatly fosters the strong and supportive community that I talked about before, and it is a great opportunity to learn more about rural life, enjoy the outdoors, and practice as many winter sports as possible! Everyone at Tuck chooses a different path. What’s your life at Tuck like? At Tuck, I am a Leadership Fellow, a co-chair for the Diversity Conference, and the TSA Captain for Europe. I am also in the process of founding the Game Club with two T’19s. There are so many opportunities at Tuck that you have to really think about what you truly want to do and go after those opportunities. If you want to be involved and be part of the community and help maintain it and even improve it going forward, there will be numerous opportunities for you to do so. I live in Sachem Village (a graduate student community 3 miles away from Tuck) with my wife (by the way, the partner community is the best you could imagine!). We both love playing hockey, hiking, and playing board games with other Tuckies. Transformational Moment The moment I decided (and my wife pressed me) to play goalie in tripod hockey. For context, tripod hockey is a hockey league run and played by current Tuckies with 4 different seasons. I had never skated before coming to Tuck and I had played offense during the fall season, falling and feeling frustrated all the time, as I realized how little (if not negatively) I was contributing to the team. However, in December, there is a “mini” league with only 6 games and playoffs where men’s tripod players play with women’s tripod players and A and B team (people who actually know what they’re doing) players together. I was ready to quit hockey after a terrible experience in less than a handful of games, but my wife’s team needed a goalie. She asked me to try it before giving up on hockey and, since it was just 6 games, I agreed to give it a shot. Given the low expectations everyone had for someone who had never played goalie in any sport and was barely able to stand on ice, any puck I saved was immediately followed by cheer and support from my team. I loved playing goalie so much that I continued to play during the winter and the spring seasons, almost never missing a game. In fact, my team won the winter championship (see the photo after the victory with my study group mate and friend Jon Ou – I am the one on the left), and I am writing these lines after having played 7 games in the last 9 days. For someone who had never really played sports before Tuck, this was a unique experience that let me appreciate the team building and support network of a sports team, especially if that team is formed by your classmates and their partners. Why did you join Tuck Student Ambassadors? As I mentioned before, current students and recent alumni were instrumental in my decision to come to Tuck, so I wanted to do the same with prospective students by sharing my personal experience. TSA is also a great way to meet those who will hopefully become members of the Tuck community in the near future. Given that we only get to interact directly with the classes above and below us, being involved with admissions as a TSA is an excellent opportunity to get to know students of the next graduating classes at Tuck. What surprised you most at Tuck? How open and helpful everyone is. Whatever it is, I just need to ask other students, professors, or the MBA Program Office and I will find a way to get it, whether it is support to found a new club, replacing a headlight in my car, or borrowing a car for an appointment in Manchester, NH (1 hour away). For reference, all these simple examples are just from the last month! Any advice for prospective students? Get in touch with us and get to know Tuck. The school does a great job making sure you will be a good fit but you also have to ensure that the school is a great fit for you. Not everyone likes the rural environment, the cold weather, or not seeing skyscrapers in the horizon, so I would encourage prospective students to come to visit Tuck, attend a class, meet current students, and explore the Upper Valley to find out whether Tuck is the perfect school for you or not. |

| FROM Tuck Admissions Blog: Creating My Tuck Story. What Will Yours Be? |

|

By Tayo Odusanya T’19 A mantra we often hear at Tuck is “pay it forward.” So it would come as no surprise that Tuck’s participation in the MBA Tour recruiting event in Lagos on October 7, 2017 was the result of alumni, opting in when Admissions asked for representation at a Lagos event. Coincidentally, I had planned to spend my fall break with family in Lagos and was more than happy to jump on board and present a student viewpoint. At the risk of sounding overly dramatic, it felt like I was a matchmaker bringing two of my faves together: Tuck in rustic Hanover and the busy, fast-paced city of Lagos. Oye Fajobi T’14, Ryan Amico T’16, and I shared our perspectives on why we chose Tuck and what the transformative journey has meant for us individually. While there was no shortage of interest in Tuck from enthusiastic prospective students, there was certainly a huge variance in knowledge about Tuck and Hanover. I’ll share here why I chose Tuck, and what I believe the program has to offer to others who might be on the fence as they consider where to make their home away from home. A small group of African students at Tuck from Ghana, Zimbabwe, Ethiopia, and Nigeria. Making the decision to leave an established life behind and journey to a different continent for advanced studies is no small feat. You’re likely leaving behind family, careers, communities, and comfort. The strong community at Tuck is one of the hallmarks of the institution. Its small class size makes it easy to get to know a larger percentage of your classmates and form close ties more organically. Whether it be through a pre-term trip, dorm life, small group dinners, tripod hockey, or a trip to Murphy’s (a popular Tuck hangout spot), you will find many opportunities to find your place in what we affectionately refer to as the Tuck Fabric. Tuck is one of the more family-friendly full-time MBA programs, with graduate housing available for students who choose to make the move with family. Your admission to make this place home is extended to your Tuck Partner (read: spouse) and your Tiny Tuckie (read: children). In addition to many and career resources, there are several ways for your Tuck Partner to get involved including auditing classes; participating in organized sports; getting involved in planned activities by the active Tuck Partner group; and through engaging with the Upper Valley community at large.  Tuck students and Tuck Partners on a pre-term trip to Croatia. Despite the small class size, there are 38 countries represented here at Tuck by citizenship. Not only do Tuckies come from all over the world, but Tuckies go all over the world. Tuck students are global-minded and participate in many experiential opportunities in the Upper Valley and beyond. A few ways I have engaged is by attending a pre-term trip to Croatia where I formed some great and lasting friendships; through Tuck Community Consulting, where I work with a team of my classmates on a project for a local nonprofit; and by volunteering on a Saturday in the New England outdoors through Tuck Serves, a day of service initiated and run by fellow students. A significant part of the Tuck experience is developing leaders with a global mindset. Tuck students are required to fulfill a global experience (TuckGO) through opportunities such as Global Insight Expeditions, First-Year Projects, OnSite Global Consulting projects, and Exchange programs. This was a huge plus for me when I was researching schools. Despite the small class size, there are 38 countries represented here at Tuck by citizenship. Not only do Tuckies come from all over the world, but Tuckies go all over the world. Tuck students are global-minded and participate in many experiential opportunities in the Upper Valley and beyond. A few ways I have engaged is by attending a pre-term trip to Croatia where I formed some great and lasting friendships; through Tuck Community Consulting, where I work with a team of my classmates on a project for a local nonprofit; and by volunteering on a Saturday in the New England outdoors through Tuck Serves, a day of service initiated and run by fellow students. A significant part of the Tuck experience is developing leaders with a global mindset. Tuck students are required to fulfill a global experience (TuckGO) through opportunities such as Global Insight Expeditions, First-Year Projects, OnSite Global Consulting projects, and Exchange programs. This was a huge plus for me when I was researching schools.  Tuck students and Tuck Partner volunteering with Upper Valley Land Trust through Tuck Serves. If we’re being honest, most of us did not embark on an MBA journey simply for community and to travel the globe. Career advancement is usually the primary motivation. While you’re at Tuck, you can count on the many resources here to help you pursue your career goals and aspirations. Just check the employment stats: Tuck consistently places students and graduates in job at record rates, with the class of 2016 clocking in at 100 percent internship placement and 98 percent job placement within three months of graduation. My experience in America from undergraduate throughout my professional career taught me one thing: the networks that you form along the way are critical for your career growth and professional development. This wasn’t something I understood fully as a 16-year-old immigrant student in college. But with age comes maturity and I knew this was a necessary component of whatever MBA program I chose. The strong alumni network is one of the open secrets here at Tuck. Tuckies, whether current or graduated, are staunch supporters and cheerleaders of other Tuckies. Be it through career chats, connecting me with important contacts, or pep talks when I need inspiration, I have found the reputation the Tuck community holds to be well earned. I knew that I wanted to have this strong, close-knit army of Tuckies by my side, not just for the two years I will spend here, but for the many years beyond graduation.  Tayo Odusanya is a first-year student at Tuck. Before Tuck, Tayo was a middle school math teacher and has a collection of funny anecdotes, fidget spinners and fond memories to prove it. After Tuck, she hopes to explore a career in management consulting. Tayo is originally from Lagos, Nigeria, but lived in Virginia and then Georgia prior to Tuck. |

