Forum Home > GMAT > Quantitative > Problem Solving (PS)

Events & Promotions

| Last visit was: 31 Oct 2024, 18:02 |

It is currently 31 Oct 2024, 18:02 |

|

|

Customized

for You

Track

Your Progress

Practice

Pays

06:00 PM EDT

-07:00 PM EDT

10:00 AM EDT

-10:30 AM EDT

08:00 PM PST

-09:00 PM PST

09:00 PM IST

-10:00 PM IST

05:30 AM PST

-06:00 PM PST

05:00 PM EST

-05:45 PM EST

| FROM CUHK: East-West Contest for Asian Finance Students |

|

Asians account for two-thirds of newly enrolled students at schools in Financial Times’ 2018 pre-experience masters in management ranking. Meanwhile, U.S. and European schools are acutely aware of the rapid rise of competitors in China, Hong Kong, Singapore, South Korea and India. While no Asian schools featured in Financial Times’ inaugural masters in finance rankings in 2011, six now occupy seven places in this year’s Financial Times Masters in Finance Pre-experience ranking table. Much of this rise is because of the growth and development of the Chinese and other Asian economies. Many Chinese students going abroad now want to come back to China because of opportunities or for family reasons. Over the past 10 years in China there has been huge and fast growing demand for students in finance. Because of a shortage of talent, financial sector pay in China is growing at about 8 per cent a year for junior and mid-level positions, according to the recruitment company Morgan McKinley. In an interview with Financial Times, Joseph Cheng, Chairman and Associate Professor of Department of Finance, and Director of MSc Programme in Finance (Full Time) at The Chinese University of Hong Kong (CUHK) Business School, notes a similar trend. “Only a couple of years ago…three months after graduation, 80 per cent of our students were staying in Hong Kong, with 20 per cent moving back to mainland China. Now, that trend is reversing. More Chinese students are willing to go back to mainland China because the economy is getting better. The pay may be lower…but our graduates can see good prospects.” Meanwhile, Asian schools are improving, says Prof. Cheng. “Asian schools can already offer some advantages over western competitors in terms of local curriculum content, placements and networking,” he adds. “But increasingly they are run according to international models and standards too. More schools are gaining accreditation from organisations such as AACSB [Association to Advance Collegiate Schools of Business]. Prof. Cheng says that core course content is similar in Asia to that elsewhere, but that [CUHK Business School] is introducing elective courses tailored to local need, such as the characteristics of Chinese equity markets… Read More (PDF) Source: Financial Times Date published: 17 June 2018 Photo: AFP The post East-West Contest for Asian Finance Students appeared first on CUHK Business School. |

| FROM CUHK: What’s in a Name? |

|

Tourism is said to be one of the four major industries of Hong Kong capable of driving the growth of other trades. In response to the government’s effort to champion tourism, CUHK set up the School of Hotel Management in 1998, and launched the BBA Programme in Hotel Management in the following year. In 2002, the School was renamed School of Hotel and Tourism Management. Last year, the programme was renamed ‘’. But the addition of ‘real estate’ may sound perplexing to some. Calling a Spade a Spade The programme director of Hospitality and Real Estate, Ms. Gentiana Cheung, said, “Twenty years ago, the BBA Programme in Hotel Management was modelled after the programme offered by Cornell, which also provided training in real estate. Our goal is ‘to train talent for the hotel, tourism and real estate industries who will be involved in investment decisions and everyday business operations.’ We have always been offering courses like ‘Hospitality Real Estate’, ‘Hospitality Real Estate Finance’, ‘Property Investment and Feasibility Study’, and ‘Real Estate Valuation’. Our renaming in 2017 was intended to reflect truthfully what we have been doing all along.” Then what is the relationship between hospitality and tourism and real estate? Ms. Cheung explained, “The whole process──from land acquisition and construction of a hotel to renovation, fitting-out and brand-building──requires a lot of efforts, and the process is expected to culminate in the deliverance of best service to our customers. Every step is interrelated. The objective of the programme is to provide an integrated training on commerce, hospitality and real estate, such that our students are well-equipped to follow through the entire process. Our core value is to provide the best service and experience.”  No Vocational Training Many people think that hospitality is no more than front desk service, housekeeping, restaurant operation, etc., and studying real estate is training to become a real property agent. Prof. David Chan, director of the School, said, “University education is not vocational training. If we only focus on the training of supporting staff, then there will be a bottleneck in our industry. It is not a problem at all for our graduates to become managers, but to be equal to the task of a general manager, they must have strategic thinking and leadership skills. We have to train up our young people as future leaders.” The programme’s well-structured curriculum reflects the School’s expectation of their students. The freshmen have to take compulsory courses offered by CUHK Business School. In the second year, they have to study courses in food and beverage, lodging facilities, management, hospitality real estate and finance, and sales and marketing. Before admission to year 3, students have to opt for either the hospitality stream or real estate stream. The hospitality stream covers human resources, law, market analysis, asset management, customer service, convention planning, and strategic branding. The real estate stream covers law, finance, investment, valuation, and facilities planning and management, as well as real estate securities and global asset allocation. The programme comes with two rounds of three- to six-month summer internships. In the initial stages of the internship, students participate in housekeeping, food and beverage, and front desk service. Later, they can work for companies with a broader scope; for instance, the Hong Kong Convention and Exhibition Centre, real estate companies, consultancies, etc., to try their hand on paper work or tasks that call for strategic thinking. The programme’s internship partners include local and international hotel groups, and companies in the travel and real estate industries. A steady supply of internship places are offered by Disney World in Florida and Hyatt Hotels Corporation. A tripartite collaboration on student exchange has been entered into with the University of Queensland in Australia and Mahidol University International College in Thailand, in addition to those arranged with Cornell University and Virginia Tech in the US, and National University of Singapore. Last year, 30% of graduates entered the hospitality industry, while 17% joined the real estate sector, and some were employed by the food service/club/event sectors. Others joined the civil service as executive officers and administrative officers, or took up jobs in the financial fields and consultancies. Some are even operating their own startups or pursuing further studies. Ms. Cheung said, “Our training hones students’ organisation and problem-solving skills. They also have good presentation and lobbying skills, making them quite versatile.” Recruiting the Best When the programme was renamed in 2017, applications recorded a slight drop owing to students’ unfamiliarity with the new title. However, the overall admission score witnessed a surge. The programme took in 69 students last year, among whom over 10 were non-local students and international students. They are of course not coming to Hong Kong to learn to be bus boys but to be leaders of the hospitality and tourism industry. They are to familiarise themselves with the whole production chain, all the way from initial planning to operation and profitability. The same applies to real estate: students have to learn the entire process flow, starting from valuation and acquisition of land to construction and transaction. To attract high-calibre students, faculty members have to visit secondary schools to impart to prospective applicants the positioning of the programme. They also held a one-day summer workshop for secondary four students or above to give them a taste of what the programme offers. Students in the workshop will have to decide what buildings are suitable for a particular site, after taking into consideration demographics, geography, and environmental factors. The two- to three-hour project is usually able to give students a good grasp of what real estate is about. In fact, most students who enrol in the programme have participated in the summer workshop before. Ms. Cheung, who has extensive experience in the hospitality industry, said, “It makes no difference whether you are from the arts, science, or commerce stream. You would have to start afresh. I attach great importance to students’ passion, willingness to interact with others, open-mindedness and positive outlook. All they lack is professional knowledge and training which we are to offer. During interviews, we look for students who have good communication and English competencies, because most of our teaching is conducted in English, and so is our medium of communication. Our international students hail from Korea, Japan, Taiwan, Singapore, the US, the UK, Australia, Kyrgyzstan and Kazakhstan. Our students will have a chance to get to understand more about other cultures and ways of thinking.” Taking Service to a New Level Hospitality refers to a whole range of services relating to entertaining. Aside from hotels, the sector also covers resorts, theme parts, tourism companies, airlines, cruises, restaurants, conventions and exhibitions. Are millennials who love to be served ready to take up the role of serving? “There is not a single trade that does not provide service,” Ms. Cheung pointed out. “Most people think that only physicians, lawyers, and accountants hold respectable jobs, but such professionals also provide services to their clients. There are no high- or low-ranking services. What counts is the interaction between people and the degree of satisfaction given to your clients. A service provider should be humble, curious, understanding, inclusive, and be able to see the good side of things. They should be professional and remain steadfast to their quest for a beautiful life.” Most young people in Hong Kong have been travellers themselves, and Ms. Cheung said this is what helps them see issues from the perspective of their customers, giving them the edge in coming up with ingenious solutions and customised services. The professional knowledge, experience, and analytical and leadership skills provided by the programme will definitely help students excel with flying colours. This article was originally published in No. 520, CUHK Newsletter on 19 June 2018. Read more: David Chan’s Journey from Hotel to School The post What’s in a Name? appeared first on CUHK Business School. |

| FROM CUHK: CUHK MSc in Finance Named Among Top 10 Programmes for Options and Futures in Financial Times Global Master’s in Finance Pre-experience Ranking 2018 |

