| Last visit was: 25 Apr 2024, 01:55 |

It is currently 25 Apr 2024, 01:55 |

Customized

for You

Track

Your Progress

Practice

Pays

| FROM Bschooladmit20 - Current Student: Stanford’s Future of Media Conference |

|

| FROM Bschooladmit20 - Current Student: Product Management for Startups = People Management |

I’ve held several product management roles in very diverse settings over the past four years. I led the development of an influencer marketing platform for a European adtech company, managed two very different Stanford-based startup teams (one primarily designer-led in ed-tech space and another engineer-led in the healthcare sector) and worked with the UK government, a large charity and an impact investor to design and launch an incubator for public services in the UK. In each of these roles, no matter how different the actual work, teams, and outcomes we were working towards, what worked- in terms of allowing us to align on a vision, undertake deep need-finding exercises, build prototypes, work together effectively and ensure that we released our product on time- was always the same. These are my key lessons: Keep the product roadmap as simple as possible + get buy-in early Your product will keep evolving: you will never get it to be perfect. Your role is to build a common vision across very different teams, keep things moving, align teams, solve problems and get buy-in. To do all those things, all day, everyday, you need to keep the product and process as simple as possible. Particularly when each team you work with has its own vocabulary, culture and norms. Ensure all your stakeholders agree on what the bare minimum viable product looks like- and that this version is genuinely usable. You can dress it up later. Manage towards outcomes: build trust Your role isn’t to tell people what to do: it’s to facilitate your teams. Create a set of project team norms and values for each product that you work on, that are continuously reinforced. Be friends with the people you work with. Take your teams out for dinner and drinks, get to know them personally. Get their buy in. Understand what excites them, stops them, or frustrates them. Protect them and remove obstacles. Don’t control the process. Give people the freedom to create. Inspire and motivate them. Then leave them to it. Over-communicate: it’s not obvious to everyone Getting buy in across teams is not easy. Your role is to be the trusted confidante. You should be the first one to know if something is going wrong; or if a deadline is going to slip. Your team needs to know exactly what is expected of them; and why. Deliver bad news upfront and early. Stay direct. Ask for and give feedback regularly. User perspective + empathy: it doesn’t matter what you think User design is always much complicated than it seems on the surface. You will never get it right. It can always be better. Don’t get dragged down a rabbit hole. Don’t get distracted by the way things look. There are no right answers. Continuously put yourself in the user’s shoes and design for them. Make sure the experience is simple, easy + intuitive- if not delightful. Move fast: decision-making & measurement You can collect as much data while you’re developing a product.In the end, you’re going to have to make some calls that are unscientific: based on your gut, instinct and qualitative feedback. Act quickly and decisively. You role is to say no, cut out the bullshit and keep going. BUT make sure that you’re continuously refining your KPIs- and that you invest in defining what data you want to collect from your users upfront before you release each iteration of your product. You want to balance releasing a version of your product with being able to test whether it is actually ‘working’- and feel free to get a little creative in defining what ‘working’ means. Prioritisation: say no You’re not going to be able to put out every fire, or keep every stakeholder (the design, engineering, client and senior management teams) happy at all times. Balance the urgent v/s the important: don’t lose sight of what you’re end goal is. It’s okay to say no, as long as as a team, you’re still heading where you want to go. Stay authentic: do what works for you Genuine leadership is an exercise in influence: understanding what motivates people, getting people with very different perspectives and backgrounds to align on a single vision, and work together, and then carrying your team across the finish line. Use your own style to make it work. |

| FROM Bschooladmit20 - Current Student: Product Management + Startups = People Management |

I’ve held several product management roles in diverse settings over the past four years. I led the development of an influencer marketing platform for a European adtech company, co-founded and managed two very different Stanford-based startup teams (one primarily designer-led in the ed-tech space and another engineer-led in the healthcare sector) and worked with the UK government, a large charity and an impact investor to design and launch an incubator for public services in the UK. In each of these roles, no matter how different the actual work, teams and outcomes we were working towards, what ‘worked’- in terms of allowing us to align on a vision, undertake deep need-finding exercises, build prototypes, work together effectively and ensure that we released our product on time- was always the same. These are my key lessons: Keep the product roadmap as simple as possible + get buy-in early Your product will keep evolving: you will never get it to be perfect. Your role is to build a common vision across different teams, keep things moving, align teams, solve problems and get buy-in. To do all those things, all day, everyday, you need to keep the product and process as simple as possible. Particularly when each team you work with has its own vocabulary, culture and norms. Ensure all your stakeholders agree on what the bare minimum viable product looks like- and that this version is genuinely usable. You can dress it up later. Manage towards outcomes: build trust Your role isn’t to tell people what to do: it’s to facilitate your teams. Create a set of project team norms and values for each product that you work on, that are continuously reinforced. Be friends with the people you work with. Take your teams out for dinner and drinks, get to know them personally. Get their buy in. Understand what excites them, stops them, or frustrates them. Protect them and remove obstacles. Don’t control the process. Give people the freedom to create. Inspire and motivate them. Then leave them to it. Over-communicate: it’s never obvious Getting buy in across teams is not easy. Your role is to be the trusted confidante. You should be the first one to know if something is going wrong; or if a deadline is going to slip. Your team needs to know exactly what is expected of them; and why. Deliver bad news upfront and early. Stay direct. Ask for and give feedback regularly. User perspective + empathy: it doesn’t matter what you think User design is always much complicated than it seems on the surface. You will never get it right. It can always be better. Don’t get dragged down a rabbit hole, or get distracted by the way things look. There are no right answers. Continuously put yourself in the user’s shoes- by actually asking them what they need/want + also observing how they interact with the product- and then design the product specifically for whichever segment you’re initially targeting. Make sure the experience is simple, easy + intuitive- if not delightful. Move fast: decision-making & measurement Run the tests. Let the data speak first. But while you can always collect more data while you’re developing a product, in the end, you’re going to have to make some calls that are unscientific: based on your gut, instinct and qualitative feedback. Act quickly and decisively. You role is to say no, cut out the bullshit and keep going. On the other hand, sure that you’re continuously refining your KPIs- and that you invest in defining what data you want to collect from your users early on, and revise this before you release each iteration of your product. You want to balance releasing a version of your product with being able to test whether it is actually ‘working’. Also, feel free to get (a little) creative in defining what ‘working’ means. Prioritisation: say no You’re not going to be able to put out every fire, or keep every stakeholder (the design, engineering, client and senior management teams) happy at all times. Balance the urgent v/s the important: don’t lose sight of what you’re end goal is. It’s okay to say no, as long as as a team, you’re still heading where you want to go. Stay authentic: do what works for you Real leadership is an exercise in influence: understanding what motivates people, getting people with very different perspectives and backgrounds to align on a single vision, and work together, and then carrying your team across the finish line. Use your own style to make it work. |

| FROM Bschooladmit20 - Current Student: What No One Tells You Product Management |