| FROM Tuck Admissions Blog: Tuckies Take on PE, VC in Boston |

By Vitalie Djugostran T’18 20°F (-6°C) outside, a group of first- and second-year Tuck MBA students are boarding the bus in Hanover to go on a Private Equity and Venture Capital (PE/VC) trek in Boston. It is the first freezing morning in the Upper Valley, but this does not deter the group of eager students from taking on a busy day with a robust schedule visiting two PEs, a VC, and a Due Diligent Management Consulting firm. This trip is part of the PE/VC trek that Tuck students organize twice a year with the help and support of the Career Development Office (CDO) and generous Tuck alumni who work in the industry. A few hours after boarding the bus, students arrive to Boston. The first meeting is with Audax Group, a leading middle market PE firm with over $12B under management. Its strategy is to buy platform companies and aggressively grow them through bolt-on acquisitions; in many cases, the number of bolt-ons exceeds 10 transactions. Audax also has an extensive network of operators and consultants on board ready to help articulate and define an investment view, conduct due diligence, and implement growth strategy. Three Tuck alumni David Goldenheim T’11, Nathan Shippee T’16, and Asheesh Gupta T’03 welcome the Tuck group for a dynamic conversation about PE. This is an action-packed meeting that covers topics such as key drivers in PE deals, operational strategies, different PE investment strategies, corporate structures, and, of course, how to break into PE. Next stop, Bain Consulting. Bain Consulting was an untraditional stop, since unlike its sibling organization Bain Capital, it is not a PE firm. However, it holds over 90 percent market share in PE due diligence for funds greater than $5B. Bain Consulting is the pioneer of PE due diligence and boasts an accomplished track record of adding value to PE firms. The meeting, led by a T’12 alumnus, covered quantitative improvements that consulting companies add. Consulting companies, and Bain specifically, help PE companies with pre-acquisition strategic and business due diligence, 100-day operational plans, vendor due diligence and exit ideas. .406 ventures is the third stop, and two Tuck alumni host the group of approximately 20 students. By this time, it feels that Tuckies are everywhere. .406 ventures is an early stage technology and health-care focused VC, and differentiates itself by working closely and collaboratively with the management teams of their portfolio companies. The speakers covered four ways to get into VC, industry trends in health care and tech VC, how they evaluate investment targets, deal sourcing, and value that they add through a high-touch process. The meeting concludes on a warm note and after exchanging contact information with the speakers, the Tuck group is off to its final company visit of the day—HarbourVest, one of the largest PE investment managers in the world. With $40B AUM, HarbourVest is a recognized global private markets investment specialist. We met with one of the principals at the firm who dove deep into the background of secondary investing, valuation mechanics, ways to evaluate managers, and how HarbourVest adds value to its customers. Conversation balanced detailed technical topics as well as more high-level overview of the return curves in the industry. The meeting also covered ways to join the PE industry coming out of business school. The trek comes to an end and the group heads to Fenway for a networking Tuck ’Tails session ahead of joining a massive crowd of Dartmouth alumni gathered to watch Dartmouth take on the Brown Football team at the Fenway ballpark, which is occasionally retrofitted to host other sports and concerts besides baseball. Although this was completely unrelated to the PE/VC trek, it is a nice coincidence and shows the breadth of the broader Dartmouth network, of which Tuck is a part. Spoiler alert, Dartmouth Big Greens prevailed over the Brown Bears 30-10. |