The Financial Times Global Master’s in Finance Pre-experience Ranking 2018 was released on 17 June 2018. The Chinese University of Hong Kong (CUHK) Business School’s MSc Programme in Finance has moved up four places to 49th, making it one of the top five master’s in finance programmes in Asia. A total of 73 schools took part in this year’s ranking exercise, and only the world’s top 67 masters in finance programmes are listed in the ranking table. Based on the 2015 graduates’ ratings of their own programme, Financial Times also announced the top 10 master’s in finance prorgrammes in 10 selected categories, including asset management, commodities, compliance / legal, consultancy, corporate finance, economics, fintech, FX & money markets, options and futures and risk management. CUHK MSc in Finance was named as one of the top 10 master’s in finance programmes for options and futures. Attributed to its strong student career support, CUHK MSc in Finance is ranked 17th in the world and as the highest ranked programme in Asia in terms of career progress*, and fourth in Asia (17th in the world) in terms of career service*. 98 percent of our graduates surveyed successfully landed a job within three months after graduation. The ranking demonstrates that CUHK MSc in Finance is able to enhance its full-time graduates’ employability and career advancement. Financial Times defines pre-experience programmes as those aimed at students who have very little or no professional experience. The rankings are calculated according to information provided by business schools and alumni who graduated three years ago, i.e. Class of 2015 for this year’s survey. Alumni responses inform six criteria — including today’s salary, placement success and international mobility — that together account for 55 per cent of the ranking’s weight. Read the full Financial Times Global Master’s in Finance Pre-experience Ranking 2018 results at: https://on.ft.com/2LWm9vx or click here to download a PDF copy. *Note on ranking criteria of measurement Career progress: This is calculated according to changes in the level of seniority and the size of company alumni are working for between graduation and today. Careers service: This reflects the effectiveness of the school careers service in terms of career counselling, personal development, networking events, internship search and recruitment, as rated by their alumni. The post CUHK MSc in Finance Named Among Top 10 Programmes for Options and Futures in Financial Times Global Master’s in Finance Pre-experience Ranking 2018 appeared first on CUHK Business School. |

| FROM CUHK: Red-Hot Hong Kong Prices Still Rising |

|

Prices for ultra-luxury units in Hong Kong’s residential market hit a peak in November 2017—literally—when a buyer purchased two units at The Peak, a development at the city’s highest elevation, for a total of HK$1.16 billion. At HK$132,060 per square feet, it set a world record for the price of a condominium or apartment transaction. Commenting on the city’s skyrocketing real-estate prices, Maggie Hu, Assistant Professor of Real Estate and Finance of School of Hotel and Tourism Management and Department of Finance at The Chinese University of Hong Kong Business School, tells Mansion Global magazine, “It is possible for Hong Kong to surpass Monaco to become the place with the most expensive property prices in the world.” At the end of the day, it comes down to a limited supply of developable land. “Only 6.9 percent, or 77 square kilometers, of Hong Kong’s landmass is zoned for housing, and about half of that is allocated to low-density rural settlements that cannot be easily transacted in the property market,” Prof. Hu adds. “This is a meager amount compared with the land allocated to country parks and natural reserves, which take up about 65.8 percent of Hong Kong’s land.”… Read More (PDF) This article first appeared in Mansion Global magazine’s June 2018 issue. Source: Mansion Global Date published: 14 June, 2018 Mansion Global is a Dow Jones publication targeting at luxury real-estate buyers. The media publication produces original articles and data analysis about the global real estate market. Photo: Getty Images The post Red-Hot Hong Kong Prices Still Rising appeared first on CUHK Business School. |

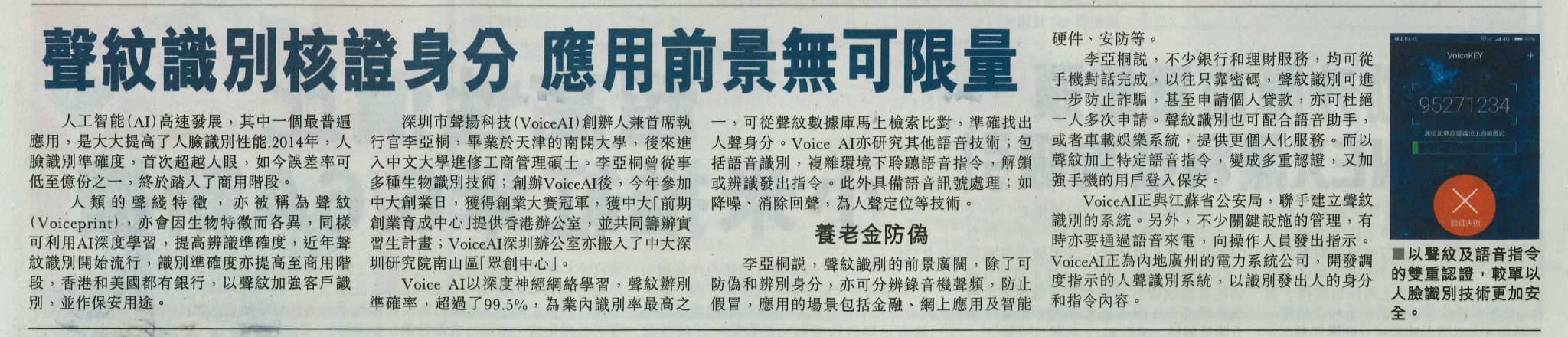

| FROM CUHK: CUHK MBA Alumnus Takes Voice AI Technology to Indonesia |

MBA alumnus and CEO of VoiceAI Technologies Co. Ltd. Kevin Li Yatong (Right) Imagine hundreds of senior citizens lining up at a bank to receive their pension several times each year. This involves so much effort on the part of the pensioners, but also a lot of time and manpower for the bank’s staff, not to mention the enormous costs. VoiceAI Technologies Co. Ltd., a Shenzhen-based startup dedicated to the research and usage of voice artificial intelligence (AI) technologies, has provided its voiceprint recognition solution to facilitate the release of the funds through the use of AI, and is now deploying the technology to serve the needs of about 2.5 million retirees in Indonesia. On 6 June 2018, Kevin Li Yatong, an alumnus of The Chinese University of Hong Kong (CUHK)’s MBA programme came back to campus and met with a group of Hong Kong media, including HK01, Hong Kong Economic Journal’s EJ Insight, Hong Kong Economic Times, Ming Pao Daily News, Oriental Daily News and Sing Tao Daily News’ IT Square. During the media interview, Li and his business partner shared about the voice AI technologies developed by their startup, and conducted a demonstration as well.     Inspired by CUHK MBA’s entrepreneurship curriculum, Li and his partners co-founded VoiceAI, and he is the CEO of the AI startup in 2016. VoiceAI currently has 16 staff members and focuses on the mainland market. The pension fund verification system developed for the Indonesian government is the first time the AI startup’s patented technology is being used in a national project on social security. Since May 2018, Taspen, the Indonesian state institution that manages the retirement funds for the country’s civil servants, has been using a verification system that allows the pensioners to confirm their identities by simply speaking a single sentence. The new system applies biometrics such as fingerprint, facial recognition and voiceprint to authenticate the identities of pensioners. “AI technology has to integrate into a practical business scenario so as to serve people and bring increased efficiency,” said Li told a group of journalists from six daily newspapers in Hong Kong. Besides its safety, convenience of use and low production cost, voiceprint recognition can effectively solve the problem of long-distance identity authentication, Li added. Users can speak a single sentence into the phone to authenticate their identity. “Identification verification for pension fund is a very representative scenario,” he said. VoiceAI’s involvement in the project started in early 2017. The Indonesian authorities were initially worried over the accuracy and reliability of the company’s technology. “After our analysis of the project, we offered our voiceprint recognition solution, which enables retirees to receive their pension without having leaving their home, while at the same time easing the workload of banks and the manpower input,” said Li. Indonesia’s retired civil servants’ population is definitely huge, and the authorities naturally demand a high degree of precision of the voiceprint recognition technology. The problem was that the company had no Indonesian speech and voice database. The startup has been collecting speech and voice data on site and conducting relevant testing since its system went online in May, with the help of sophisticated equipment including different brands of Android mobile phones and iPhones. The entire process of data collection and testing is expected to be completed in three to six months. Li and his team were Champions and the Most Outstanding Solution Awardee of the 2018 CUHK Entrepreneurship Competition held in May 2018. VoiceAI completed angel funding of several million yuan early this year and plans to carry out a pre-series A funding worth 3 million US dollars this year. Seven media stories have been generated so far with positive and encouraging messages. The media stories have appeared in HK01 (PDF), Hong Kong Economic Times’ TOPick (PDF) online news portal, Hong Kong Economic Journal’s EJ Insight (PDF), Hong Kong Economic Times (story 1, 2) (PDF), Oriental Daily News (PDF) and Ming Pao Daily News (PDF). The HK01 one has also been reprinted by popular internet portal Yahoo! Hong Kong (PDF). To read more about the media stories (in Chinese) by Hong Kong Economic Times, Ming Pao Daily News and Sing Tao Daily News’ IT Square, please click on the images below. Source: HK01, Hong Kong Economic Journal’s EJ Insight, Hong Kong Economic Times, Hong Kong Economic Times’ TOPick, Oriental Daily News, Ming Pao Daily News and Sing Tao Daily News’ IT Square Date published: 20 June 2018  Hong Kong Economic Times  Ming Pao Daily News  Sing Tao Daily News, IT Square Photo: VoiceAI, CUHK and Edmond Siu The post CUHK MBA Alumnus Takes Voice AI Technology to Indonesia appeared first on CUHK Business School. |

