Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 19

12:30 PM EST

-01:30 PM EST

Learn how Keshav, a Chartered Accountant, scored an impressive 705 on GMAT in just 30 days with GMATWhiz's expert guidance. In this video, he shares preparation tips and strategies that worked for him, including the mock, time management, and more - Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 20

01:30 PM EST

-02:30 PM IST

Learn how Kamakshi achieved a GMAT 675 with an impressive 96th %ile in Data Insights. Discover the unique methods and exam strategies that helped her excel in DI along with other sections for a balanced and high score. - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 24

07:00 PM PST

-08:00 PM PST

Full-length FE mock with insightful analytics, weakness diagnosis, and video explanations! - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

Kudos

Bookmarks

D

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

95%

(hard)

95%

(hard)

Question Stats:

34% (02:21) correct 66%

(02:32)

wrong

66%

(02:32)

wrong  based on 1071

sessions

based on 1071

sessions

History

Date

Time

Result

Not Attempted Yet

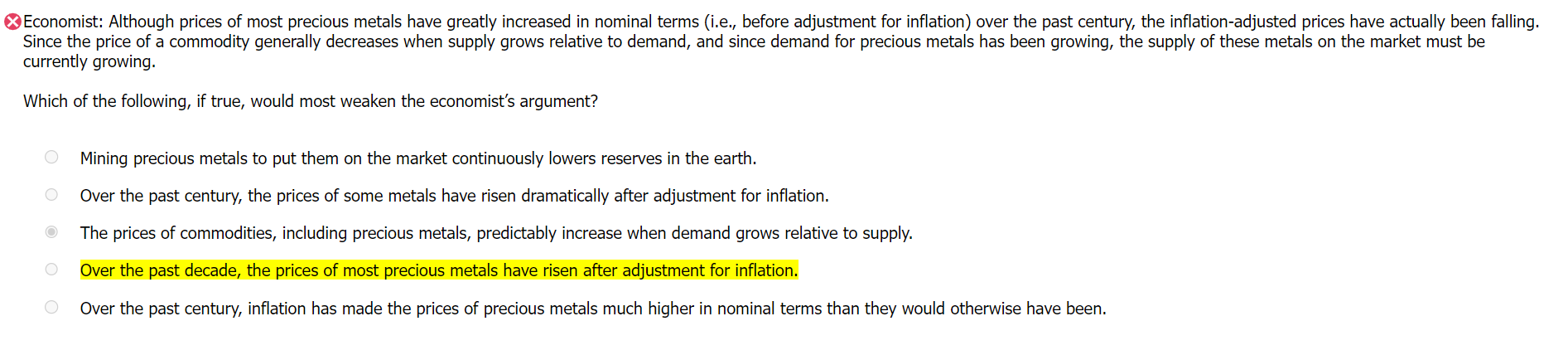

Economist: Although prices of most precious metals have greatly increased in nominal terms (i.e., before adjustment for inflation) over the past century, the inflation-adjusted prices have actually been falling. Since the price of a commodity generally decreases when supply grows relative to demand, and since demand for precious metals has been growing, the supply of these metals on the market must be currently growing.

Which of the following, if true, would most weaken the economist's argument?

A. Mining precious metals to put them on the market continuously lowers reserves in the earth.

B. Over the past century, the prices of some metals have risen dramatically after adjustment for inflation.

C. The prices of commodities, including precious metals, predictably increase when demand grows relative to supply.

D. Over the past decade, the prices of most precious metals have risen after adjustment for inflation.

E. Over the past century, inflation has made the prices of precious metals much higher in nominal terms than they would otherwise have been.

GMAT-Club-Forum-3q1etk6h.png [ 97.95 KiB | Viewed 3649 times ]

Which of the following, if true, would most weaken the economist's argument?

A. Mining precious metals to put them on the market continuously lowers reserves in the earth.

B. Over the past century, the prices of some metals have risen dramatically after adjustment for inflation.

C. The prices of commodities, including precious metals, predictably increase when demand grows relative to supply.

D. Over the past decade, the prices of most precious metals have risen after adjustment for inflation.

E. Over the past century, inflation has made the prices of precious metals much higher in nominal terms than they would otherwise have been.