| FROM Tuck Admissions Blog: Why I Left the Military and Chose Tuck |

By Mike Keating If my decision to join the military was the best decision I ever made, then deciding to separate after eight years was the hardest. I felt lucky to be a member of teams which accomplished so much. I grew enormously, developed a great deal of confidence, and learned from my successes and failures. I’m proud of whatever small part I played in helping some of our nation’s finest young people come together as a team in service to our country and its values. I’m indebted to the lessons these same young people taught me. I suspect my time in the Navy will forever be the best thing I ever did. Everyone separates from the military, be it after 4, 12, or 25 years. The question I asked myself was what comes next. Though I liked the Navy and envisioned a great career, there were professional opportunities on the outside that I was intrigued by. I feel strongly that service has many forms, one no better than the rest, and that valuable roles exist in business, government, and society for veterans of my generation. However, it’s hard to leave the only thing you’ve ever known. I was extremely apprehensive to leave an institution that had been deeply immersive, defining, and intimate. On advice from a friend, I decided to check out Tuck. I traveled from my office in the Pentagon to Hanover and sat down with Kristin Roth, the Military Liaison in Tuck Admissions. The rest is history. I quickly realized it was Tuck or bust. I couldn’t find another school that better espoused the values I was leaving behind in the Navy. The Tuck experience is designed to be deeply personal, connected, and transformative. Sound familiar? Two years later, the journey to Tuck has ended and I’m enrolled in the Fall terms of my first year. I’m loving every minute. Tuck is a program which champions empathy, judgment, and confident humility. These aren’t just catchphrases. It’s the way Tuck does business. I realized I wanted to go to Tuck BECAUSE of its relative geographic isolation, not despite it. I concluded there was no program or location more conducive for personal discernment as I launched a career pivot. Though I’m supremely busy with my course load and recruiting, I’ve found myself decompressing thanks to Tuck’s stunning campus and the beauty of Hanover and the surrounding Upper Valley. Here’s the icing on the cake: no MBA program participates more robustly in the Yellow Ribbon Program/G.I. Bill. The lifelong Tuck network is superior, the Tuck veterans network even more so. Getting ranked the #5 MBA program by Forbes this year doesn’t hurt either. If you are even remotely curious about Tuck and are considering transitioning from the military, reach out. I had a ton of help through the admissions process. There are plenty of veterans on campus who would love to help you out.  Mike grew up in San Diego, CA and graduated from Boston College in 2009 with a B.A. in History. A Surface Warfare Officer, he commissioned via Officer Candidate School in 2009 and reported to USS ANTIETAM (CG-54) in San Diego, CA. He deployed to South America in 2010 onboard USS BUNKER HILL (CG-52) and took part in humanitarian assistance and disaster relief efforts in Haiti following the earthquake. In 2012, he transferred to Coastal Riverine Squadron 3 and deployed to the Northern Arabian Gulf from 2013 to 2014 as the Officer in Charge of an independent expeditionary task unit. From 2014-2016 he served at the Pentagon, where he managed the Directed Energy and Railgun portfolio for the Surface Warfare Directorate on the Chief of Naval Operations Staff. He separated from active duty in 2016 and transferred to the reserves. Mike is a dual-degree candidate, concurrently earning a MA in International Relations at the Fletcher School of Law and Diplomacy at Tufts University. He will graduate in 2019 with a MALD from Fletcher and a MBA from Tuck. In his free time, he likes reading, being on the water, and adventuring with his girlfriend Tara, a professional ballerina. |

| FROM Tuck Admissions Blog: Why Travel? A Tuck MBA Weighs In |

By Tanvi Nayar T’18 If you are budgeting for school right now, then this post is for you. For starters, please add a new line item for traveling in that excel model you have created. I cannot, cannot, CANNOT stress enough the importance of traveling and exploring different cultures. It has been the highlight of my past year at Tuck. I have traveled to nine countries. They were, however, a frugal student’s trips, consisting of cheap flight deals, Airbnbs/hostels, tastiest and cheapest foods, and lots of walking (which counter balanced the effects of all the food I ate). BUT the experiences gave me the awesome company of my classmates and friends, and a culturally immersive experience. So, why do I travel? Meeting people from different cultures has increased my connection with myself, and created a new sense of empathy for strangers. It has made me more grounded and thankful for everything that I have in my life. It has put me in situations which honestly which were uncomfortable at times, but helped me grow immensely as a person and as a future business leader. If you haven’t yet bought the idea, then here are a few highlights of all my travels, because, after all, what is a post without bullet points?

This is the perfect time to travel. Use your classmates who come from all over the world as resources to learn about their countries. Get inside scoops from them on the best offbeat things to do! Because, if not now, then, when?  Tanvi Nayar T’18 is a Tuck Student Ambassador co-captain for India. Please reach out to her or any other student ambassadors using this website. They love to connect with future Tuckies, especially when they're from "home!” |

| FROM Tuck Admissions Blog: TUCKCAST: Get to Know Tuck Associate Dean Praveen Kopalle |