| FROM CUHK: Long Road to Better Taxi Service in Hong Kong |

|

Overcharge, strike one. Refuse to pick up fare, strike two. No loose change for passengers, another strike. But the list of strikes doesn’t end there for Hong Kong’s 40,000 taxi drivers. According to data from the HKSAR government’s Transport Complaints Unit, in 2016, 10,300 complaints on taxi service were received, making up 46 per cent of all complaints about public transport services in Hong Kong. The number of complaints per million passenger journeys was also the highest among all types of public transport. In a refreshing approach to years of gridlock when it comes to improving taxi services, the Committee on Taxi Service Quality — chaired by the government’s Commissioner for Transport — has proposed a new demerit point system. This is how it will work: Chalk up 15 points in a two-year period and a driver’s licence will be suspended for three months. It is six months for repeat offenders. The proposed system, over and above existing penalties, covers 18 of 24 existing road traffic offences. Six major offences, including overcharging and tampering with the taxi meter, attract the highest penalty of 10 demerit points. It is between three and five demerit points for offences of a less serious nature such as refusal to issue a receipt. In Hong Kong, taxi drivers rent their vehicles from operators who have paid exorbitant sums for taxi licences. These licences, which can be bought or sold in the market freely, can each cost as much as HK$7 million, enough to buy a tiny new flat in land-scarce Hong Kong. Getting their own taxi licence is beyond the financial means of cabbies, says Simon Lee, Co-director of International Business and Chinese Enterprise Programme and Senior Lecturer of School of Accountancy at The Chinese University of Hong Kong Business School in an interview with The Straits Times. Cabbies pay on average about HK$440 for rent and HK$200 for petrol each day. They need to chalk up HK$1,200 in fares, which give them net earnings of about HK$600 a day or about HK$12,000 a month. Given how little a taxi driver makes, there is no incentive to provide good service, comments Lee… Read More (PDF) This article also appeared in the print edition of The Straits Times on July 14, 2018, with the headline “Long road to better taxi services in HK”. Please click the image below to view the story. Source: The Straits Times Date published: 14 July 2018 Photo: Diego Delso, delso.photo, License CC-BY-SA The post Long Road to Better Taxi Service in Hong Kong appeared first on CUHK Business School. |

| FROM CUHK: 中大商學院發布第三屆「香港企業可持續發展指數」 |

|

香港中文大學(中大)商學院商業可持續發展中心(CBS)今天發布第三屆「香港企業可持續發展指數」(Hong Kong Business Sustainability Index / HKBSICBS),結果顯示本港上市公司日益重視業務可持續性和企業社會責任。 CBS於今年三月成立,是中大政治與行政學系及管理學系合作的成果,其前身是香港理工大學(理大)可持續發展管理研究中心(SMRC),由盧永鴻教授於2013年5月成立,並在策略性夥伴香港社會服務聯會和香港生產力促進局的支持下,展開HKBSI及其他可持續發展指數的編制項目,往後CBS將會繼續相關指數的編制。 作為CBS的主要項目之一,HKBSI旨在鼓勵香港公司承擔企業社會責任,藉此先進營商模式實現企業可持續發展。  香港中文大學商學院商業可持續發展中心主任盧永鴻教授(請按上圖放大及下載) 五十家恒生指數成份股公司(截至2017年6月6日為止)在今屆指數的總平均分為50.82分(總分100分),比2016年發布的第二屆指數上升11.13%;首20名企業的平均分則為72.46分(總分100分),上升5.29%。 HKBSI總平均分及首20名企業的平均分皆連續兩屆錄得上升。跟2015年12月發布的第一屆HKBSI(41.75分)相比,第三屆HKBSI的總平均分上升21.72%。今屆首20名企業的平均分亦錄得顯著升幅,達到26.57%(第一屆HKBSI為57.25分)。 CBS主任盧永鴻教授表示,HKBSI是根據SMRC建構並在2015年發布的「價值觀(Values)—過程(Process)—影響(Impact)」(VPI)模式編制而成。他強調過去三屆HKBSI見證了企業可持續發展的表現不斷進步。然而,他亦指出雖然最新一屆指數的總平均分有所上升,但標準差(Standard deviation)亦達到21.5之高,反映高排名與低排名公司的表現有相當大差異。總分達80分以上的高排名公司達到了領導業界發展的程度,媲美國際水平;得分低於總平均分的企業則仍然處於探索階段,尚未制定清晰的企業社會責任定位,亦欠缺完善的管理架構。 在VPI所評估的各項因素之中,各企業於第三屆HKBSI在「價值觀」取得62.40之最高評分,相比第二屆的增長率高達16.57%,升幅亦是各評估因素之冠。在「過程—管理」(58.48分)及「過程—實踐」(56.22分)方面的表現亦相當出色,分別錄得6.72%及8.72%的升幅。至於在「影響」方面,分數雖然躍升14.33%,但仍然是表現最弱的範疇,平均只有32.59分。 盧教授認為商界更樂意採納有關持續性和企業社會責任的概念綱領,並且日益關注各方持份者的要求,因此在「價值觀」方面表現出色。研究結果顯示這些企業日益以策略性眼光來看待企業社會責任項目,並且根據其業務發展來制定優先次序,讓公司能夠發揮優勢來令對象獲得更大效益。 「影響」是企業在VPI模式中表現最遜色的一環,盧教授指出,許多公司仍然以項目為主導的方式來實踐企業社會責任項目。雖然很多企業已開始認真看待「影響」,但仍然無法從「質」與「量」兩方面來評估企業社會責任項目實踐後所產生的結果和影響。他表示,許多企業對實踐有關項目的評估和檢討未夠成熟,若要有所改善,最重要是採用與企業社會責任管理相關,而又可量度關鍵影響指標和比較的數據;這些評估不僅有利於企業改善其內部管治,亦可增強對外的問責性。 現時逾半(52%)恒生指數成份股企業為非香港公司,當中計有H股、紅籌和其他在香港上市的中國內地企業。這些企業在第三屆HKBSI的總平均分為42.33(總分100分),對比第一屆的升幅為20.36%,顯示它們在業務可持續性方面不斷進步。 盧教授對此感到鼓舞,認為這些非香港公司大部分都是中國內地企業,對商業可持續性發展的認識較有限,算是企業社會責任方面的後起之秀。他預料,隨着這些公司逐步掌握企業社會責任的實現門徑,在有關方面的管理和表現將會不斷改進,並最終取得有目共睹的成績。盧教授表示,這些中國內地企業在履行企業社會責任方面的表現持續進步,反映相關企業的管理質素亦突飛猛進,而這將大大增強其競爭優勢及投資價值。 通過聚焦多家香港最大型的企業,HKBSI旨在鼓勵香港公司承擔企業社會責任,藉此先進營商模式實現企業可持續發展。五十家恒生指數成份股公司獲邀於網上完成評估問卷,根據公司的公開資料,填寫其截至2015/16年度關於企業社會責任的表現。SMRC按每家公司在企業社會責任三大方面作評估,即其企業社會責任的價值觀、過程(包括管理和實踐)、對七組持份者所帶來的影響以及對經濟、社會和自然環境可持續發展的貢獻。技術合作夥伴香港通用檢測認證有限公司(SGS)在評估過程中,抽樣核實個別企業提交的資料。 理大轄下的SMRC自2015年起每年編制HKBSI和發布相關結果,以期就恒生指數成份股公司在企業可持續發展方面的發展和表現,為本地和國際商界提供適時資訊。隨着盧永鴻教授從理大轉職到中大,HKBSI的編制工作亦於今年轉移到CBS,繼續肩負起在本地及區域商界社群間推動企業社會責任和商業可持續發展的使命。第四屆HKBSI的編制工作現已在積極籌備之中,結果將於今年底公布。 盧教授表示:「我們希望各恒生指數成份股公司能夠充分運用HKBSI的評核結果及個別企業報告,就其企業社會責任和可持續性水平的績效,每年進行全面和整體的評估;與此同時,配合有關資訊來發掘其他有效方法,針對表現較遜色的範疇,持續改善其企業社會責任的『實踐』和『影響』。」 請按此下載PDF檔案。 本文另提供英文及簡體中文版。 附錄一 香港企業可持續發展指數 — 平均分 第三屆HKBSI 第二屆HKBSI 變化(第三屆與第二屆HKBSI比較) 第一屆HKBSI 變化(第三屆與第一屆HKBSI比較) 平均分(所有公司) 50.82 45.73 +11.13% 41.75 +21.72% 首20名企業平均分 72.46 68.82 +5.29% 57.25 +26.57% 香港公司平均分 60.01 55.44 +8.25% 49.42 +21.43% 非香港公司平均分 42.33 36.02 +17.52% 35.17 +20.36% 附錄二 「價值觀—過程—影響」(VPI Model)分數變化 — 第三屆與第二屆HKBSI比較 第三屆HKBSI 第二屆HKBSI 變化(第三屆與第二屆HKBSI比較) 價值觀 62.40 53.53 +16.57% 過程—管理 58.48 54.80 +6.72% 過程—實踐 56.22 51.71 +8.72% 影響 32.59 28.51 +14.33% 附錄三 第三屆香港企業可持續發展指數公司名單(按英文名稱排序) 瑞聲科技控股有限公司 友邦保險控股有限公司 中國銀行股份有限公司 交通銀行股份有限公司 東亞銀行有限公司 * 百麗國際控股有限公司 中銀香港(控股)有限公司 * 國泰航空有限公司 * 中國建設銀行股份有限公司 中國人壽保險股份有限公司 中國蒙牛乳業有限公司 招商局港口控股有限公司 中國移動有限公司 中國海外發展有限公司 中國石油化工股份有限公司 華潤置地有限公司 * 華潤電力控股有限公司 * 中國神華能源股份有限公司 中國聯合網路通信(香港)股份有限公司 中國中信股份有限公司 長江實業集團有限公司 長江和記實業有限公司 長江基建集團有限公司 中電控股有限公司 * 中國海洋石油有限公司 * 銀河娛樂集團有限公司 吉利汽車控股有限公司 恒隆地產有限公司 * 恒生銀行有限公司 * 恒基兆業地產有限公司 * 恒安國際集團有限公司 香港中華煤氣有限公司 * 香港交易及結算所有限公司 * 滙豐控股有限公司 * 中國工商銀行股份有限公司 昆侖能源有限公司 聯想集團有限公司 * 領展房地產投資信託基金 香港鐵路有限公司 * 新世界發展有限公司 * 中國石油天然氣股份有限公司 中國平安保險(集團)股份有限公司 電能實業有限公司 * 金沙中國有限公司 信和置業有限公司 * 新鴻基地產發展有限公司 * 太古股份有限公司 ‘A’ * 騰訊控股有限公司 中國旺旺控股有限公司 九龍倉集團有限公司 * 第三屆香港企業可持續發展指數首二十名企業 The post 中大商學院發布第三屆「香港企業可持續發展指數」 appeared first on CUHK Business School. |