Attachment:

GMAT-Club-Forum-3q1etk6h.png [ 97.95 KiB | Viewed 3649 times ]

Kudos

Bookmarks

Economist: Although prices of most precious metals have greatly increased in nominal terms (i.e., before adjustment for inflation) over the past century, the inflation-adjusted prices have actually been falling. Since the price of a commodity generally decreases when supply grows relative to demand, and since demand for precious metals has been growing, the supply of these metals on the market must be currently growing.

The economist has concluded the following:

the supply of these (precious) metals on the market must be currently growing

The support for the conclusion is the following:

over the past century, the inflation-adjusted prices (of precious metals) have actually been falling

the price of a commodity generally decreases when supply grows relative to demand

demand for precious metals has been growing

We see that the economist has reasoned that, since prices are decreasing and demand is increasing, supply must be increasing.

One thing that we might notice in reading the passage (although we don't have to notice it on the first read to get this question correct) is the following important difference betweent the evidence and the conclusion: The evidence involves prices falling "over the past century" whereas the conclusion is that supply must be growing "currently."

Which of the following, if true, would most weaken the economist's argument?

The correct answer will weaken the support the evidence provides for the conclusion.

A) Mining precious metals to put them on the market continuously lowers reserves in the earth.

This choice may seem to explain why supply of precious metals would not be increasing. It could be that supply is not increasing because reserves of precious metals are decreasing because of continuous mining.

At the same time, we don't need an explanation for why supply is decreasing rather than, as the conclusion says, increasing. We need a reason to believe that supply is not actually increasing.

This general fact about reserves doesn't mean that supply is not increasing. Rather, the fact that prices have decreased while demand has increased still appears to support the conclusion that supply is growing, even if reserves may be decreasing.

Eliminate.

B) Over the past century, the prices of some metals have risen dramatically after adjustment for inflation.

This choice tempts us by appearing to change the scenario. We might think it indicates that precious metals prices have actually increased rather than decreased and thus that supply is not increasing.

However, this choice doesn't actually change what we know. After all, the evidence is about "most precious metals." The fact stated by this choice, that the prices of "some metals" have increased doesn't change the fact that the prices of "most precious metals" have decreased.

Eliminate.

C) The prices of commodities, including precious metals, predictably increase when demand grows relative to supply.

This choice strengthens, rather than weakens, the argument. Here's how.

The passage says that demand for precious metals is growing.

Now, this choice says that prices increase when demands grows relative to supply.

However, the passage says that prices are not increasing. So, demand must not be growing relative to supply.

In that case, if demand is growing, supply must be growing as well.

So, the information provided by this choice confirms the conclusion of the argument that supply is growing.

Eliminate.

D) Over the past decade, the prices of most precious metals have risen after adjustment for inflation.

We might think this choice can't be correct since it seems to conflict with a premise of the argument. After all, the passage says the following:

the inflation-adjusted prices (of most precious metals) have actually been falling

So, what this choice says about prices rising could seem to be the opposite of what the passage says.

However, if we haven't noticed a key diference between what the passage says and what this choice says, we can see that difference by going back to the passage and rereading. Doing so, we see that, actually, what the passage says is the following:

over the past century, the inflation-adjusted prices (of precious metals) have actually been falling

We see that the statement in the passage and this choice are about different time periods. The statement in the passage is about "the past century" whereas this choice is about "the past decade."

Having seen that difference, we can also note that the conclusion is that supply must be growing "currently."

So, now, we see a weakness in the argument and how this choice weakens the argument.

The evidence is about the past century, whereas the conclusion is about what's occurring "currently." So, information provided by this choice, that prices have risen "over the past decade," shows that the evidence about the past century doesn't support the conclusion about what's going on "currently."

This choice tells us that what occurred "over the past century" does not support the conclusion about supply growing "currently" because what's has occurred "over the past decade" is different. Over the past decade prices did increase, so supply may not be growing currently.

Keep

E) Over the past century, inflation has made the prices of precious metals much higher in nominal terms than they would otherwise have been.

This choice does not materially change what we know. It just qualifies it.

We already know from the passage that "prices of most precious metals have greatly increased in nominal terms." Now this choice tells us that the prices have increased a lot in nominal terms.