In the latest edition of TuckCast, Alen Amini T’18 sits down with Praveen Kopalle, associate dean for the Tuck MBA program and the Signal Companies’ Professor of Management. Kopalle shares more about his role at Tuck, what he’s currently researching, and his advice for prospective students applying to Tuck. “Do your homework. Attend as many admissions events as possible. Start early and do your research about Tuck,” says Kopalle. “Second, begin building your dossier that shows why Tuck is the right place for you, what you bring to the table, and how you see yourself in terms of enhancing your classmates’ experience. And finally, spend the time and effort to score well on the GMAT!” LISTEN Your browser does not support the audio element. |

| FROM Tuck Admissions Blog: Military & Financing Your MBA |

Let’s not mince words: MBAs are expensive. As a US military service member, you have resources available that may make the cost of an MBA, especially at Tuck, a much less daunting proposition. Be sure to explore all your financing opportunities so you understand what schools offer and how schools partner with the VA to make education more affordable. As a military veteran, you may have earned benefits through the Post-9/11 GI Bill® and the Yellow Ribbon Program. Below, I’ll outline a little about each benefit, however please be sure to get detailed information about these benefits. The GI Bill provides financial support if you’ve served at least 90 days (in aggregate) on or after September 11, 2001. How much you’re eligible for is based on your length of service. The GI Bill assists with tuition and fees as well as providing a housing allowance and books/supplies allowance. In general, with the exception of the MHA, this benefit does not vary based on the MBA program you attend. In contrast, Yellow Ribbon Program (YRP) benefits are available only if you are eligible at the 100% payment tier for the GI Bill. Also, available benefits depend on whether your school participates in the YRP and the level at which your school participates. YRP works like this: participating schools elect (with some limitations) the level at which they participate and the number of veterans who may participate in the program. Programs may fund tuition and fees that exceed the VA cap of $22,805.34 at private institutions. Schools can contribute up to 50% of those expenses and the VA matches that. What does that mean at Tuck? At Tuck, we participate in the YRP without limitation on the number of veterans enrolled. If you are YRP-eligible, we contribute $20,000 to fund tuition and fees, and the VA matches that at $20,000. Combine YRP and GI Bill benefits together at Tuck, and a large portion of your costs at Tuck are covered. There are a lot of details which I won’t get into here, and things may vary from veteran to veteran depending on your personal situation. If you have questions, please contact Admissions or our wonderful Financial Aid team to get answers. GI Bill® is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available on this page of the official U.S. government website. |

| FROM Tuck Admissions Blog: Considering an MBA? Start Here |

If you’re considering an MBA, don’t start with the GMAT—start here:

Good luck as you get started and we look forward to staying in touch! |

| FROM Tuck Admissions Blog: My Favorite Professors at Tuck |

By Ana Belén Mañón Suárez T'18 Coming to Tuck was the best decision I’ve made in my life. It’s hard to pick a single favorite thing here, but, as a person who came to Hanover to get inspired, I would like to share with you six Tuck professors who have had a profound impact on me during my time at Tuck. 1. Daniella Reichstetter T'07 Daniella (pictured above), as she likes to be called, is an adjunct professor of entrepreneurship and the executive director at the Center for Private Equity and Entrepreneurship. She co-teaches the courses Entrepreneurial Thinking and Building Entrepreneurial Ventures, advises several Independent Studies, and helps manage entrepreneurial First-Year Projects. I first met her while travelling to Israel for my GIX and she later became one of my advisers at the Tuck Social Venture Fund (TSVF). Daniella’s Socratic style of teaching is sharp and effective. She masters the art of facilitating the “aha moments” that make lessons so sticky. I have certainly benefited from her style and the 15+ years of real-world experience that she brings to the table. As one of the directors at TSVF, I find it extremely useful to have a former serial entrepreneur guiding me through the sourcing, due diligence, and investing processes for potential deals for the fund. As an aspiring VC fund manager, I appreciate having someone who can help me navigate the different paths that will take me where I want to be. Daniella takes a special interest in her students. I am fortunate to say that I found a life-long mentor at Tuck. 2. Emily Blanchard  Emily Blanchard is one of the most beloved professors here. She teaches the second core economics course and a seminar on firms and trade policy. Her interests are not limited to economics—you will find her making guest appearances at other professors’ classes, leading academic trips to Mississippi, moderating fireside chats with candidates for state governor, hosting formal lunches to discuss her research, informal lunches to get to know students, and opening events such as the Tuck Business, Government and Society Conference. Professor Blanchard’s witty sense of humor and warm approach to cold calling students creates the optimal learning environment for assimilating complex topics. I must say it is a pleasure to witness how she perfectly orchestrates each class. Emily’s impact extends beyond the classroom. I have had plenty of opportunities to engage in conversations with her about a wide range of important topics. She is often highlighted as a role model to students, myself included. She gave me a new perspective and had a lasting impact on me. 3. Adam Kleinbaum  Adam Kleinbaum is an associate professor in the strategy and management area at Tuck. He offers a well-rounded variety of courses that include Leading Individuals and Teams. He also leads the Israel GIX and a seminar on social networks. I took all of them and I personally find his research on social networks fascinating. After taking his seminar, I decided to enroll into more courses in that format. Professor Kleinbaum’s teaching style is insightful and inclusive. He does a great job of incorporating every student’s perspective into the discussion. Adam seems to enjoy exchanging ideas with students to deepen his research and encourages intellectual challenges. It was a great experience to travel to Israel with him and learn more about topics I otherwise would have never been introduced to. 4. John H. Lynch  Governor Lynch is a clinical professor at Tuck and a senior fellow at the Center for Business, Government & Society. His course, The CEO Experience, is very popular among Tuckies. He focuses on the similarities and differences between being a leader in the private sector and a leader in the public sector by sharing his experiences as former governor of New Hampshire and CEO of Knoll. As a teacher, I would describe him as warm and memorable. He always starts class recalling the most important lesson from the previous session and closes by stressing the most important lesson of the day. As a leader I would describe him as wise and down to earth. Professor Lynch taught me that the wisest leaders are also the most human. It was an honor to have him as a professor during my MBA. 5. Ron Adner  Ron Adner is an award-winning professor of strategy who focuses on innovation and entrepreneurship. When he describes the content of his courses as “all Adner,” he means it. He teaches theories and ideas that sometimes are not yet published, making his class experience very original. It is not often that you get the opportunity to enroll in a course that no other MBA programs are teaching. Professor Adner’s teaching style is fun, dynamic, and entertaining. He is as good of a performer as he is a teacher. He encourages new perspectives and out-of-the-box thinking. Ron Adner certainly widened the lens though which I see the world. 6. Philip Ferneau D’84, T’96  Phil Ferneau is an adjunct professor of private equity and venture capital at Tuck. He teaches Field Studies in Private Equity and is involved with First-Year Projects. As a current managing director at Borealis Ventures and a board member at multiple companies, he brings real-world experience to each lecture. I cannot stress enough how useful it is to have practitioners such as Professor Ferneau teaching the day to day issues of early stage investments. Professor Ferneau’s teaching style couldn’t be more varied. When taking his course, you will negotiate term sheets, engage in role plays, present investment recommendations to other experienced practitioners, screen real deals, analyze portfolio management operations, and meet fantastic top-notch guest speakers. He is committed to deliver the best class experience for aspiring entrepreneurs and fund managers and he is constantly incorporating student feedback in his lectures. I always look forward to attending Phil’s class on Mondays.  Ana is a second-year student at Tuck who is in love with Hanover. Her background is in finance, particularly within the banking, private equity, and venture capital industries in Mexico. She holds a BA in economics from Instituto Tecnológico Autónomo de México. At Tuck she is a co-chair of The Film Society and a director at the Tuck Social Venture Fund (TSVF), a student-run venture capital fund that invests in for profit companies focused on social impact. Her long-term goal is to stay connected to the Mexican entrepreneurship world as an investor. |