| FROM CUHK: CUHK Business School Announces the 3rd Hong Kong Sustainability Index |

|

The Chinese University of Hong Kong (CUHK) Business School’s Centre for Business Sustainability (CBS) announced today results of the 3rd Hong Kong Business Sustainability Index (HKBSI), where leading companies in Hong Kong have shown increasing concerns for corporate social responsibility (CSR) and business sustainability. Established in March this year, CBS is a joint effort of Department of Government and Public Administration and Department of Management at CUHK. The Centre will continue the sustainability index projects initiated by Prof. Carlos Lo, when he set up the Sustainability Management Research Centre (SMRC) at The Hong Kong Polytechnic University (PolyU) in May 2013, with the support of The Hong Kong Council of Social Service and the Hong Kong Productivity Council as strategic partners. As one of the major initiatives, HKBSI aspires to inspire companies in Hong Kong to adopt CSR as a progressive business model for them to achieve business sustainability.  Prof. Carlos Lo, Director of Centre for Business Sustainability (Click the image to enlarge and download) Compared to the results of the 2nd HKBSI released in 2016, the overall average score of the 50 constituent companies of the Hang Seng Index (HSI) as at 6 June 2017 in the 3rd HKBSI was 50.82 (out of 100 points), an increase of 11.13 per cent, whereas the average score of the top 20 Index companies has recorded 72.46 (out of 100 points), up by 5.29 per cent. Both the overall average score and that of the top 20 Index companies have registered an increase for two consecutive rounds of HKBSI. In comparison with that of the 1st HKBSI, which was launched in December 2015, the overall average score of the 3rd HKBSI registered an increase of 21.72 per cent (from 41.75 points in the 1st HKBSI). For the top 20 HKBSI Index companies, the mean score of this round has recorded a significant improvement of 26.57 per cent (from 57.25 points in the 1st HKBSI). Prof. Carlos Lo, Director of CBS, explained that the assessment of HKBSI is based on the unique “Values – Process – Impact” (VPI) model, which was developed by SMRC and launched in 2015. He highlighted the progressive advancement in the performance of business sustainability over the past three rounds of HKBSI. However, he pointed out that in this latest round, despite an increase in the overall average score, the standard deviation was also visibly large (21.5 points), reflecting a huge performance gap between the top and bottom companies. For the top companies with over 80 points, their overall performance in sustainability attained the level of “pace-setter” and was comparable to international standard. But for those companies scored below the overall average score, they were still in the stage of “explorer” and have yet to set a clear CSR orientation and a proper management framework. Among the assessment aspects of VPI, in comparison with the results of the 2nd HKBSI, “Values” has registered the highest score of 62.40 points and the highest growth of 16.57 per cent in the 3rd round. “Process-Management” (58.48 points) and “Process-Practice” (56.22 points) have also performed well, recording 6.72 per cent and 8.72 per cent rise respectively. The average score of “Impact” (32.59 points) has chalked up an impressive increase of 14.33 per cent; yet, “Impact” has remained as the weakest area across the board. Prof. Lo attributed the high score in “Values” to the companies’ increasing adoption of conceptual frameworks related to business sustainability and CSR, as well as their greater concern for various stakeholders. It shows that companies have increasingly approached their CSR activities in a strategic manner, with defined priorities aligned with their business drivers, thus enabling the companies to leverage their strengths for achieving better impact on the beneficiaries. On “Impact” of the VPI model, the weakest area that companies performed, Prof. Lo said many companies are still implementing CSR on project-driven basis. Although many have begun to take “Impact” more seriously, they still lack the ability to measure, both qualitatively and quantitatively, the results and impacts of their CSR practices and activities. He said evaluation and review of these practices are still relatively less developed in many companies, and it will be important for them to apply measurable Key Impact Indicators and comparable data related to CSR management. Such evaluations are useful for companies in not only improving their internal governance, but also strengthening their external accountability. Currently, more than half (52 per cent) of the HSI constituent companies are non-Hong Kong based companies, comprising of H-shares, red chips and other mainland Chinese firms listed in Hong Kong. The overall average score of these companies in the 3rd HKBSI recorded a 20.36 per cent rise to 42.33 (out of 100 points) when compared to that of the 1st HKBSI, showing a continuous improvement in the performance of business sustainability. “This is an encouraging trend, indeed”, expressed by Prof. Lo, given that most of these non-local companies are Chinese firms, which are late comers of CSR with limited knowledge on business sustainability. It is expected that this group of companies will continue to make noticeable improvement in their CSR management and performance as their learning curve steadily progresses. On the whole, the rising trend of their CSR performance indicates a lift of the quality of corporate management, which in return, will positively impact their competitive advantage and hence investment value. HKBSI aims at encouraging companies in Hong Kong to adopt CSR as a progressive business model for them to achieve business sustainability. Putting a spotlight on the largest companies as a leading force, fifty HSI constituent companies were invited to complete an online assessment questionnaire concerning their CSR performance for the financial year ended in 2015/16, based on publicly available information. Each company was assessed in three major areas, namely CSR Values, CSR Process (comprising CSR management and practices) and CSR Impact against seven stakeholder groups, as well as the company’s contributions to economic, social and environmental sustainability. As the Technical Partner of the project, SGS Hong Kong Limited conducted sample check and verification of the information provided by individual companies. Since 2015, SMRC at PolyU has compiled the HKBSI and announced the results on an annual basis in order to timely inform both the local and the international business communities the on-going development and performance of the Hang Seng Index’s constituent companies on business sustainability. CBS will continue such meaningful project to promote CSR and business sustainability in both local and regional business communities in the wake of the move of Prof. Carlos Lo from PolyU to CUHK. The compilation of the 4th HKBSI is now under preparation and the results will be announced toward the end of this year. “We hope that participating companies can make full use of HKBSI assessment and individual company reports, which reflect their CSR performance and level of sustainability, as a comprehensive and holistic tool to review their annual business sustainability achievements, and to identify ways for improving the weaker areas in their CSR practices and impacts,” said Prof. Lo. Please click here to download the PDF format. This press release is also available in traditional and . Appendix 1 The Hong Kong Business Sustainability Index – Average Score 3rd HKSBI 2nd HKBSI Changes (3rd vs 2nd HKBSI) 1st HKBSI Changes (3rd vs 1st HKBSI) Overall average (all companies) 50.82 45.73 +11.13% 41.75 +21.72% Top 20 average 72.46 68.82 +5.29% 57.25 +26.57% HK-based average 60.01 55.44 +8.25% 49.42 +21.43% Non HK-based average 42.33 36.02 +17.52% 35.17 +20.36% Appendix 2 Scores by VPI Model – 3rd HKBSI vs 2nd HKBSI 3rd HKSBI 2nd HKBSI Changes (3rd vs 2nd HKBSI) Values 62.40 53.53 +16.57% Process–Management 58.48 54.80 +6.72% Process–Practice 56.22 51.71 +8.72% Impact 32.59 28.51 +14.33% Appendix 3 The 3rd Hong Kong Business Sustainability Index Company List (in alphabetical order) AAC Technologies Holdings Inc. AIA Group Ltd. Bank of China Ltd. Bank of Communications Co., Ltd. The Bank of East Asia, Ltd. * Belle International Holdings Ltd. BOC Hong Kong (Holdings) Ltd. * Cathay Pacific Airways Ltd. * China Construction Bank Corporation China Life Insurance Co. Ltd. China Mengniu Dairy Co. Ltd. China Merchants Port Holdings Co. Ltd. China Mobile Ltd. China Overseas Land & Investment Ltd. China Petroleum & Chemical Corporation China Resources Land Ltd. * China Resources Power Holdings Co., Ltd. * China Shenhua Energy Co. Ltd. China Unicom (Hong Kong) Ltd. CITIC Ltd. CK Asset Holdings Limited CK Hutchison Holdings Ltd. CK Infrastructure Holdings Ltd. CLP Holdings Ltd. * CNOOC Ltd. * Galaxy Entertainment Group Ltd. Geely Automobile Holdings Ltd. Hang Lung Properties Ltd. * Hang Seng Bank Ltd. * Henderson Land Development Co. Ltd. * Hengan International Group Co. Ltd. The Hong Kong and China Gas Co. Ltd. * Hong Kong Exchanges and Clearing Ltd. * HSBC Holdings plc * Industrial and Commercial Bank of China Ltd. Kunlun Energy Co. Ltd. Lenovo Group Ltd. * Link Real Estate Investment Trust MTR Corporation Ltd. * New World Development Co. Ltd. * PetroChina Co. Ltd. Ping An Insurance (Group) Co. of China Ltd. Power Assets Holdings Ltd. * Sands China Ltd. Sino Land Co. Ltd. * Sun Hung Kai Properties Ltd. * Swire Pacific Ltd. ‘A’ * Tencent Holdings Ltd. Want Want China Holdings Ltd. The Wharf (Holdings) Ltd. * Top 20 Companies in the 3rd Hong Kong Business Sustainability Index The post CUHK Business School Announces the 3rd Hong Kong Sustainability Index appeared first on CUHK Business School. |