What No One Tells You About Product Management Product management + startups = people managementI’ve held several product management roles in diverse settings over the past four years. I led the development of an influencer marketing platform for a European adtech company, co-founded and managed two very different Stanford-based startup teams (one primarily designer-led in the ed-tech space and another engineer-led in the healthcare sector) and worked with the UK government, a large charity and an impact investor to design and launch an incubator for public services in the UK. In each of these roles, no matter how different the actual work, teams and outcomes we were working towards, what ‘worked’- in terms of allowing us to align on a vision, undertake deep need-finding exercises, build prototypes, work together effectively and ensure that we released our product on time- was always the same. These are my key lessons: Keep the product roadmap as simple as possible + get buy-in early Your product will keep evolving: you will never get it to be perfect. Your role is to build a common vision across different teams, keep things moving, align teams, solve problems and get buy-in. To do all those things, all day, everyday, you need to keep the product and process as simple as possible. Particularly when each team you work with has its own vocabulary, culture and norms. Ensure all your stakeholders agree on what the bare minimum viable product looks like- and that this version is genuinely usable. You can dress it up later. Manage towards outcomes: build trust Your role isn’t to tell people what to do: it’s to facilitate your teams. Create a set of project team norms and values for each product that you work on, that are continuously reinforced. Be friends with the people you work with. Take your teams out for dinner and drinks, get to know them personally. Get their buy in. Understand what excites them, stops them, or frustrates them. Protect them and remove obstacles. Don’t control the process. Give people the freedom to create. Inspire and motivate them. Then leave them to it. Over-communicate: it’s never obvious Getting buy in across teams is not easy. Your role is to be the trusted confidante. You should be the first one to know if something is going wrong; or if a deadline is going to slip. Your team needs to know exactly what is expected of them; and why. Deliver bad news upfront and early. Stay direct. Ask for and give feedback regularly. User perspective + empathy: it doesn’t matter what you think User design is always much complicated than it seems on the surface. You will never get it right. It can always be better. Don’t get dragged down a rabbit hole, or get distracted by the way things look. There are no right answers. Continuously put yourself in the user’s shoes- by actually asking them what they need/want + also observing how they interact with the product- and then design the product specifically for whichever segment you’re initially targeting. Make sure the experience is simple, easy + intuitive- if not delightful. Move fast: decision-making & measurement Run the tests. Let the data speak first. But while you can always collect more data while you’re developing a product, in the end, you’re going to have to make some calls that are unscientific: based on your gut, instinct and qualitative feedback. Act quickly and decisively. You role is to say no, cut out the bullshit and keep going. On the other hand, sure that you’re continuously refining your KPIs- and that you invest in defining what data you want to collect from your users early on, and revise this before you release each iteration of your product. You want to balance releasing a version of your product with being able to test whether it is actually ‘working’. Also, feel free to get (a little) creative in defining what ‘working’ means. Prioritisation: say no You’re not going to be able to put out every fire, or keep every stakeholder (the design, engineering, client and senior management teams) happy at all times. Balance the urgent v/s the important: don’t lose sight of what you’re end goal is. It’s okay to say no, as long as as a team, you’re still heading where you want to go. Stay authentic: do what works for you Real leadership is an exercise in influence: understanding what motivates people, getting people with very different perspectives and backgrounds to align on a single vision, and work together, and then carrying your team across the finish line. Use your own style to make it work. |

| FROM Bschooladmit20 - Current Student: What No One Tells You About Being a Product Manager |

Product management + startups = people managementI’ve held several product management roles in diverse settings over the past four years. I led the development of an influencer marketing platform for a European adtech company, co-founded and managed two very different Stanford-based startup teams (one primarily designer-led in the ed-tech space and another engineer-led in the healthcare sector) and worked with the UK government, a large charity, a global infrastructure company and an impact investor to design and launch an incubator for public services in the UK. In each of these roles, no matter how different the actual work, teams and outcomes we were working towards, what ‘worked’- in terms of allowing us to align on a vision, undertake deep need-finding exercises, build prototypes, work together effectively and ensure that we released our product on time- was always the same. These are my key lessons: Keep the product roadmap as simple as possible + get buy-in early Your product will keep evolving: you will never get it to be perfect. Your role is to build a common vision across different teams, keep things moving, align teams, solve problems and get buy-in. To do all those things, all day, everyday, you need to keep the product and process as simple as possible. Particularly when each team you work with has its own vocabulary, culture and norms. Ensure all your stakeholders agree on what the bare minimum viable product looks like- and that this version is genuinely usable. You can dress it up later. Manage towards outcomes: build trust Your role isn’t to tell people what to do: it’s to facilitate your teams. Create a set of project team norms and values for each product that you work on, that are continuously reinforced. Be friends with the people you work with. Take your teams out for dinner and drinks, get to know them personally. Get their buy in. Understand what excites them, stops them, or frustrates them. Protect them and remove obstacles. Don’t control the process. Give people the freedom to create. Inspire and motivate them. Then leave them to it. Over-communicate: it’s never obvious Getting buy in across teams is not easy. Your role is to be the trusted confidante. You should be the first one to know if something is going wrong; or if a deadline is going to slip. Your team needs to know exactly what is expected of them; and why. Deliver bad news upfront and early. Stay direct. Ask for and give feedback regularly. User perspective + empathy: it doesn’t matter what you think User design is always much complicated than it seems on the surface. You will never get it right. It can always be better. Don’t get dragged down a rabbit hole, or get distracted by the way things look. There are no right answers. Continuously put yourself in the user’s shoes- by actually asking them what they need/want + also observing how they interact with the product- and then design the product specifically for whichever segment you’re initially targeting. Make sure the experience is simple, easy + intuitive- if not delightful. Move fast: decision-making & measurement Run the tests. Let the data speak first. But while you can always collect more data while you’re developing a product, in the end, you’re going to have to make some calls that are unscientific: based on your gut, instinct and qualitative feedback. Act quickly and decisively. You role is to say no, cut out the bullshit and keep going. On the other hand, sure that you’re continuously refining your KPIs- and that you invest in defining what data you want to collect from your users early on, and revise this before you release each iteration of your product. You want to balance releasing a version of your product with being able to test whether it is actually ‘working’. Also, feel free to get (a little) creative in defining what ‘working’ means. Prioritisation: say no You’re not going to be able to put out every fire, or keep every stakeholder (the design, engineering, client and senior management teams) happy at all times. Balance the urgent v/s the important: don’t lose sight of what you’re end goal is. It’s okay to say no, as long as as a team, you’re still heading where you want to go. Stay authentic: do what works for you Real leadership is an exercise in influence: understanding what motivates people, getting people with very different perspectives and backgrounds to align on a single vision, and work together, and then carrying your team across the finish line. Use your own style to make it work. |

| FROM Bschooladmit20 - Current Student: What No One Tells You About Being a Product Manager |