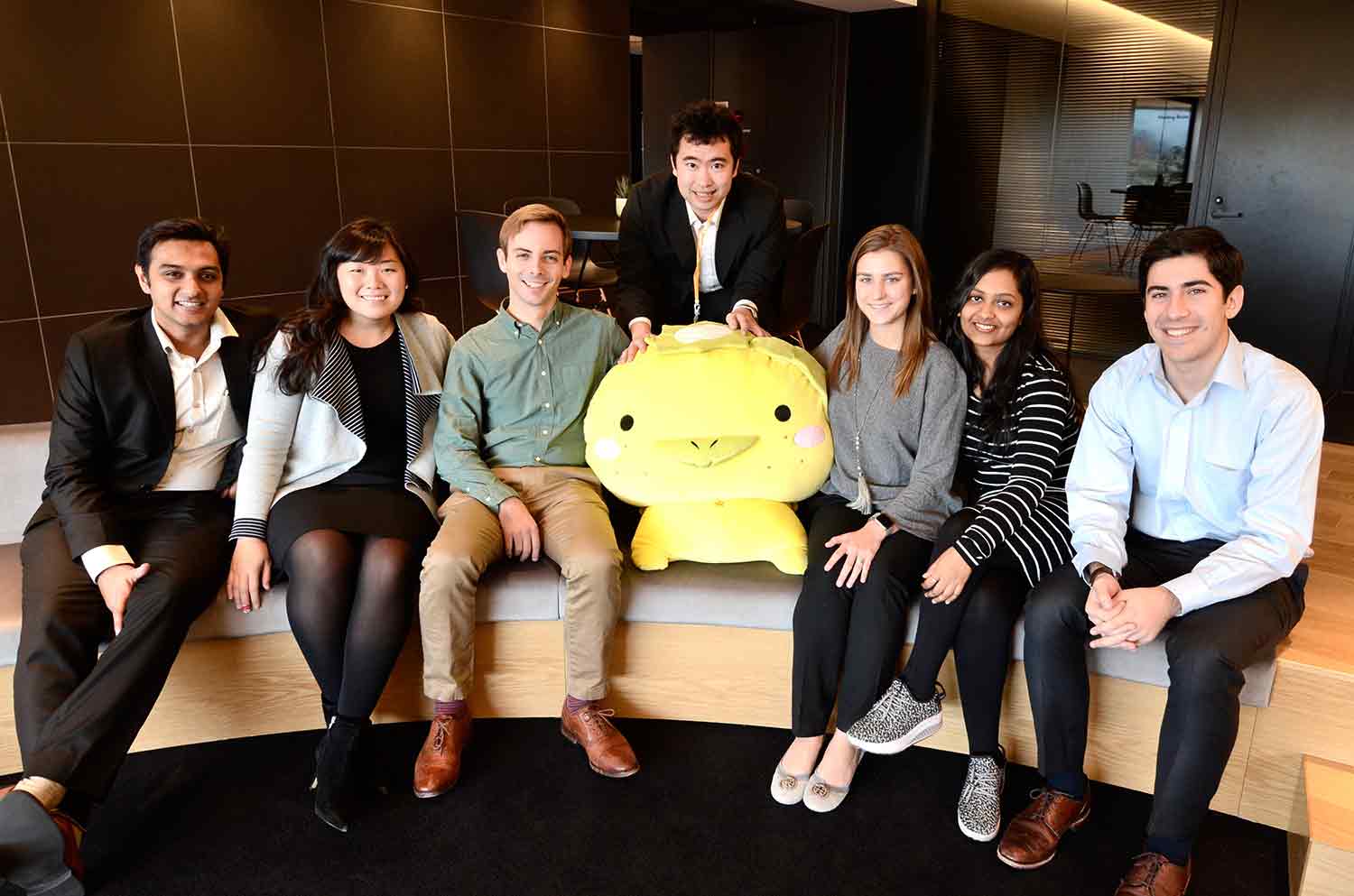

| FROM Tuck Admissions Blog: Tuck OnSite Global Consulting Project in Tokyo, Japan |