| FROM CUHK: Get Equipped for a Career in Finance – MSc in Finance 2019/20 Application Opens |

|

MSc in Finance for 2019/20 is open for Application Now If you are considering a career in investment banking, commercial and corporate banking, asset management, or any other functions with the financial industry, this is a programme that can equip you. Our programme offers you rigorous training to master financial theories and techniques and develop strong quantitative reasoning, along with the latest technological skills in finance. You can study full-time for 1 year with opportunities to go on exchange and study field trips, or part-time for 2 years. Please visit Application Procedure for more details, or Apply here if you’re ready! The post Get Equipped for a Career in Finance – MSc in Finance 2019/20 Application Opens appeared first on CUHK Business School. |

| FROM CUHK: Make a Difference to the Society and Earn Credits – MGNT 6020E Social Entrepreneurship and Impact Investment |

|

In this action-based learning course, students will learn the cutting edge knowledge in social innovation and essential business skills. They will work in teams to help their social venture partners to ensure sustainability of the business while addressing some social problems at the same time. The best team will win HK$250,000 of grant for its social venture partner to implement the ideas. Upon successful completion of this course, students are expected to understand the current landscape of the social enterprises and venture philanthropy industry. Also, they will acquire hands-on knowledge and practical skills in the areas of management consulting, impact investing and social innovation through their project works. Moreover, they will have the ability to conduct advanced analysis of critical business issues of a social enterprise and conduct basic due diligence. Apart from MBA students, this special course is open to Taught Postgraduate programme students and senior undergraduate students. The course titled is MGNT6020E Selected Topics in Business – Social Entrepreneurship and Impact Investment, bearing 3 credit units offered by the MBA Programmes. Timeslot Mondays – 3 September to 19 November 2018 (06:45PM – 10:00PM) – no class on 1 October Venue Emerald Room, CUHK MBA Town Centre How to Apply? For MBA students, please apply through Online Course Registration System. For non-MBA students, please apply through the website of Center for Entrepreneurship by 22 August 2018 (Wednesday) 12:00nn. Should you have any enquiries, please contact Ms. Purple Tsoi of Center for Entrepreneurship at 3943 9525. Let’s make the change together… See you in class! Download Course Brochure The post Make a Difference to the Society and Earn Credits – MGNT 6020E Social Entrepreneurship and Impact Investment appeared first on CUHK Business School. |

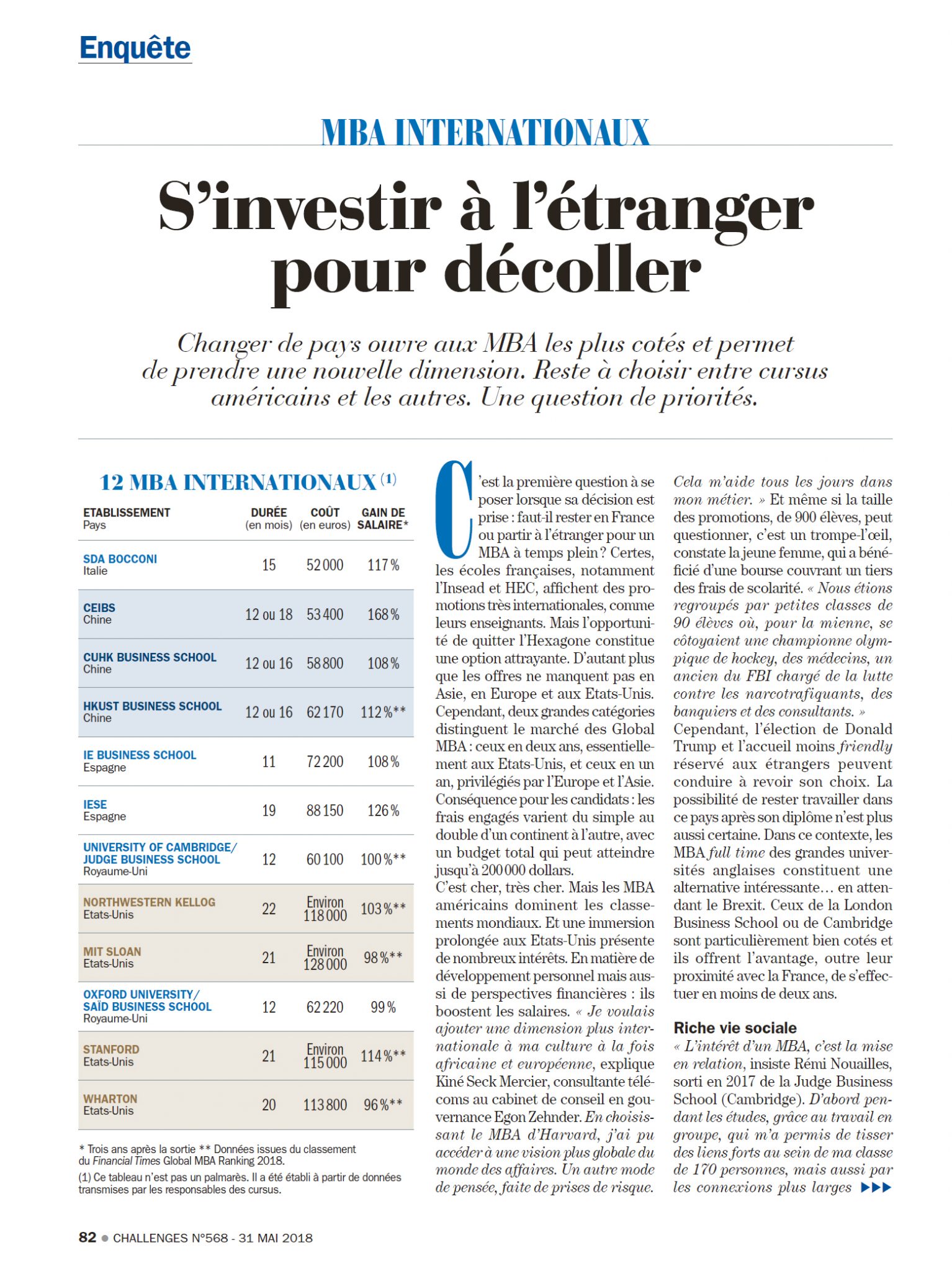

| FROM CUHK: Study MBA Abroad to Stand Out from the Crowd |

|

Getting an MBA abroad can give working professionals a new dimension to their career path. It is a question of priority on whether to stay in France or go overseas to study full-time MBA programme. The United States dominates global MBA rankings but there are plenty of offers in Europe and Asia. MBAs offered by business schools from the U.S. usually last for 2 years but those in Europe and Asia can be completed within a year. The expenses incurred can vary, and it is advisable to study in the geographical region where you want to secure a placement. In an interview with Challenges magazine, CUHK MBA alumnus Philippe Delplancke said “In the past, pursuing an MBA gives you access to important positions in multinational corporations but nowadays, this has changed. I personally prefer working in companies with a smaller and more agile structure as I can take up more responsibilities. I thrive in my work and learn new skills through day-to-day management. The fact that having studied in Hong Kong facilitates the communications with my colleagues at Nanoleaf China.” Graduated from CUHK Business School’s full-time MBA programme in 2014, Delpancke has joined Nanoleaf’s Paris office as Managing Director for the EMEA region. The Canadian startup is specialising in LED lighting, developing sustainable and focused lighting solutions in both non-connected and the connected space. Please click the images below to read the original story in French. Source: Challenges Date published: 31 May 2018   The post Study MBA Abroad to Stand Out from the Crowd appeared first on CUHK Business School. |