Product management + startups = people managementI’ve held several diverse product management roles* over the past four years. In each of these roles, no matter how different the actual work, teams and outcomes we were working towards, what ‘worked’- in terms of allowing us to align on a vision, undertake deep need-finding exercises, build prototypes, work together effectively and ensure that we released our product on time- was always the same. These are my key lessons: Keep the product roadmap as simple as possible + get buy-in early Your product will keep evolving: you will never get it to be perfect. Your role is to build a common vision across different teams, keep things moving, align teams, solve problems and get buy-in. To do all those things, all day, everyday, you need to keep the product and process as simple as possible. Particularly when each team you work with has its own vocabulary, culture and norms. Ensure all your stakeholders agree on what the bare minimum viable product looks like- and that this version is genuinely usable. You can dress it up later. Manage towards outcomes: build trust Your role isn’t to tell people what to do: it’s to facilitate your teams. Create a set of project team norms and values for each product that you work on, that are continuously reinforced. Be friends with the people you work with. Take your teams out for dinner and drinks, get to know them personally. Get their buy in. Understand what excites them, stops them, or frustrates them. Protect them and remove obstacles. Don’t control the process. Give people the freedom to create. Inspire and motivate them. Then leave them to it. Over-communicate: it’s never obvious Getting buy in across teams is not easy. Your role is to be the trusted confidante. You should be the first one to know if something is going wrong; or if a deadline is going to slip. Your team needs to know exactly what is expected of them; and why. Deliver bad news upfront and early. Stay direct. Ask for and give feedback regularly. User perspective + empathy: it doesn’t matter what you think User design is always much complicated than it seems on the surface. You will never get it right. It can always be better. Don’t get dragged down a rabbit hole, or get distracted by the way things look. There are no right answers. Continuously put yourself in the user’s shoes- by actually asking them what they need/want + also observing how they interact with the product- and then design the product specifically for whichever segment you’re initially targeting. Make sure the experience is simple, easy + intuitive- if not delightful. Move fast: decision-making & measurement Run the tests. Let the data speak first. But while you can always collect more data while you’re developing a product, in the end, you’re going to have to make some calls that are unscientific: based on your gut, instinct and qualitative feedback. Act quickly and decisively. You role is to say no, cut out the bullshit and keep going. On the other hand, sure that you’re continuously refining your KPIs- and that you invest in defining what data you want to collect from your users early on, and revise this before you release each iteration of your product. You want to balance releasing a version of your product with being able to test whether it is actually ‘working’. Also, feel free to get (a little) creative in defining what ‘working’ means. Prioritisation: say no You’re not going to be able to put out every fire, or keep every stakeholder (the design, engineering, client and senior management teams) happy at all times. Balance the urgent v/s the important: don’t lose sight of what you’re end goal is. It’s okay to say no, as long as as a team, you’re still heading where you want to go. Stay authentic: do what works for you Real leadership is an exercise in influence: understanding what motivates people, getting people with very different perspectives and backgrounds to align on a single vision, and work together, and then carrying your team across the finish line. Use your own style to make it work. — *I led the development of an influencer marketing platform for a European adtech company, managed two very different Stanford-based startup teams (one primarily designer-led in the ed-tech space and another engineer-led in the healthcare sector) and worked with the UK government, a large charity and an impact investor to design and launch an incubator for public services in the UK. What No One Tells You About Being a Product Manager was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: What I Learned as a Second Year Stanford MBA Student |

Doing an MBA is like drinking from a firehouse. You will have more opportunities- in terms of internships, jobs, classes, friendships and travel- come your way than you can imagine. The two years are a gift. But learning what options to ignore, and what to chase, is an art. I’m incredibly grateful to have had the chance to study at Stanford’s Graduate School of Business. I’ve learned more in the past 18 months, professionally and personally, than I thought was possible. These are my key takeaways on making the most of the MBA program. Focus: pick a topic, sector, person, question Build a brand- or rebrand professionally- particularly if you’re looking to change geographies, functions or industries. Use that lens to choose your classes, internships and club leadership experience. Once you’re known as the ‘fill in the blank’ person, you’ll start getting opportunities passed your way, without you having to do any of the ground work. Don’t underestimate how amazingly thoughtful + well connected your classmates are. Get some real-life work experience on the side It’s hard to truly absorb everything you’re learning, no matter how phenomenal the classes or speakers, until you try and apply it yourself. I wouldn’t have gotten half as much as I did from the program, if I hadn’t worked on startups and done a second internship. Not only does this allow you to develop practical skills: this is an entirely risk-free time. You can be as experimental as you want with your side projects. I had the chance to work on two wildly different startups, with two wildly different teams*, and loved having the chance to learn from both. Don’t forget the professors Invest in your coursework: this is your chance to build a relationship with some stellar thought leaders. Take your professors out for coffee or lunch: if you can, do a research project or write a paper with them. This gives you the incredible ability to to call up or meet whoever you want, in order to answer a question of your choosing. Doing an independent study on the rapidly evolving digital media landscape in India with Stanford’s ex-Dean was one of my most professionally meaningful experiences at the GSB. See yourself from a distance You will be given the chance to reflect, ask yourself what you truly want to do with your life, and develop self-awareness, through your classes, workshops and classmates. Don’t be afraid to be vulnerable. Ask your peers for feedback regularly: they can often see your strengths and weaknesses more clearly than you can. I had the chance to deliver a TALK (a GSB institution, where every week, a classmate delivers a highly personal 30 minute reflection of the key events that have shaped them, to hundreds of other classmates). It was incredibly difficult to write and deliver, and painful at times, but the event will undoubtedly be one of the first things I will remember ten years down the line. This community will perhaps be the most supportive + collaborative one that you will ever experience. Let yourself fall: you will be caught. Organise a trek, conference or trip I couldn’t understand why anyone would want to organise a trip or conference, given all the administrative hassle associated with the process, until I Co-Chaired Stanford’s Future of Media Conference this year. The logistics were definitely as painful as I’d expected, but the upside, in terms of the lessons I learned around teamwork, branding, facilitation and operations was so much greater. Travel, host dinners and go out Make room for spontaneity, and to truly have fun. You don’t have to plan every day. Your classmates are the biggest gift of these two years. They will change the way you see the world, and yourself. You’ve no doubt heard already heard that you will make friends that will last lifetime. This is true. But don’t forget to take an interest, and be generous + kind to the people you don’t know too. Build the community you want to be a part of. Don’t follow the herd Ultimately, each one of your classmates will have a unique experience, based on the choices they make. You can’t escape FOMO, but stay true to yourself. Spend your time the way you want to. Invest in what you consider meaningful. No one has the answer, because there isn’t one. |