By Kohei Suwabe T'18 Japan is my home country and I worked in Japan for seven years prior to Tuck. When I was assigned to the OnSite Global Consulting project in Tokyo, Japan, I considered myself fluent in Japanese business culture and expected to primarily learn core consulting skills through this experience. However, through this OnSite experience I was able to both make a meaningful contribution to my client and deepen my understanding about Japan. Our client is one of the biggest eBook brokers in Japan. They enable hundreds of Japanese publishers to digitize traditional paper books and distribute them digitally. Our project was to think of the global expansion strategy for this company.  It was my first experience working in a Japanese start-up culture, which is quite different from large corporate culture I already experienced. They had a very open office layout and the office had a beautiful view, which we were able to see the Japanese Imperial Palace. During the first half of the project, we interviewed members of their top management staff and key business partners. One of my favorite parts of this project, was getting to know the company’s CEO. The CEO spent a lot of time with us telling us the story of how he founded the company and his future vision. We learned that he founded his company while he was at college in 1994 and how he transformed the company several times into what it is now. He also shared his strong passion and pride for his hometown, Tokushima.  Cultural exchange was an important part of our project, and we learned a great deal away from the boardroom. On one particular evening the CEO hosted our team for dinner and shared with us his other business ventures that are aimed at sharing the culture of his hometown, Tokushima. We learned that the Kito region, where Tokushima is located, is known for growing exceptional “yuzu” or Japanese citrus. The CEO owns a yuzu farm, in which he reinvests some of the profits to his hometown to reinvigorate the city. In the office, there were lots of symbols and imagery of the “yuzu”. In the picture below, my team and I are sitting by a “yuzu” stuffed animal.  At the office, I could see his employees had tremendous respect for his vision and it was a great experience for me to learn about his leadership style and how he follows his passion towards his business. Our OnSite project team had a mix of five Tuck students, two Dartmouth undergraduate students, and a faculty advisor, who is also a Tuck alumnus. The background of the team members was varied, and we learned from each other’s past professional experiences. I also did my best to share my home and my time working in Japan. Outside the office, I wanted my team members to have an authentic Tokyo experience. I showed them around the places I typically visit in Tokyo, including Japanese bars (izakaya), shopping areas, and karaoke. Even though I had been to all these places before, it was a fresh experience for me to experience Tokyo with my teammates. At the end of the project, I am proud that we were able to deliver a meaningful product for our client. The client thanked us and said, “the final deliverable is very much useful and helped us to clarify issues that are tangled inside our head,” which made our team especially delighted. I learned a lot about Japan through this experience and traveling to my home country with my OnSite team. I am very glad we were able to make a meaningful contribution to our client and have a wonderful cultural experience! Kohei Suwabe T’18 is a second-year student at Tuck. He grew up in Tokyo, Japan and worked for Japanese insurance company called Tokio Marine before attending Tuck. During his time at Tuck, he also had a chance to travel to Nepal for his global First Year Project (FYP). |

| FROM Tuck Admissions Blog: Emerging Market Exposure at Tuck |

By Kristin Unruh T’19 This might sound surprising, but one of the main reasons I came to Tuck was to get exposure to emerging markets. Between Global Insight Expeditions, international First-Year Projects (FYPGO), school clubs, and classes, there are a lot of ways to feed my passion for emerging markets, but the event that I am most excited about is Tuck’s upcoming inaugural Emerging Markets Conference on March 2. Next Friday, global leaders from Latin America, Africa, and Asia who are at the forefront of shaping disruptive technology, finance, and policy will come to campus to talk about our conference theme, “Leapfrogging the Developing World.” I’ll have the opportunity to engage with featured speakers including Diego Ferro T’93, chief investment officer of Greylock Capital Management, Michael Dorsey, an international expert on climate change finance and policy, and Kunal Sood, founder of the NOVUS Summit at the United Nations. The conference will be a great opportunity for me and other Dartmouth students, faculty, and speakers to gather and discuss business challenges and opportunities in the developing markets. And I’m not the only one who is excited. In anticipation of next week, I caught up with several classmates to understand what excites them most about our inaugural Emerging Markets Conference. Register Now Alison Donnally T’18 said, “Tuck’s mission is to educate wise leaders to better the world of business. Imperative to the success of that mission is exposing Tuckies to a variety of business cultures and market dynamics. You cannot better the world of business if you do not understand it in the first place and the Emerging Markets Conference is a fantastic opportunity to deepen our understanding.” Second-year student Taylor Reckhow shared, “Tuck emphasizes the global experience, and the Emerging Markets Conference gives students another outlet to develop this skill set. Global exposure, whether through travel or discussion, is incredibly important in an MBA program. We will all be exposed to leaders of different backgrounds, companies in different countries, and cultural norms that impact strategy, and learning what we can to come to the table for those opportunities is important.” Kristin Unruh T’19 reflected, “After living and working in East Africa, I am excited to spend a dedicated day sharing insights with others who have and interest and experience in emerging markets. The Emerging Markets Conference will give me the chance to learn from leading global practitioners and investors about identifying and accelerating growth opportunities.” I can’t wait for the conference next week! Whether you are a current student, prospect or simply interested in emerging markets, I hope you’ll join us! |

| FROM Tuck Admissions Blog: Endurance Companies: Entrepreneurship in Hanover |

By Erica Toews T'18 Braden Pan T’15 hosted the Entrepreneurship Club at Endurance Companies in downtown Hanover. Located in the old Rosey Jekes building, which has been a coffee shop and high-end women’s clothing store, Endurance shares space with startups Picaboo and Vidigami. Endurance is a holding company with the mission to empower good people to build meaningful companies. The three Endurance partners are the CEOs of fintech startup Funding Circle, edtech startup Vocate, and emergency room software company Collective Medical. Becoming part of Endurance allows companies to mitigate risks and benefit from network effects by gaining access to capital and advice. Endurance Companies has a small portfolio of opportunistic investments as well. Braden said, “We bet on the jockey, not the horse. We care more about the people than their companies.” Braden is a Principal at Endurance but spends most of his time in his role as Marketing Director at Vocate, an education technology startup that provides career services for college students. In the world of entrepreneurship, ideation is about identifying points of frustration and addressing them in creative ways. Alex Tonelli was frustrated by the difficulty of deciding what to do after college, so he founded Vocate. Headquarters are in San Francisco with development in Poland and operations in Hanover. Braden advised us to determine whether there is a product market fit before we start our own companies. He encouraged us to found companies around our passions and gave examples of three entrepreneurial Tuck students from his class: one is running a successful company, one sold his company to Google, and one gave up his company and works at Facebook. Though they’ve taken different paths, they’re all doing well, so we shouldn’t be afraid to go for it. Endurance Companies is not an incubator, but Braden is always excited to have conversations with Tuck students who are committed to entrepreneurship. I walked away thinking that Endurance Companies is one more example of an amazing resource right in Hanover. |

| FROM Tuck Admissions Blog: What We Learned: 2018 Tuck Private Equity Conference |