| FROM CUHK: Setting Sail in the Tech Blue Ocean |

|

Turning up in a coral dress, Cindy Chow (IBBA 1992) was the very picture of charm and high spirits. She kicked off the interview by offering her take on top performers in the HKDSE opting to pursue studies for a career in the classic professions such as medicine and law. “No doubt our community needs professionals like doctors and lawyers. But we also need others to come up with innovative solutions to make our lives better. I hope our next generation will have more diverse options for their career development.” 2015 saw the launch of the $1 billion Alibaba Hong Kong Entrepreneurs Fund initiated by Jack Ma, Alibaba Group’s Executive Chairman, to boost the local startup scene. Cindy previously served as the Group’s Senior Director of International Finance, overseeing financial management and corporate planning. As a firm believer in the Fund’s mission, she then became its Executive Director and has invested over US$30 million in 17 startup projects. Under the auspices of the Alibaba Hong Kong Entrepreneurs Fund, no time limit is imposed on the projects. Nor will Alibaba recoup the investment returns, which will continue to be deployed by the Fund to nurture the local startup ecology. Though a charity in effect, the Fund is operated as a purely financial investment like any other venture capital fund. “In Jack’s opinion, it is necessary to run this non-profit-making fund like a business to ensure its sustainable development.”  Cindy: “In a joint study released with KPMG, we’re glad to have discovered nearly 90% of the young interviewees aspire to advance community development by entrepreneurship.” As the Fund’s investment manager, Gobi Partners is responsible for screening investment projects and making investment decisions. The independent venture capital firm has been chosen because of the two partners’ close connections with Hong Kong. “We share the same vision and want to do something for Hong Kong,” Cindy said. ‘Connection to Hong Kong’ being the primary criterion for project selection, the range of investment covers the Internet of Things, Fintech, e-commerce, clean energy, sharing economy, and digital health care, etc. In 2017, the Fund teamed up with Cyberport and the Hong Kong Science and Technology Parks Corporation (HKSTP) to organise the startup contest ‘Jumpstarter’. Among the 600-plus entries received, the majority fell into the categories of e-commerce, Smart City and AI/Big Data. The 24 finalists competed to be in the final three at the end of November. Each winner was awarded up to US$1 million in investment commitment from the Fund. En-trak, one of the awardees, came up with a smart system integrating data on water, electricity, and gas consumption for clients to facilitate energy saving at source.  Grand Finale of the startup contest Jumpstarter (courtesy of the interviewee) Cindy is a graduate of CUHK’s Faculty of Business Administration and a member of United College. For the startup contest, she sent out sponsorship invitations to her classmates from the Faculty and United College. “Some of them may have been out of touch for years but, after just a phone call, they were happy to pass the news to the senior management in their companies.” Jumpstarter eventually secured support from many sponsors. What she valued most, however, was not the sponsorship amount. “Once the company sponsors are on board, they will pay attention to the contestants’ business nature, connecting the startups with potential clients. That was how En-trak won investors’ endorsement at the contest and completed its pre-series A funding round at the end of July led by Alibaba and CLP Innovation Ventures.” On the tortuous path of starting a business, resolving capital flow problems but overlooking market research and sales channels can land a new venture in trouble. For this reason, the Fund team has organised various activities to help budding entrepreneurs. One of these is ‘Venture Hours’ which offers participants 20 minutes of face time for each meeting. “The human touch is so important. We will find out from the participants what their problems are and provide them with practical advice for their startup plans.” Starting this year, ‘Venture Hours’ features a quarterly meeting in which a distinguished entrepreneur is invited to talk about venture and business strategies. Dr. Allan Zeman shared his Lan Kwai Fong experience in the inaugural event. Last year PricewaterhouseCoopers released its Global Artificial Intelligence Study, predicting that in 2030, AI will contribute to 14% of global GDP growth, surpassing the combined GDP of China and India in 2017. In May 2018, Alibaba, SenseTime, and HKSTP jointly established an AI laboratory in Hong Kong. “With Alibaba as a lead investor, SenseTime became the first unicorn in HKSTP. SenseTime’s co-founder Prof. Sean Tang of CUHK’s Department of Information Engineering once told Joseph Tsai, Alibaba’s Executive Vice Chairman, that business support was indispensable to the commercialization of research and development (R&D) technologies. Subsequently the AI Lab was launched.”  Alibaba, SenseTime and HKSTP join hands to found The Hong Kong AI Lab (courtesy of the interviewee) Under the plan to be implemented this September, capital, R&D, and operational support will be provided for around 10 successful startup applicants. Alibaba will offer the startups technical support such as GPU-equipped computer resources, HKSTP will allocate free office spaces, while SenseTime will provide a deep-learning platform. Startups with great potential will even benefit from the guidance of top AI scientists, entrepreneurs and professors. “Technology and innovation are the driving force for the sustainable and diversified development of society. If we can—like the companies in Silicon Valley—reinvest our returns in the local venture ecosphere, this will bring about a virtuous cycle.” Accountants often give the impression that they prefer to play it safe and go by the book. However, Cindy tends to be adventurous and to seize every opportunity that comes her way. Given her recent promotion in the company she’s then working for, her decision to join Alibaba in 2007 took many by surprise. “Back then Alibaba was not yet a household name in Hong Kong. But I loved experimenting and I had high hopes for the Chinese market and innovation and technology. So I changed jobs.” For Cindy, apart from her battle-ready work experience, the undergraduate studies and General Education at CUHK have become the advantages that stand her in good stead in her adventures. “Professional knowledge aside, General Education at the University has honed my independent-thinking and problem-solving skills. Back then, I took classes in the methodology of thinking, logic, sociology, etc. With more and more experience, I have come to realise what a great help General Education has been in my personal growth, family life and career, giving me understanding of and wisdom in life.”  Cindy embodies the Alibaba motto of “Have fun at work. Be earnest in life.” In addition to nurturing startups, Cindy is dedicated to giving back to society with her experience and professional expertise. Not only does she advise the Government on policies related to innovation, technology and re-industrialization, she also offers guidance to the Youth Arch Foundation. How does she manage the tensions between work and family? She responded lightheartedly, “Work-life balance is achievable. I cherish the quality time with my family. But, whenever I have free time at home, I also handle work-related matters. As the saying among those who work in Alibaba goes, ‘Have fun at work. Be earnest in life.’ That’s the idea.” Reported by Jenny Lau, ISO Photos by Eric Sin This article first appeared in CUHK Website, republished with permission from Information Services Office, CUHK. The post Setting Sail in the Tech Blue Ocean appeared first on CUHK Business School. |