| FROM Bschooladmit20 - Current Student: You Can’t Go Home |

You’re excited to move back to your home country, after living abroad for ten years. You’re enthusiastic about the potential to bring back new ideas, about the professional opportunities. You’re always stunned by how quickly your country is changing, in terms of consumption patterns and tastes when you visit. There’s so much left to be done and built. But you’re also scared. Everything seems to stay the same, but you feel less at home every time you go back. You know you’ve changed. You make an effort to sound and look like your old self- and you do admittedly regress around your parents. But you look at the world differently now. You value space and independence in a way that you didn’t know was possible, when you were growing up. You can’t help being bothered by the disregard people seem to have of boundaries. They seem so comfortable asking intimate details of your personal life, commenting on your appearance and life choices. Why does no one seem to value time or space here? Maybe it’s because they’ve never experienced it themselves.You’re not being used to told what to do, who to meet or what to wear. When you talk about your professional ambitions, you’re asked who will take care of the house and/or your husband. Have you traveled back in time? You’re often dismayed at how women are viewed in conversations- but they don’t seem to be upset themselves. The constant gender segregation at dinner tables, the fact that women are expected to go into the kitchen and serve the men at parties, when the men don’t lift a finger or acknowledge the effort, makes you angry. You’re almost beginning to miss the hidden, subtle sexism you’re used to facing. You’re not here to solely support others. You intend to live life your life on your own terms. You consider speaking up. You share your thoughts with some of the women back home. But they can’t understand why you’re getting indignant on their behalf. They don’t want the choices you want them to have. You know there is no right way to live. You tell yourself you don’t care what the community will think, but you’re watching and judging them too. Are you any better? You don’t want them to hold you to their standards, but you’re holding them to yours. Not every decision or act is intended to be an act of rebellion. But maybe it needs to be. |

| FROM Bschooladmit20 - Current Student: Startup Lessons at Stanford |

I worked on two very different startups, with two very different teams, during my MBA at Stanford.  One team was focused on building a language learning platformfor first-generation immigrants, in order to help them build their confidence and speak English more frequently. We were based at Stanford’s d. school, focused deeply on need-finding using design thinking principles, and had two product designers and a computer science major on our team. The other team’s goal was to build a non-invasive tool to help glaucoma patients measure their eye pressure, in order to proactively manage their condition, and prevent blindness. We were based at Stanford’s Engineering School, had two electrical engineers, a patent-holder and professor, and an economics major on the team. I am very grateful for the diversity of experience and learning, but am also struck by how transferable the lessons I learned from these very different experiences are. These are my key takeaways: Start somewhere: your product will never be ready The starting point for both teams was different: on the first team, we had a blank sheet of paper, and began by defining user need. On the second team, we had a patented technology that we were trying to commercialise. Our level of fear, uncertainty and excitement differed based on our stage of development. However, surprisingly, this didn’t make as much difference as I thought it would to our day-to-day activities- except when it came to raising money. You’re always going to have to continuously iterate and improve your product, no matter the stage you’re at: the challenge is ensuring you have enough time and resource to be able to fail fast, and developing a clear set of priorities of what you want to change and build over time, based on user feedback. Defining our minimum viable product was often one of the most challenging exercises we undertook at every stage. Empathise with and delight your customers Both teams used design thinking processes to understand consumer need, prototype and iterate, given that we were building consumer-focused software in both cases, and were aiming to help our users create new habits, albeit in very different contexts. We were often surprised at how wrong our initial assumptions about our target consumers were, when we did in-depth consumer interviews to gain insight into their pain-points. You have to be able to develop empathy with your users, and put yourself in their shoes when you’re trying to develop an understanding of their needs, or get feedback on your product. However, you also have to retain the ability to deviate from what they tell you they want- and surprise them- in the hope of delighting them- because they don’t always know what they want or need until they see it. Great processes are easier to replicate than cultures Both the teams I worked on very extremely high functioning. The diversity of skill-sets and perspectives, based on education, professional experience and nationality, greatly enhanced our productivity. However, the same factors also sometimes made seemingly straightforward tasks, such as scheduling interviews and gathering customer feedback, more difficult. We worked through this by agreeing upon team norms and values (such as being transparent, asking for and giving regular feedback, asking for help when needed) upfront. The importance of regularly discussing, repeating and reinforcing these principles will stick with me. I also learned the importance of ensuring that the team had a shared vocabulary, was unafraid to ask ‘basic’ questions, and challenge the direction we were heading in: most of our mistakes were a direct result of miscommunication or ego. People management matters as much as product management At the start, I was insecure about my inability to code, given the strong engineering talent on the second team- but I quickly realised how much value I could add, through ensuring the team was working on a shared vision, that our work-streams were being actively managed and coordinated, and that we stayed aligned as a team across important and/or difficult decisions. I learned that being able to read, motivate and manage people matters as much, if not at times more, than the product you’re building. You have to be able to influence stakeholders at every stage: you’re constantly selling your idea to existing and new customers, investors, potential hires and your team. Mission matters Both ventures had an ambitious mission- this also ended up being an importance force in attracting great people, and allowing us to stay aligned. If you begin by building a stellar team, who’s bought into the company’s mission, you can work together to execute on all the basic steps a startup needs to follow- such as choosing a target market, building and testing prototypes, and experimenting with business models. However, if you’re unable to motivate and align your team, it doesn’t matter how great your idea or product is. Feedback is a gift: you’re a work in progress If you can’t manage yourself, you can’t manage others. Being able to see yourself from a distance, continuously learn, hire for or delegate your weaknesses, and staying unemotional about your work matters. Your product will always be a work in progress: so will you. We set up quarterly team feedback sessions for both teams: and I was always impressed at how much I learned about myself and others from these. These sessions also greatly helped build relationships within the team. They both helped clear the air when necessary, and build trust. Startup Lessons at Stanford was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: Startup Adventures at Stanford |