All the same, that information doesn't mean that prices have increased in real terms. So, the scenerio remains the same: prices have decreased in real terms, a fact that supports the conclusion that supply has increased.

Eliminate.

Correct answer: D

The economist has concluded the following:

the supply of these (precious) metals on the market must be currently growing

The support for the conclusion is the following:

over the past century, the inflation-adjusted prices (of precious metals) have actually been falling

the price of a commodity generally decreases when supply grows relative to demand

demand for precious metals has been growing

We see that the economist has reasoned that, since prices are decreasing and demand is increasing, supply must be increasing.

One thing that we might notice in reading the passage (although we don't have to notice it on the first read to get this question correct) is the following important difference betweent the evidence and the conclusion: The evidence involves prices falling "over the past century" whereas the conclusion is that supply must be growing "currently."

Which of the following, if true, would most weaken the economist's argument?

The correct answer will weaken the support the evidence provides for the conclusion.

A) Mining precious metals to put them on the market continuously lowers reserves in the earth.

This choice may seem to explain why supply of precious metals would not be increasing. It could be that supply is not increasing because reserves of precious metals are decreasing because of continuous mining.

At the same time, we don't need an explanation for why supply is decreasing rather than, as the conclusion says, increasing. We need a reason to believe that supply is not actually increasing.

This general fact about reserves doesn't mean that supply is not increasing. Rather, the fact that prices have decreased while demand has increased still appears to support the conclusion that supply is growing, even if reserves may be decreasing.

Eliminate.

B) Over the past century, the prices of some metals have risen dramatically after adjustment for inflation.

This choice tempts us by appearing to change the scenario. We might think it indicates that precious metals prices have actually increased rather than decreased and thus that supply is not increasing.

However, this choice doesn't actually change what we know. After all, the evidence is about "most precious metals." The fact stated by this choice, that the prices of "some metals" have increased doesn't change the fact that the prices of "most precious metals" have decreased.

Eliminate.

C) The prices of commodities, including precious metals, predictably increase when demand grows relative to supply.

This choice strengthens, rather than weakens, the argument. Here's how.

The passage says that demand for precious metals is growing.

Now, this choice says that prices increase when demands grows relative to supply.

However, the passage says that prices are not increasing. So, demand must not be growing relative to supply.

In that case, if demand is growing, supply must be growing as well.

So, the information provided by this choice confirms the conclusion of the argument that supply is growing.

Eliminate.

D) Over the past decade, the prices of most precious metals have risen after adjustment for inflation.

We might think this choice can't be correct since it seems to conflict with a premise of the argument. After all, the passage says the following:

the inflation-adjusted prices (of most precious metals) have actually been falling

So, what this choice says about prices rising could seem to be the opposite of what the passage says.

However, if we haven't noticed a key diference between what the passage says and what this choice says, we can see that difference by going back to the passage and rereading. Doing so, we see that, actually, what the passage says is the following:

over the past century, the inflation-adjusted prices (of precious metals) have actually been falling

We see that the statement in the passage and this choice are about different time periods. The statement in the passage is about "the past century" whereas this choice is about "the past decade."

Having seen that difference, we can also note that the conclusion is that supply must be growing "currently."

So, now, we see a weakness in the argument and how this choice weakens the argument.

The evidence is about the past century, whereas the conclusion is about what's occurring "currently." So, information provided by this choice, that prices have risen "over the past decade," shows that the evidence about the past century doesn't support the conclusion about what's going on "currently."

This choice tells us that what occurred "over the past century" does not support the conclusion about supply growing "currently" because what's has occurred "over the past decade" is different. Over the past decade prices did increase, so supply may not be growing currently.

Keep

E) Over the past century, inflation has made the prices of precious metals much higher in nominal terms than they would otherwise have been.

This choice does not materially change what we know. It just qualifies it.

We already know from the passage that "prices of most precious metals have greatly increased in nominal terms." Now this choice tells us that the prices have increased a lot in nominal terms.

All the same, that information doesn't mean that prices have increased in real terms. So, the scenerio remains the same: prices have decreased in real terms, a fact that supports the conclusion that supply has increased.

Eliminate.

Correct answer: D

General Discussion