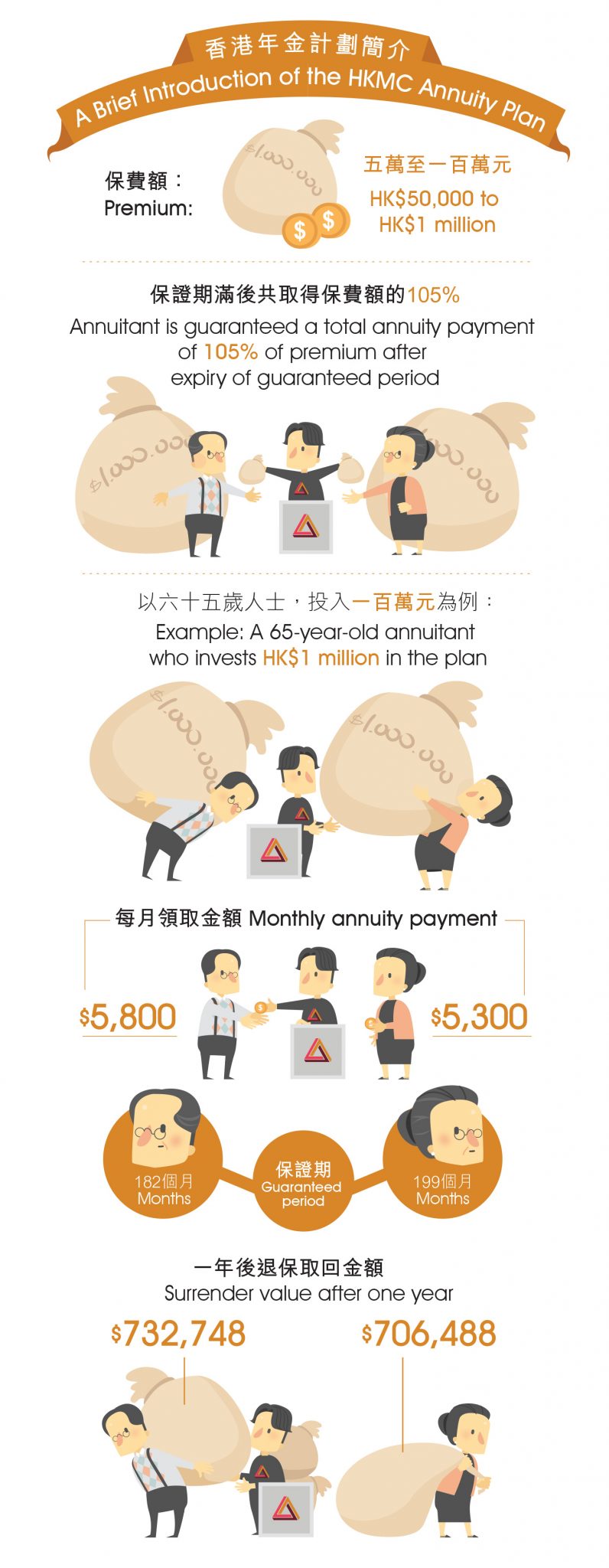

| FROM CUHK: Worry-free Retirement? |

|

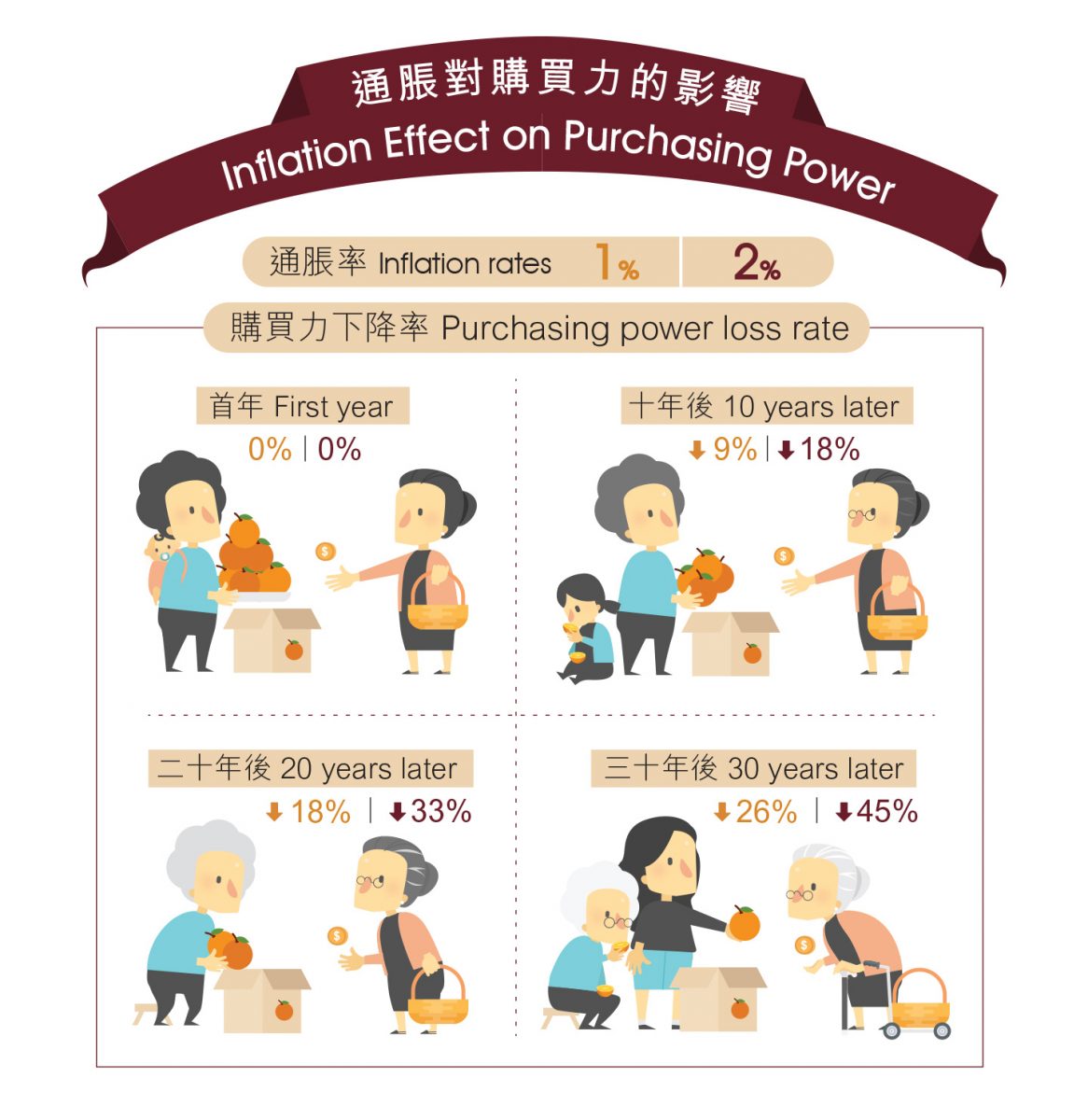

After over one year of promotion, the government finally launched its first-ever life annuity scheme—the HKMC Annuity Plan (Figure 1). All citizens aged 65 or above are entitled to lifetime guaranteed monthly annuity payments after paying a single premium. The tranche quota has been set at HK$10 billion. To make the plan more attractive, the one-off lump-sum premium payment placed with the annuity scheme will not be counted as asset. In other words, subscribing for the plan will have no impact on eligibility for the Old Age Living Allowance. The Annuity Plan is an alternative life insurance plan, but the major difference between the two lies in the fact that the latter requires monthly payments over an extended period before the policy owner can claim the sum insured, while the former involves payment of a single premium in return for regular payments. Annuity schemes have been implemented in other countries but it is a novelty in Hong Kong. Is it fair to say that the plan should have been implemented earlier? Is it a wise thing to invest in the Annuity Plan? An Advantageous Late Start Prof. Chan Wai-sum of the Department of Finance is a Member Trustee for CUHK’s Staff Superannuation Scheme (1995) and Terms of Service (C) Staff Terminal Gratuity Scheme (TGS), and one of his research areas is retirement protection. He has been actively involved in annuities research commissioned by the government, being one of the writers of a report titled ‘How to Increase the Demand for Annuities in Hong Kong: A Study of Middle-Aged Adults’ completed in 2016. Professor Chan said, “In terms of the timeframe for setting up an annuity scheme, Hong Kong is evidently lagging behind. From another point of view, that may not be an entirely bad thing. If we examine Taiwan and Japan where annuity schemes were set up long ago, we can see what problems we may run into in future. The ageing problem has almost brought the annuity fund of Taiwan to its knee, making it a necessity to reduce its annuity payout rates. This of course has led to social discontent and protests. In Japan, the financial health of its annuity scheme is also being called into question. Hong Kong can learn from their mistakes and devise better thought-out annuity schemes.”  Prof. Chan Wai-sum (Photo by ISO Staff) “The government launched the Mandatory Provident Fund (MPF) scheme in 2000, and a considerable sum has accumulated since then. The timing is right for MPF subscribers to build on their returns through investing in the Annuity Plan.” Questions and Limitations With a return of 4%, the guaranteed monthly annuity payments of the HKMC Annuity Plan are deemed reasonable by Professor Chan. That said, return rates are determined by the annuity principal and the condition of the global investment market. He assumes that the capital amassed from annuity subscriptions will be transferred to the Exchange Fund for investment. If the fund’s investments fail, leading to a reduction of investment capital, then it shall unleash a vicious cycle impacting on the regular payments of annuity income. The global financial market was quite volatile in the first half of the year, and a loss of HK$7.7 billion was announced by the Hong Kong Monetary Authority. “The HKMC Annuity Limited, wholly-owned by the Hong Kong government, will of course be spared from bankruptcy. But when major losses hit, what solutions do we have? Should the losses be covered by the public coffers? The government hasn’t clarified on the issue yet.” Professor Chan also has reservation about citizens’ acceptance of the Annuity Plan. Take the reverse mortgage programme as an example. From 2011 when the programme was introduced to the end of June 2018, there have only been 2,600-plus cases of transactions, meaning that the programme has not been popular at all. He said, “When I first embarked on my research in 2005, there was no privately run annuity scheme in Hong Kong. It was only recently that insurance companies started to make a foray into the annuity market.” According to the statistics of the Insurance Authority, the premium invested in privately run annuity schemes reached HK$2.5 billion in the first quarter. “The crux is how many people are willing to join the Annuity Plan. If the subscription rate of the plan is low, then the principal capital and return rates will plummet accordingly.” Another issue is the fact that the HKMC Annuity Plan only caters for individual subscriptions. Professor Chan said, “If a husband and wife, aged 68 and 65, respectively, want to invest HK$1 million in the plan, they must subscribe separately under the current system. A mature annuity market offers joint and survivor annuities, allowing the surviving annuitant to continue receiving regular payments.”  Figure 1 Erosive Effects of Inflation The replacement rate refers to one’s income after retirement divided by his or her pre-retirement income. The higher the rate, the higher one’s standard of living after retirement. Excluding medical expenses, a replacement rate of 40% to 60% can be considered satisfactory. Professor Chan said, “If you have a pre-retirement income of HK$15,000, a monthly annuity income of some HK$5,000 only amounts to a replacement rate of 30% or more, which is far from adequate.” “Don’t forget that annuity is a fixed income which does not increase with inflation. From 1987 to 2017, Hong Kong’s average inflation rate was about 1.2%. If the monthly income received by annuitants remain unchanged, then its purchasing power will fall. For example, a 65-year-old woman who invests HK$1 million in the Annuity Plan will get a monthly income of HK$5,300, but after 30 years, the purchasing power of her income will have declined by 26% (HK$3,922) if inflation is 1% or 45% (HK$2,915), if inflation is 2% (Figure 2). In a word, the Annuity Plan offers long-term protection, but that protection may not be enough.”  Figure 2 Expert Advice On the whole, Professor Chan regards as a good start for Hong Kong the setting up of an annuity scheme, which reminds us of the necessity for timely retirement planning. He said, “We should not only focus on annuity income and assume it can solve all our problems. Everyone’s needs are different, and in making a retirement plan, one should take into consideration one’s anticipated retirement age, anticipated longevity, condition of health, anticipated way of life and standard of living, medical expenses, income sources, net asset value, cash flow, financial competency, aggressiveness, location of residence, inflation rate and market interest rate fluctuations.” The advertisement of the Annuity Plan also reminds viewers not to put all eggs in one basket. Professor Chan said, “If I am over 65 and in good health, then I will invest in the plan. However, this is a personal decision. Potential subscribers should deliberate carefully or talk to their financial consultants.” On retirement planning, Professor Chan, who has been entrusted to monitor the Staff Superannuation Scheme and TGS for seven years, thinks that employees should take better control of their fund accounts. “Some colleagues may forget about their accounts completely, assuming that the University is managing the accounts for them. However, those accounts have to be managed by themselves after retirement, and so I would encourage them to understand more about the basics of financial management and chart out the retirement plans suitable for themselves.”  Prof. Chan Wai-sum (Photo by ISO Staff) Professor Chan added, “It is always better to plan your retirement earlier than later. When you are young, you can set a general goal and make long-term investments, reviewing them every five or 10 years. After you have reached 40, you have to start making plans for your retirement. You do not have to go into the details but planning is always a must, because choosing the right tools of investment and reaping the benefits require some time.” C.F. This article was originally published in No. 521, CUHK Newsletter on 19 August 2018. The post Worry-free Retirement? appeared first on CUHK Business School. |