I worked on two very different startups, with two very different teams, during my MBA at Stanford.  One team was focused on building a language learning platformfor first-generation immigrants, in order to help them build their confidence and speak English more frequently. We were based at Stanford’s d. school, focused deeply on need-finding using design thinking principles, and had two product designers and a computer science major on our team. The other team’s goal was to build a non-invasive tool to help glaucoma patients measure their eye pressure, in order to proactively manage their condition, and prevent blindness. We were based at Stanford’s Engineering School, had two electrical engineers, a patent-holder and professor, and an economics major on the team. I am very grateful for the diversity of experience and learning, but am also struck by how transferable the lessons from these very different experiences are. These are my key takeaways: Start somewhere: your product will never be ready The starting point for both teams was different: on the first team, we had a blank sheet of paper, and began by defining user need. On the second team, we had a patented technology that we were trying to commercialise. Our level of fear, uncertainty and excitement differed based on our stage of development. However, surprisingly, this didn’t make as much difference as I thought it would to our day-to-day activities- except when it came to raising money. You’re always going to have to continuously iterate and improve your product, no matter the stage you’re at: the challenge is ensuring you have enough time and resource to be able to fail fast, and developing a clear set of priorities of what you want to change and build over time, based on user feedback. Defining our minimum viable product was often one of the most challenging exercises we undertook at every stage. Empathise with and delight your customers Both teams used design thinking processes to understand consumer need, prototype and iterate, given that we were building consumer-focused software in both cases, and were aiming to help our users create new habits, albeit in very different contexts. We were often surprised at how wrong our initial assumptions about our target consumers were, when we did in-depth consumer interviews to gain insight into their pain-points. You have to be able to develop empathy with your users, and put yourself in their shoes when you’re trying to develop an understanding of their needs, or get feedback on your product. However, you also have to retain the ability to deviate from what they tell you they want- and surprise them- in the hope of delighting them- because they don’t always know what they want or need until they see it. Great processes are easier to replicate than cultures Both the teams I worked on very extremely high functioning. The diversity of skill-sets and perspectives, based on education, professional experience and nationality, greatly enhanced our productivity. However, the same factors also sometimes made seemingly straightforward tasks, such as scheduling interviews and gathering customer feedback, more difficult. We worked through this by agreeing upon team norms and values (such as being transparent, asking for and giving regular feedback, asking for help when needed) upfront. The importance of regularly discussing, repeating and reinforcing these principles will stick with me. I also learned the importance of ensuring that the team had a shared vocabulary, was unafraid to ask ‘basic’ questions, and challenge the direction we were heading in: most of our mistakes were a direct result of miscommunication or ego. People management matters as much as product management At the start, I was insecure about my inability to code, given the strong engineering talent on the second team- but I quickly realised how much value I could add, through ensuring the team was working on a shared vision, that our work-streams were being actively managed and coordinated, and that we stayed aligned as a team across important and/or difficult decisions. I learned that being able to read, motivate and manage people matters as much, if not at times more, than the product you’re building.You have to be able to influence stakeholders at every stage: you’re constantly selling your idea to existing and new customers, investors, potential hires and your team. Mission matters Both ventures had an ambitious mission- this also ended up being an importance force in attracting great people, and allowing us to stay aligned. If you begin by building a stellar team, who’s bought into the company’s mission, you can work together to execute on all the basic steps a startup needs to follow- such as choosing a target market, building and testing prototypes, and experimenting with business models. However, if you’re unable to motivate and align your team, it doesn’t matter how great your idea or product is. Feedback is a gift: you’re a work in progress If you can’t manage yourself, you can’t manage others. Being able to see yourself from a distance, continuously learn, hire for or delegate your weaknesses, and staying unemotional about your work matters. Your product will always be a work in progress: so will you.We set up quarterly team feedback sessions for both teams: and I was always impressed at how much I learned about myself and others from these. These sessions also greatly helped build relationships within the team. They both helped clear the air when necessary, and build trust. Startup Adventures at Stanford was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: Silicon Valley + Hollywood = ? |

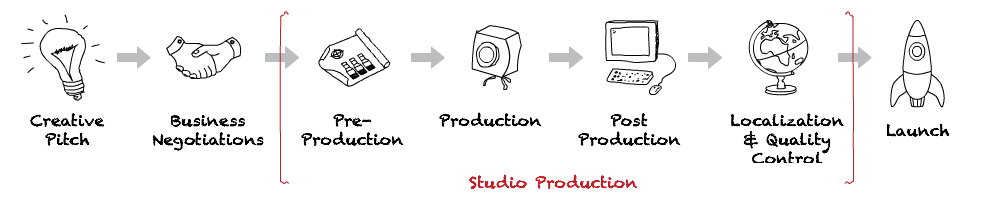

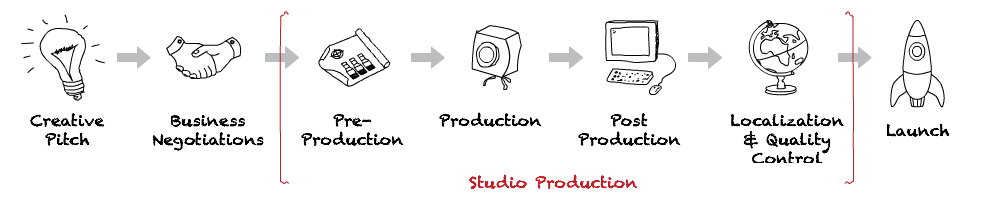

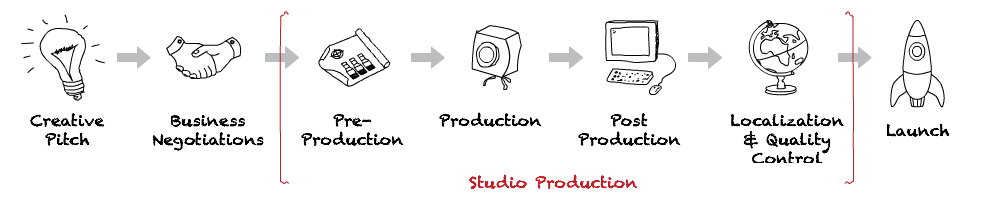

Via Netflix BlogWilliam Goldman, a two time Oscar-winning screenwriter, famously said, “Nobody knows anything…Not one person in the entire motion picture field knows for a certainty what’s going to work. Every time out it’s a guess and, if you’re lucky, an educated one.” However, due to the explosion of data and analytics tools, we now have the ability to analyse patterns such as viewing behaviour and user feedback (through social media) real-time. Over time, this data could allow creators to predict the most effective casting and plot lines. For example, when the Times Group used insights from a data analytics app, Parse.ly to reorder their gallery stories, their page views went up by 70%. The editors now use the tool to shape the direction of stories, using real-time data of audience engagement. Hollywood is already redefining its relationshipbetween the creator and consumer: various tools are allowing production houses to incorporate audience reactions into how content gets created, marketed and distributed. IBM offers social sentiment analysis to gauge the emotional response to films through Twitter and Facebook responses. These tools can not only highlight the responses, but attempt to explain the reasons for these responses. This of, course, is limiting: if you use historical data to predict future behaviour, you are unlikely to support potentially game-changing scripts or talent. Moreover, key Hollywood executives such as Richard Plepler and Nina Jacobson, have publicly stated that they believe that data science can only be used to an extent in content creation: in the end, the fundamentals- such as the quality of story, talent and production value- matter more. Additionally, the literature on what makes a ‘hit’ TV show or film highlights that while there are certain formulas you can follow to create appealing content, ultimately even the Silicon Valley players such as Netflix and Facebook agree that data analytics are better utilised in 1) content distribution and audience targeting/ personalisation of contentrecommendations and 2) understanding audience engagement. And yet, the content production process itself needs to adapt, given the 1) influx of capital into original programming, as tech players look to compete for high quality content and 2) changing audience behaviours and tastes and 3) the rapid globalisation of content distribution. In 2017 itself, Apple and Facebook both budgeted over $1 billion for original programming, and Netflix announced that it planned to spend $8 billion on content. This year, there are over 500 scripted TV shows being made- which is 2x the number in 2012. The amount of content being made, the variety of content being made, and the locations at which the content is being created is increasing rapidly, while the supply of talent, and audience attentions spans stays constant. The industry has already been disrupted: it needs the tools to adapt. I believe data science can be used to disrupt the content production process itself.Given that the most time consuming parts of the process can be 1) storyboarding and shot list generation 2) schedule optimisation and 3 budgeting: data science could be used to automate the more tedious processes, so that content creators can focus on the storytelling + other more creative parts of the process. Project management appsare already helping production teams collaborate across teams and locations. However, these apps face severe challenges when it comes to large-scale adoption, given that production teams are often freelance teams that work together for a period of time, and come from a non tech savvy culture. When Netflix introduced an ecosystem of apps to improve efficiency, it found encouraging the adoption of this new technology difficult at the start. However, usingAI for ‘agile’ content creationcould both reduce script rewriting time and improve production planning by running ‘what if’ scenarios to test script variations, and removing certain elements of production to reduce costs. This would also not require wholesale adoption across production teams, as is required in the case of production management apps. Netflix is already pioneering this approach. As highlighted in it’s Medium Blog, this is a necessity, given the scale at which it is producing content: “Each production is a mountain of operational and logistical challenges that consumes and produces tremendous amounts of data. At Netflix’s scale, this is further amplified to levels seldom encountered before in the history of entertainment. This has created opportunities to organize, analyze and model this data that are equally singular in history. This is where data science can aid the art of producing entertainment.” To provide a few examples, the company models cost estimations of how much a production will cost, that can deal with data sparsity. It also generates schedules using mathematical optimisation. As the company expands globally, it is using visualisation to analyse resource dependency and anticipate production delivery patterns. Lastly it uses prediction algorithms to sequence and scale its content localisation slating across markets. Clearly, the exploration of applying data science to pre and post content production is a nascent field. As more tech platforms begin to invest in content at a large-scale globally, the use of data science will become a necessity, both in terms of efficiency of content production and content economics. Given this approach plays into these companies’ strengths, I think a large-scale change in culture is likely afoot. I look forward to seeing whether AI can successfully be applied to analysing scripts and storylines over the next few years, as several ventures are already attempting to tackle this complex challenge. I’m also planning to explore whether data science can help identify new talent. The stars seem to be aligning. The need for new, diverse voices in Hollywood- across production, acting and writing- is resoundingly clear. The appetite for this new crop of talent has already been validated at the box office. On the other hand, there is an entire generation of social media stars that has built up a following, and talent on Youtube that is waiting to be discovered. We’re already seeing companies using AI to identify future leaders: how long will it be before this is applied to future stars and influencers? Silicon Valley + Hollywood = ? was originally published in The Startup on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: Silicon Valley + Hollywood = ? |