By Lauren Baldwin T’19 Tuck’s 13th annual Private Equity Conference brought together nearly 250 professionals and students to discuss current trends in the industry and to share best practices in a competitive environment. I’d like to highlight a few themes from the conference, and thoughts from our impressive and inspiring speakers.  Creating Unique Angles in a Competitive Market We kicked off the conference on Thursday evening with a fireside chat moderated by Dean Matthew J. Slaughter with keynote speaker Vikrant Sawhney D’92, senior managing director & COO of Blackstone, who highlighted a key issue prevalent across the industry today, competition for deals—multiples are high, GDP growth is low, and there is no shortage of buyers. He encouraged investors to seek companies where there is a way to create value through operational improvements, where they have a compelling angle, and to only invest in businesses that generate cash. Dotty Bollinger of GPB Capital encouraged us to approach sectors in different, creative ways. Her health care services team, for example, is backing a management team with operational expertise to pursue a roll-up strategy in the physical therapy sector by approaching sellers in a different way than the larger players do. The team has been thus far successful, having completed and integrated several acquisitions. After discussing her best deal and the one that got away, keynote speaker Susan Carter, former president and CEO of Commonfund Capital, Inc., reminded us that you don’t need to do every good deal, but every deal you do has to be a good one, and not to invest in anything you don’t understand. Sourcing Strategies  Finding proprietary deals in this market is a challenge. Jake Colognesi T’11 of Volition Capital discussed the importance of connecting with founders and management teams, encouraging us to make outreach something executives cannot ignore. His team differentiated itself in front of the CEO of Chewy.com, a leading e-retailer of premium pet food, by flying to Ft. Lauderdale within 24 hours of speaking to him. Volition Capital ultimately had great success with the investment. Bill Christ T’08 of TA Associates echoed Jake; he spends a significant amount of his time visiting with executives, and often finds a company second. In the case of Skinny Pop, his team found a great executive who helped grow the company from four to over one thousand employees, and launched a broader, better for you snacking platform. Team Building & Diversity  In an industry that has historically been male-dominated, several speakers were pressed on what their companies are doing to attract, train, and retain diverse candidates. Both Susan Carter and keynote speaker Marc Wolpow, co-CEO and co-founder of Audax Group, shared that the heterogeneity of thought is critical to finding a wider set of solutions and making the best business decisions. Susan Carter discussed the importance of building the pipeline of female talent (which she helps further through the organization Girls Who Invest), and strengthening the culture at firms to improve retention. She encouraged the men in the audience to be willing to listen without interrupting, engage in discussions, and to be a sponsor around the promotion table. As a woman in private equity, it was great to hear her call to action and advice. Career Advice With students making up nearly half the audience, many young professionals were eager to hear advice on how to break into the industry, and build long-term, successful careers. Bill encouraged students to stand out by developing a thesis on an industry, learning as much as you can, and selling it to an investment team. And when you do make it, Susan advised us to surround ourselves with a team that has expertise where we don’t. After a long and successful tenure in the industry, Marc Wolpow said he still loves the business, even though he doesn’t do deals anymore. And finally, I thought Vikrant Sawhney gave great advice that we should all remember—If you want to be excellent at something, you have to work really hard. Thanks to all the speakers for joining us (despite the snowstorm!), and the Center for Private Equity and Entrepreneurship and the Tuck Private Equity Club for sponsoring the conference. Looking forward to learning more in 2019!