| FROM CUHK: Professor Yesha Sivan Present at the Human Brain Project (HBP), Berlin |

|

On 4-6 July, Prof. Yesha Sivan attended the Human Brain Project (HBP), Berlin, presenting the Blue Ocean Strategy for innovation at the 2nd HBP Curriculum Workshop Series on Entrepreneurship in Neuroscience – Turning Science into Invention and Innovation. This was the 2nd HBP Curriculum Workshop Series, The HBP Curriculum on Interdisciplinary Brain Science combines web-based distance learning courses and face-to-face workshops that provide basic lessons in the HBP core fields neuroscience, medicine, and ICT as well as the complementary subjects of ethics and intellectual property rights. This ‘hackathon’ style workshop was a hands-on intensive experience complementing the theoretical aspects of the online course on intellectual property rights, translation, and exploitation of research. Students worked in small multi-disciplinary teams to assemble joint applied research proposals in the wide range of fields in brain science. Experienced entrepreneurs, top executives at the interface between academia and industry and researchers from academia presented, mentored and advised on the translational aspects of the offered projects including how to advance their proposal from the lab to market, understand the problems and accordingly define the needs in the chosen field, how to choose or identify the target population, patentability options and how to build a business model. Finally, they presented their proposals to industry and academy experts. The workshop was a unique experience of diving into the entrepreneurial world, learning how to incorporate innovation and entrepreneurship mindset and concepts into day-today research work and beyond. Prof. Yesha Sivan is the founder and CEO of i8 ventures – a business platform focusing on innovating innovating, he is also a visiting professor of innovation and venture at The Chinese University of Hong Kong Business School. Sivan’s professional experience includes developing and deploying innovative solutions for corporate, hi-tech, government, and defense environments. He focus on digital strategy (SVIT – Strategic Value of Innovation Technology), innovation and venture (employment black holes), mindful leadership (orange bike workshop), virtual worlds (3D3C platforms), and knowledge age standards. After receiving his doctorate from Harvard University, he has taught executives, EMBA, MBA, engineering and design courses in his areas of expertise. His blog is www.dryesha.com.  The post Professor Yesha Sivan Present at the Human Brain Project (HBP), Berlin appeared first on CUHK Business School. |

| FROM CUHK: Mourning Professor Sir James Mirrlees, Founding Master of Morningside College and Distinguished Professor-at-Large of CUHK |

|

Professor Sir James Mirrlees, Founding Master of Morningside College and Distinguished Professor-at-Large of The Chinese University of Hong Kong (CUHK), passed away on 29 August 2018 in Cambridge, UK at the age of 82. Professor Mirrlees was a world-renowned economist and was awarded the Nobel Prize in Economic Sciences in 1996. CUHK is profoundly saddened by the death of Professor Mirrlees and has extended its deep condolences to his family. Professor Rocky S. Tuan, Vice-Chancellor and President of CUHK expressed his great sorrow at the passing of Professor Mirrlees. “Professor Mirrlees, Distinguished Professor-at-Large at CUHK and Master of Morningside College, was a brilliant economist, whose outstanding contributions to economic theory had profound impact on global economic development, earning him the Nobel Prize in Economics in 1996,” said Professor Tuan. “The CUHK community will always remember his exemplary academic and scholarly leadership and dedicated stewardship at Morningside College. I am truly grateful for his profound contribution to higher education in Hong Kong. All of us at CUHK will miss not only his scholarship and wisdom, but also his wit, his smiles, and his always insightful remarks. Professor Mirrlees’ passing is a great loss for both CUHK and the entire higher education sector in Hong Kong and the world. On behalf of our staff and students, I express our sincerest condolence to Lady Patricia Mirrlees and Professor Mirrlees’ family.” Professor Mirrlees was born in 1936 in Scotland. A pioneer in optimal tax theory, he was awarded the Nobel Prize in Economic Sciences in 1996 in recognition of his fundamental contributions to the economic theory of incentives under asymmetric information. After graduating in mathematics from the University of Edinburgh in 1957, Professor Mirrlees went to Trinity College, Cambridge, initially to do mathematics, and received his PhD in Economics in 1963. From 1968 to 1995 he was Edgeworth Professor of Economics at the University of Oxford and a Fellow of Nuffield College. From 1995 to 2003, he served as Professor of Political Economy at the University of Cambridge. He was knighted in 1997 and awarded the Royal Medal by The Royal Society of Edinburgh in 2009 in recognition of his outstanding contributions to economic theory. He was Distinguished Professor-at-Large at CUHK from 2002 and was the Founding Master of Morningside College, CUHK. Professor Mirrless also held Visiting Professorships at MIT, UC Berkeley, Yale, Melbourne and Peking University. He was President of the Royal Economic Society from 1989 to 1992, and a fellow of the British Academy, the Royal Society of Edinburgh and the Econometric Society, and a Foreign Honorary Member of the U.S. National Academy of Sciences and the American Economic Association. This press release first appeared in CUHK Website. The post Mourning Professor Sir James Mirrlees, Founding Master of Morningside College and Distinguished Professor-at-Large of CUHK appeared first on CUHK Business School. |

| FROM CUHK: CUHK Business School Holds the Inauguration Ceremony for Undergraduates 2018 |

After attending the university’s inauguration ceremony, students then joined the CUBK Business School Inauguration Ceremony, where Prof. Kalok Chan, Dean of CUHK Business School and Wei Lun Professor of Financce, along with Prof. Andy Wong, Associate Dean (Undergraduate Studies) and Associate Professor of Practice in Marketing of CUHK Business School, and Mr. Derek Yung, Managing Director of AllianceBernstein Taiwan, took turns to address students, giving them words of wisdom and encouragement on how to dream big and find purpose in the next four years. Dean Kalok Chan took to the floor by welcoming students from 20 countries/regions, including Brazil, Canada, France, India, Indonesia, Kazakhstan, Kyrgyzstan, Malaysia, Philippines, Portugal, Russia, Slovakia, South Korea, Thailand, UK and US. Among this year’s diverse group of freshman were also numerous talent who excel at sports, a few of them on the Hong Kong team and admitted via the Sports Scholarship Scheme. The Dean encouraged undergraduates to embrace opportunities on campus, to be innovative, stay positive in the face of failures and setbacks, and also develop a social responsibility mindset while serving the various communities around universities.        CUHK EMBA alumnus Mr. Derek Yung, who was also inducted to the Beta Gamma Sigma (CUHK Chapter), as a chapter honouree, recounted his experience growing up, counting his blessings of being able to be admitted to one of two universities back in his day, as one of only a hundred or so business school students. He encouraged students to dream big, to be resilient, and to live a purpose-driven life during their four years in university and beyond. Finally, Prof. Wong took to food for three analogies – water, chocolate and chicken wings – to charge students on never giving up too early and outlasting their problems, because this is what separates successful entrepreneurs with the ordinary ones; ending the Inauguration Ceremony by quoting Genevan philosopher Jean-Jacques Rousseau, “Patience is bitter, but its fruit is sweet”. The post CUHK Business School Holds the Inauguration Ceremony for Undergraduates 2018 appeared first on CUHK Business School. |