Via Netflix BlogWilliam Goldman, a two time Oscar-winning screenwriter, famously said, “Nobody knows anything…Not one person in the entire motion picture field knows for a certainty what’s going to work. Every time out it’s a guess and, if you’re lucky, an educated one.” However, due to the explosion of data and analytics tools, we now have the ability to analyse patterns such as viewing behaviour and user feedback (through social media) real-time. Over time, this data could allow creators to predict the most effective casting and plot lines. For example, when the Times Group used insights from a data analytics app, Parse.ly to reorder their gallery stories, their page views went up by 70%. The editors now use the tool to shape the direction of stories, using real-time data of audience engagement. Hollywood is already redefining its relationshipbetween the creator and consumer: various tools are allowing production houses to incorporate audience reactions into how content gets created, marketed and distributed. IBM offers social sentiment analysis to gauge the emotional response to films through Twitter and Facebook responses. These tools can not only highlight the responses, but attempt to explain the reasons for these responses. This of, course, is limiting: if you use historical data to predict future behaviour, you are unlikely to support potentially game-changing scripts or talent. Moreover, key Hollywood executives such as Richard Plepler and Nina Jacobson, have publicly stated that they believe that data science can only be used to an extent in content creation: in the end, the fundamentals- such as the quality of story, talent and production value- matter more. Additionally, the literature on what makes a ‘hit’ TV show or film highlights that while there are certain formulas you can follow to create appealing content, ultimately even the Silicon Valley players such as Netflix and Facebook agree that data analytics are better utilised in 1) content distribution and audience targeting/ personalisation of contentrecommendations and 2) understanding audience engagement. And yet, the content production process itself needs to adapt, given the 1) influx of capital into original programming, as tech players look to compete for high quality content and 2) changing audience behaviours and tastes and 3) the rapid globalisation of content distribution. In 2017 itself, Apple and Facebook both budgeted over $1 billion for original programming, and Netflix announced that it planned to spend $8 billion on content. This year, there are over 500 scripted TV shows being made- which is 2x the number in 2012. The amount of content being made, the variety of content being made, and the locations at which the content is being created is increasing rapidly, while the supply of talent, and audience attentions spans stays constant. The industry has already been disrupted: it needs the tools to adapt. I believe data science can be used to disrupt the content production process itself.Given that the most time consuming parts of the process can be 1) storyboarding and shot list generation 2) schedule optimisation and 3 budgeting: data science could be used to automate the more tedious processes, so that content creators can focus on the storytelling + other more creative parts of the process. Project management appsare already helping production teams collaborate across teams and locations. However, these apps face severe challenges when it comes to large-scale adoption, given that production teams are often freelance teams that work together for a period of time, and come from a non tech savvy culture. When Netflix introduced an ecosystem of apps to improve efficiency, it found encouraging the adoption of this new technology difficult at the start. However, usingAI for ‘agile’ content creationcould both reduce script rewriting time and improve production planning by running ‘what if’ scenarios to test script variations, and removing certain elements of production to reduce costs. This would also not require wholesale adoption across production teams, as is required in the case of production management apps. Netflix is already pioneering this approach. As highlighted in it’s Medium Blog, this is a necessity, given the scale at which it is producing content: “Each production is a mountain of operational and logistical challenges that consumes and produces tremendous amounts of data. At Netflix’s scale, this is further amplified to levels seldom encountered before in the history of entertainment. This has created opportunities to organize, analyze and model this data that are equally singular in history. This is where data science can aid the art of producing entertainment.” To provide a few examples, the company models cost estimations of how much a production will cost, that can deal with data sparsity. It also generates schedules using mathematical optimisation. As the company expands globally, it is using visualisation to analyse resource dependency and anticipate production delivery patterns. Lastly it uses prediction algorithms to sequence and scale its content localisation slating across markets. Clearly, the exploration of applying data science to pre and post content production is a nascent field. As more tech platforms begin to invest in content at a large-scale globally, the use of data science will become a necessity, both in terms of efficiency of content production and content economics. Given this approach plays into these companies’ strengths, I think a large-scale change in culture is likely afoot. I’m excited to see whether AI can successfully be applied to analysing scripts and storylines over the next few years; several ventures are already attempting to tackle this complex challenge. A blue ocean space is using data science to identify new talent. The stars seem to be aligning in this area. The need for new, diverse voices in Hollywood- across production, acting and writing- is resoundingly clear. The appetite for this new crop of talent has already been validated at the box office. On the other hand, there is an entire generation of social media stars that has built up a following, and talent on Youtube that is waiting to be discovered. We’re already seeing companies attempting to use AI to identify future leaders: how long will it be before this is applied to future stars and influencers? Silicon Valley + Hollywood = ? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: Big Data + Hollywood = ? |