|

| FROM Tuck Admissions Blog: Exploring Boston’s Startup Scene |

By Martial Combari T’18 At the end of January, 20 Tuck students "ventured” out of Hanover into Boston to explore the startup scene in Boston. Over the course of two days, we visited four startups in marketing, health care, cloud infrastructure, and fintech as well as four VCs with differing cultures and investment philosophies. By the end of the trek, we had learned about the challenges of growing and scaling businesses, how companies pivot multiples times before finding product market fit, and how different investors evaluate “winners” in the technology sector. Drift We started the trek at Drift, a marketing software company aiming to transform how businesses sell to each other. Will Collins T’16, head of business operations, spoke with us about the company’s story and introduced us to members of various teams across the business, including marketing, customer success, product marketing, and engineering. We learned about how, under the leadership of the former chief product officer of HubSpot, the company’s product and offering has evolved and pivoted, and is now finding its place in the marketing stack. Having honed in on its product market fit, Drift has begun scaling rapidly.  Bain Capital Venture Our next stop was down the street in Copley Square at Bain Capital Ventures (BCV) where we met associates Akshay Agrawal and Aneesha Mehta, who shared with us BCV’s broad investment strategies across a variety of verticals. BCV differentiates itself from other firms by leveraging the broader Bain network, often times using contacts and intel from Bain Capital Private Equity during diligence and offering operating advice. CloudHealth Technologie Next, we visited CloudHealth Technologies, a cloud infrastructure monitoring software company that helps clients better optimize the use of their cloud environments. We had the unique opportunity to be hosted by the first investor and current CFO, Larry Begley (also a proud father of a recent Tuck grad), and CTO and co-founder Joe Kinsella. Gaining each of their perspectives on the early evolution of the business was valuable for those in the room interested in VC and entrepreneurship. In addition, Joe provided advice that resonated with those aspiring entrepreneurs who were wondering when it’s the best time to start a business. In his view, to make the journey real, you need to “burn your boats” which could mean quitting a job or forgoing consulting or service contracts to commit to building a real product. Quantopia To end the first day, we visited Quantopian, a fintech startup that curates and licenses investment algorithms from users who get paid for performance. Josh Payne, the VP of Product and a D’96, shared with us his journey through the Boston-area tech scene, from feeling constricted working in a large corporate environment, to joining the HubSpot team during its growth stage—and now leading product at Quantopian.  Openview Venture Partner The next morning, we kicked off the day by visiting Openview Venture Partners, a venture capital firm founded by Insight Venture Partners alum, Steve Maxwell. Openview focuses on expansion stage B2B SaaS investing, with notable investments in companies like ExactTarget and Instructure. The firm differentiates itself by offering a robust portfolio support team that includes Sales and Marketing strategy support, Talent Recruiting, and Market Research. We were hosted by Brendan Deer (partner), Adam Marcus T’07 (managing partner), and John McCullough T’10 (VP of corporate development). All three had unique stories and perspectives on how they ended up in venture. However, what particularly stood out was Adam’s advice to really focus on building meaningful relationships across both classes during our Tuck experience and relentlessly pursue our career aspirations during our time in business school—things he managed to balance simultaneously when he worked fulltime for Battery Ventures during his time at Tuck. Wellfram Next, we went across the street to Wellframe, a digital health startup that partners with health-care plans and providers to deliver support and guidance from caregivers to patients through a mobile application. For many of us, health care was an unfamiliar industry, but our talks with members of the team from across the organization helped us better understand the complex challenges of delivering meaningful change in such a complex market.  Accomplice V We then made our way into Cambridge to visit Accomplice, an early stage investor focused on technology investments. Sarah Downey (principal) and TJ Mahony (partner) walked us through the firm’s history, starting with Atlas Venture, which spun off its technology practice into Accomplice, led by founding partners Ryan Moore and Jeff Fagnan. They also described the firm’s venture partner model, where entrepreneurs in their portfolio are given access to investable capital to deploy based on the idea that entrepreneurs have the ability to effectively source deals. From a career standpoint, TJ and Sarah maintained that for those of us seeking a career in venture, it is better to pursue peripheral careers in technology or entrepreneurship before considering the transition. Previously, TJ was a successful entrepreneur and Sarah had worked in startup leadership positions. General Catalyst To conclude the trek, we visited General Catalyst where we met with Holly Maloney McConnell (managing director) and Natalie Bartlett (associate). General Catalyst invests in early and growth stage technology companies in both B2B and B2C channels. Holly, who works on mainly on expansion stage investments, talked about her journey from investment banking and growth equity investing to her current role, where she enjoys partnering with companies to help them grow and scale. Natalie, in addition to her day-to-day work, works actively with Rough Draft Ventures, which funds student entrepreneurs across the country.  Martial Combari T’18 is an African-born, French and American-educated finance enthusiast who now calls the U.S. home. He spent five years working in financial services in New York, Minneapolis and San Antonio."My experiences at Tuck have provided me with a distinctive viewpoint that compels me to continuously challenge the status quo, influence change in communities, and ideally help others succeed along the way." |

| FROM Tuck Admissions Blog: OnSite Global Consulting: Working with the St. Boniface Haiti Foundation |

By Gillian Wong T’18 OnSite Global Consulting is one of three opportunities Tuck provides to students to learn more about working in a different country. I had already been on a Global Insight Expedition to Armenia, and wanted to continue broadening my international experience. As a result, I spent three weeks in Haiti working with the St. Boniface Haiti Foundation (SBHF), which runs the largest hospital in the south of the island. SBHF is accessible to anyone needing care, and served over 100,000 patients last year. They had asked our OnSite team to help find ways to optimize their consumable supply chain with the goal of minimizing (and ultimately eliminating!) shortages. Although I’d been to Haiti before as a volunteer, I was excited to return. Not only was I helping in a new way and drawing on my experiences at Tuck, but helping at SBHF was sure to inform my understanding of how big companies might approach expansion into developing countries. St. Boniface welcomed us from day one and every person we spoke with reiterated the importance of the supply chain issue. Learning about the health care system, especially so quickly, was fascinating. St. Boniface’s root issues were predictable—they weren’t matching supply with demand, were short-staffed, and didn’t have a comprehensive data tracking system—but I was surprised by the scale of their problems and how they overlapped one another. The limited connectivity, the fragility of the roads from suppliers to the hospital, and the necessity of making sure any supplies they received would be of sufficient quality were all factors that complicated each other.  It also surprised me how similar organizations can be. It struck me during interviews with surgical nurses how many of our questions were just like those asked in factory plants: What is your daily process like? How do you know what to order? Is everything easily visible and storable? These questions were ones I’d seen in both company interviews and in our Operations class, but primarily for industrial goods companies. On paper I could understand how operations principles were also necessary in the health care and nonprofit space as well, especially because of the personnel’s time constraints, but seeing it live made those principles all the more relevant. We knew that we needed to revamp the system without making the hospital adjust to something completely new. By using the existing requisition system and making key changes, we aligned the new system with the hospital staff’s habits, making it more likely that they would be able to easily implement it. Our recommendation then introduced other new changes in phases, so that we were slowly moving the system and making sure the hospital was still running at the same time. The trip was amazing. I learned more than I ever expected in three weeks, not only from the project itself, but from the different ways each member in our team approached the problem. It was an honor to help an organization with such a vital mission, and an unforgettable experience. We even managed to dig our toes in the sand on the weekends (as you can see below)! Gillian Wong is a second-year student at Tuck, who worked at Standard & Poor's in content management and publishing. |

|

|

||

|

Hi Generic [Bot],

Here are updates for you:

ANNOUNCEMENTS

Watch earlier episodes of DI series below EP1: 6 Hardest Two-Part Analysis Questions EP2: 5 Hardest Graphical Interpretation Questions

Tuck at Dartmouth

|