A question that is very often asked on GMAT Club's MBA Forums - What is the true value of your MBA degree? How much is MBA worth? How long does it take to pay off business school loans? How much will I be earning after graduation? etc.

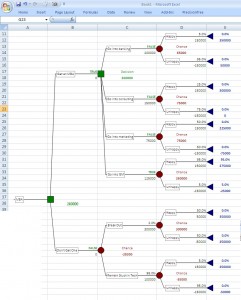

As humans, we are risk averse, and naturally want a clear answer. Until now, it was all speculation, weak estimates, or projections, but now the questions is answered with a very detailed tool by Ryguy904, that takes into consideration not only things such as salary after graduation, signing bonus, how long it takes to find a job, but also tax rate, tax deductions with borrowed interest, as well as inability to take those deductions due to a high income bracket. This goes beyond any of the Business Week's calculations (useful but weak). Proceed when you are ready:

Step 1: Value of an MBA Degree - visit this topic and download the spreadsheet

Step 2: Review the assumptions below that went into this work

Step 3: If you have any questions, post them in The True Value of Your MBA Degree thread

General Assumptions

1) Compensation upon graduation will be 50% in your first year. This assumes that you work from July - December in the year that you graduate. Again, your situation may be that you wish to go on vacation for three months and "utilize" your signing bonuses and instead start in September. Feel free to adjust accordingly.

2) Assumptions are that you will not have any compensation in the year of matriculation. I realize this is completely unrealistic, but I did this for two reasons. a) Some folks are short-timing it four months prior to school ( I won't name names), while others take a week off before starting. b) This brings about a more conservative approach in the calculation (if you don't make any manual adjustments) in terms of when you will "breakeven." Being a conservative guy, I chose this as the default method. Have I mentioned that you can adjust things if you prefer to do so??

3) The models assume that tuition is paid in the year that you attend school. I realize this is an unrealistic assumption for almost everybody. Most of us will be taking out student loans and paying them back over the course of 5, 10, or even 30 years. However, I chose to do it this way, because again, it is the conservative approach (makes your NPV and payback time for the MBA route look worse). Feel free to adjust your model accordingly if wish to do so. For example, if you are going into investment banking, you could say that your tuition is $0 (or you can choose to plug in your living expenses---again your choice) and you will pay back $20,000 in year 1, $30,000 in year 2, and $50,000 in year 3. You can make a manual adjustment in the cell for post-MBA year 1 by tacking on a "-25000" to the formula. You would then adjust post-MBA years 2 and 3 accordingly.

4) You can also include living expenses in the cell marked tuition/fees. I chose not to, since I have an S.O. that will be "helping" me with this. My living expenses will remain (somewhat) the same whether I'm in school or not. I won't be eating at the same restaurants, or for that matter eating out as much, but I'll still be consuming. Furthermore, I chose to show compensation as gross compensation (not net of housing, food, living expenses, taxes, etc.).

5) Discount rate is just a fancy-pants finance term. It basically means that a dollar today is worth more than a dollar tomorrow. Conversely, a dollar tomorrow is worth less than a dollar today. Don't believe me? Would you rather have $150,000 today or $150,000 one year from now. Good! So now you're with me! Don't be freaked out (or overly excited) about seeing a salary in 2020 of $250,000. It's not the same as $250,000 in today's terms. I don't know what the exact discount rate should be, but I'd say that it should be in the range of 3-10%. 3% would be a more "aggressive approach" meaning that time factor is not as sensitive and future compensation "means more" (i.e., has more value) in the calculations. 10% would be extremely conservative. I'd choose something like 4-7% to be the most realistic.

6) If you don't want to have your compensation go up by X% per year, you can manually type in your expected compensation in the appropriate year(s). The NPV and breakeven formulas will still calculate accordingly. Bear in mind, this may overwrite other formulas, which you will have to recreate (or open the original document) if you want to get those back.

7) Part-time programs. There is a drop-down box that allows you to choose the program that you are interested in. If you are interested in the part-time program, you will then need to enter in your current salary and this will be used accordingly to offset your tuition (which again, I assumed is being paid upfront). I assumed that part-timers would not have an internship during school and also that they would not receive a signing bonus upon graduation like full-timers usually do.

Single Stage Assumptions

1) For the non-MBA model, your current compensation will continue to grow at the same rate until the end of time.

2) For the MBA model, your compensation upon graduation will continue to grow at the same rate until the end of time.

Two Stage Assumptions

1) For the non-MBA model, your current compensation will continue to grow at the same rate for two years (i.e., you will be in the job for three years). It is assumed that you will receive a new/better/higher-paying job based on work experience and increased responsibilities at the beginning of 2012. After that, your compensation will grow at the same rate until the end of time.

2) For the MBA model, your post-MBA compensation will continue to grow at the same rate for three years (i.e., you will be in your post-MBA job for a total of four years). It is assumed that you will receive a new/better/higher-paying job at the beginning of 2016. After that, your compensation will grow at the same rate until the end of time.

3) If you feel like that you would transition to jobs soon/later, feel free to adjust accordingly.

Three Stage Assumptions

1) For the non-MBA model, your current compensation will continue to grow at the same rate for two years (i.e., you will be in your current job for three years). It is assumed that you will receive a new/better/higher-paying job based on work experience and increased responsibilities at the beginning of 2012. After that, your compensation will grow at a constant rate for another three years. After that, it is assumed that you will receive a new/better/higher-paying job based on increased work experience and job responsibilities at the beginning of 2016. After that, your compensation will grow at the same rate until the end of time.

2) For the MBA model, your post-MBA compensation will continue to grow at the same rate for three years (i.e., you will be in your post-MBA job for a total of four years). It is assumed that you will receive a new/better/higher-paying job at the beginning of 2015. After that, your compensation will grow at a constant rate for another two years (i.e., you will be in your second post-MBA job for a total of three years). After that, you will receive another new/better/higher-paying job at the beginning of 2018, at which point your compensation will grow at the same rate until the end of time.

3) If you feel like that you would transition to jobs soon/later, feel free to adjust accordingly.