Via Netflix BlogWilliam Goldman, a two time Oscar-winning screenwriter, famously said, “Nobody knows anything…Not one person in the entire motion picture field knows for a certainty what’s going to work. Every time out it’s a guess and, if you’re lucky, an educated one.” However, due to the explosion of data and analytics tools, we now have the ability to analyse patterns such as viewing behaviour and user feedback (through social media) real-time. Over time, this data could allow creators to predict the most effective casting and plot lines. For example, when the Times Group used insights from a data analytics app, Parse.ly to reorder their gallery stories, their page views went up by 70%. The editors now use the tool to shape the direction of stories, using real-time data of audience engagement. Hollywood is already redefining its relationshipbetween the creator and consumer: various tools are allowing production houses to incorporate audience reactions into how content gets created, marketed and distributed. IBM offers social sentiment analysis to gauge the emotional response to films through Twitter and Facebook responses. These tools can not only highlight the responses, but attempt to explain the reasons for these responses. This of, course, is limiting: if you use historical data to predict future behaviour, you are unlikely to support potentially game-changing scripts or talent. Moreover, key Hollywood executives such as Richard Plepler and Nina Jacobson, have publicly stated that they believe that data science can only be used to an extent in content creation: in the end, the fundamentals- such as the quality of story, talent and production value- matter more. Additionally, the literature on what makes a ‘hit’ TV show or film highlights that while there are certain formulas you can follow to create appealing content, ultimately even the Silicon Valley players such as Netflix and Facebook agree that data analytics are better utilised in 1) content distribution and audience targeting/ personalisation of contentrecommendations and 2) understanding audience engagement. And yet, the content production process itself needs to adapt, given the 1) influx of capital into original programming, as tech players look to compete for high quality content and 2) changing audience behaviours and tastes and 3) the rapid globalisation of content distribution. In 2017 itself, Apple and Facebook both budgeted over $1 billion for original programming, and Netflix announced that it planned to spend $8 billion on content. This year, there are over 500 scripted TV shows being made- which is 2x the number in 2012. The amount of content being made, the variety of content being made, and the locations at which the content is being created is increasing rapidly, while the supply of talent, and audience attentions spans stays constant. The industry has already been disrupted: it needs the tools to adapt. I believe data science can be used to disrupt the content production process itself.Given that the most time consuming parts of the process can be 1) storyboarding and shot list generation 2) schedule optimisation and 3 budgeting: data science could be used to automate the more tedious processes, so that content creators can focus on the storytelling + other more creative parts of the process. Project management appsare already helping production teams collaborate across teams and locations. However, these apps face severe challenges when it comes to large-scale adoption, given that production teams are often freelance teams that work together for a period of time, and come from a non tech savvy culture. When Netflix introduced an ecosystem of apps to improve efficiency, it found encouraging the adoption of this new technology difficult at the start. However, usingAI for ‘agile’ content creationcould both reduce script rewriting time and improve production planning by running ‘what if’ scenarios to test script variations, and removing certain elements of production to reduce costs. This would also not require wholesale adoption across production teams, as is required in the case of production management apps. Netflix is already pioneering this approach. As highlighted in it’s Medium Blog, this is a necessity, given the scale at which it is producing content: “Each production is a mountain of operational and logistical challenges that consumes and produces tremendous amounts of data. At Netflix’s scale, this is further amplified to levels seldom encountered before in the history of entertainment. This has created opportunities to organize, analyze and model this data that are equally singular in history. This is where data science can aid the art of producing entertainment.” To provide a few examples, the company models cost estimations of how much a production will cost, that can deal with data sparsity. It also generates schedules using mathematical optimisation. As the company expands globally, it is using visualisation to analyse resource dependency and anticipate production delivery patterns. Lastly it uses prediction algorithms to sequence and scale its content localisation slating across markets. Clearly, the exploration of applying data science to pre and post content production is a nascent field. As more tech platforms begin to invest in content at a large-scale globally, the use of data science will become a necessity, both in terms of efficiency of content production and content economics. Given this approach plays into these companies’ strengths, I think a large-scale change in culture is likely afoot. I’m excited to see whether AI can successfully be applied to analysing scripts and storylines over the next few years; several ventures are already attempting to tackle this complex challenge. A blue ocean space is using data science to identify new talent. The stars seem to be aligning in this area. The need for new, diverse voices in Hollywood- across production, acting and writing- is resoundingly clear. The appetite for this new crop of talent has already been validated at the box office. On the other hand, there is an entire generation of social media stars that has built up a following, and talent on Youtube that is waiting to be discovered. We’re already seeing companies attempting to use AI to identify future leaders: how long will it be before this is applied to future stars and influencers? Big Data + Hollywood = ? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: More Content, More Hits? |

William Goldman, a two time Oscar-winning screenwriter, famously said, “Nobody knows anything…Not one person in the entire motion picture field knows for a certainty what’s going to work. Every time out it’s a guess and, if you’re lucky, an educated one.” However, due to the explosion of data and analytics tools, we now have the ability to analyse patterns such as viewing behaviour and user feedback (through social media) real-time. Over time, this data could allow creators to predict the most effective casting and plot lines. For example, when the Times Group used insights from a data analytics app, Parse.ly to reorder their gallery stories, their page views went up by 70%. The editors now use the tool to shape the direction of stories, using real-time data of audience engagement. Hollywood is already redefining its relationshipbetween the creator and consumer: various tools are allowing production houses to incorporate audience reactions into how content gets created, marketed and distributed. IBM offers social sentiment analysis to gauge the emotional response to films through Twitter and Facebook responses. These tools can not only highlight the responses, but attempt to explain the reasons for these responses. This of, course, is limiting: if you use historical data to predict future behaviour, you are unlikely to support potentially game-changing scripts or talent. Moreover, key Hollywood executives such as Richard Plepler and Nina Jacobson, have publicly stated that they believe that data science can only be used to an extent in content creation: in the end, the fundamentals- such as the quality of story, talent and production value- matter more. Additionally, the literature on what makes a ‘hit’ TV show or film highlights that while there are certain formulas you can follow to create appealing content, ultimately even the Silicon Valley players such as Netflix and Facebook agree that data analytics are better utilised in 1) content distribution and audience targeting/ personalisation of contentrecommendations and 2) understanding audience engagement. And yet, the content production process itself needs to adapt, given the 1) influx of capital into original programming, as tech players look to compete for high quality content and 2) changing audience behaviours and tastes and 3) the rapid globalisation of content distribution. In 2017 itself, Apple and Facebook both budgeted over $1 billion for original programming, and Netflix announced that it planned to spend $8 billion on content. This year, there are over 500 scripted TV shows being made- which is 2x the number in 2012. The amount of content being made, the variety of content being made, and the locations at which the content is being created is increasing rapidly, while the supply of talent, and audience attentions spans stays constant. The industry has already been disrupted: it needs the tools to adapt. I believe data science can be used to disrupt the content production process itself.Given that the most time consuming parts of the process can be 1) storyboarding and shot list generation 2) schedule optimisation and 3 budgeting: data science could be used to automate the more tedious processes, so that content creators can focus on the storytelling + other more creative parts of the process. Project management appsare already helping production teams collaborate across teams and locations. However, these apps face severe challenges when it comes to large-scale adoption, given that production teams are often freelance teams that work together for a period of time, and come from a non tech savvy culture. When Netflix introduced an ecosystem of apps to improve efficiency, it found encouraging the adoption of this new technology difficult at the start. However, usingAI for ‘agile’ content creationcould both reduce script rewriting time and improve production planning by running ‘what if’ scenarios to test script variations, and removing certain elements of production to reduce costs. This would also not require wholesale adoption across production teams, as is required in the case of production management apps. Netflix is already pioneering this approach. As highlighted in it’s Medium Blog, this is a necessity, given the scale at which it is producing content: “Each production is a mountain of operational and logistical challenges that consumes and produces tremendous amounts of data. At Netflix’s scale, this is further amplified to levels seldom encountered before in the history of entertainment. This has created opportunities to organize, analyze and model this data that are equally singular in history. This is where data science can aid the art of producing entertainment.” To provide a few examples, the company models cost estimations of how much a production will cost, that can deal with data sparsity. It also generates schedules using mathematical optimisation. As the company expands globally, it is using visualisation to analyse resource dependency and anticipate production delivery patterns. Lastly it uses prediction algorithms to sequence and scale its content localisation slating across markets. Clearly, the exploration of applying data science to pre and post content production is a nascent field. As more tech platforms begin to invest in content at a large-scale globally, the use of data science will become a necessity, both in terms of efficiency of content production and content economics. Given this approach plays into these companies’ strengths, I think a large-scale change in culture is likely afoot. I’m excited to see whether AI can successfully be applied to analysing scripts and storylines over the next few years; several ventures are already attempting to tackle this complex challenge. A blue ocean space is using data science to identify new talent. The stars seem to be aligning in this area. The need for new, diverse voices in Hollywood- across production, acting and writing- is resoundingly clear. The appetite for this new crop of talent has already been validated at the box office. On the other hand, there is an entire generation of social media stars that has built up a following, and talent on Youtube that is waiting to be discovered. We’re already seeing companies attempting to use AI to identify future leaders: how long will it be before this is applied to future stars and influencers? More Content, More Hits? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: Getting Creative: More Content, More Hits? |

William Goldman, a two time Oscar-winning screenwriter, famously said, “Nobody knows anything…Not one person in the entire motion picture field knows for a certainty what’s going to work. Every time out it’s a guess and, if you’re lucky, an educated one.” However, due to the explosion of data and analytics tools, we now have the ability to analyse patterns such as viewing behaviour and user feedback (through social media) real-time. Over time, this data could allow creators to predict the most effective casting and plot lines. For example, when the Times Group used insights from a data analytics app, Parse.ly to reorder their gallery stories, their page views went up by 70%. The editors now use the tool to shape the direction of stories, using real-time data of audience engagement. Hollywood is already redefining its relationshipbetween the creator and consumer: various tools are allowing production houses to incorporate audience reactions into how content gets created, marketed and distributed. IBM offers social sentiment analysis to gauge the emotional response to films through Twitter and Facebook responses. These tools can not only highlight the responses, but attempt to explain the reasons for these responses. This of, course, is limiting: if you use historical data to predict future behaviour, you are unlikely to support potentially game-changing scripts or talent. Moreover, key Hollywood executives such as Richard Plepler and Nina Jacobson, have publicly stated that they believe that data science can only be used to an extent in content creation: in the end, the fundamentals- such as the quality of story, talent and production value- matter more. Additionally, the literature on what makes a ‘hit’ TV show or film highlights that while there are certain formulas you can follow to create appealing content, ultimately even the Silicon Valley players such as Netflix and Facebook agree that data analytics are better utilised in 1) content distribution and audience targeting/ personalisation of contentrecommendations and 2) understanding audience engagement. And yet, the content production process itself needs to adapt, given the 1) influx of capital into original programming, as tech players look to compete for high quality content and 2) changing audience behaviours and tastes and 3) the rapid globalisation of content distribution. In 2017 itself, Apple and Facebook both budgeted over $1 billion for original programming, and Netflix announced that it planned to spend $8 billion on content. This year, there are over 500 scripted TV shows being made- which is 2x the number in 2012. The amount of content being made, the variety of content being made, and the locations at which the content is being created is increasing rapidly, while the supply of talent, and audience attentions spans stays constant. The industry has already been disrupted: it needs the tools to adapt. I believe data science can be used to disrupt the content production process itself.Given that the most time consuming parts of the process can be 1) storyboarding and shot list generation 2) schedule optimisation and 3 budgeting: data science could be used to automate the more tedious processes, so that content creators can focus on the storytelling + other more creative parts of the process. Project management appsare already helping production teams collaborate across teams and locations. However, these apps face severe challenges when it comes to large-scale adoption, given that production teams are often freelance teams that work together for a period of time, and come from a non tech savvy culture. When Netflix introduced an ecosystem of apps to improve efficiency, it found encouraging the adoption of this new technology difficult at the start. However, usingAI for ‘agile’ content creationcould both reduce script rewriting time and improve production planning by running ‘what if’ scenarios to test script variations, and removing certain elements of production to reduce costs. This would also not require wholesale adoption across production teams, as is required in the case of production management apps. Netflix is already pioneering this approach. As highlighted in it’s Medium Blog, this is a necessity, given the scale at which it is producing content: “Each production is a mountain of operational and logistical challenges that consumes and produces tremendous amounts of data. At Netflix’s scale, this is further amplified to levels seldom encountered before in the history of entertainment. This has created opportunities to organize, analyze and model this data that are equally singular in history. This is where data science can aid the art of producing entertainment.” To provide a few examples, the company models cost estimations of how much a production will cost, that can deal with data sparsity. It also generates schedules using mathematical optimisation. As the company expands globally, it is using visualisation to analyse resource dependency and anticipate production delivery patterns. Lastly it uses prediction algorithms to sequence and scale its content localisation slating across markets. Clearly, the exploration of applying data science to pre and post content production is a nascent field. As more tech platforms begin to invest in content at a large-scale globally, the use of data science will become a necessity, both in terms of efficiency of content production and content economics. Given this approach plays into these companies’ strengths, I think a large-scale change in culture is likely afoot. I’m excited to see whether AI can successfully be applied to analysing scripts and storylines over the next few years; several ventures are already attempting to tackle this complex challenge. A blue ocean space is using data science to identify new talent. The stars seem to be aligning in this area. The need for new, diverse voices in Hollywood- across production, acting and writing- is resoundingly clear. The appetite for this new crop of talent has already been validated at the box office. On the other hand, there is an entire generation of social media stars that has built up a following, and talent on Youtube that is waiting to be discovered. We’re already seeing companies attempting to use AI to identify future leaders: how long will it be before this is applied to future stars and influencers? Getting Creative: More Content, More Hits? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story. |

| FROM Bschooladmit20 - Current Student: The Next Frontier in Digital Entertainment: Conquering India |