Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 19

12:30 PM EST

-01:30 PM EST

Learn how Keshav, a Chartered Accountant, scored an impressive 705 on GMAT in just 30 days with GMATWhiz's expert guidance. In this video, he shares preparation tips and strategies that worked for him, including the mock, time management, and more - Nov 18

11:00 AM PST

-12:00 PM PST

Join us in a live GMAT practice session and solve 30 challenging GMAT questions with other test takers in timed conditions, covering GMAT Quant, Data Sufficiency, Data Insights, Reading Comprehension, and Critical Reasoning questions. - Nov 20

01:30 PM EST

-02:30 PM IST

Learn how Kamakshi achieved a GMAT 675 with an impressive 96th %ile in Data Insights. Discover the unique methods and exam strategies that helped her excel in DI along with other sections for a balanced and high score. - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 24

07:00 PM PST

-08:00 PM PST

Full-length FE mock with insightful analytics, weakness diagnosis, and video explanations! - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

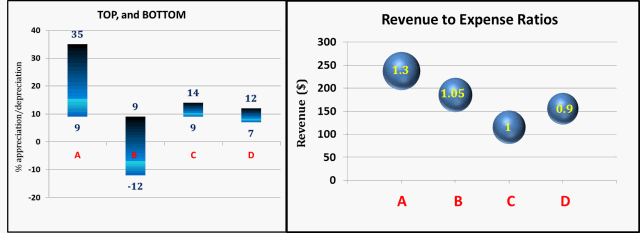

Holy Faith Broking Company classifies stocks of listed companies on the basis of two parameters.

Stock Valuation Classification

TOP – ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.

BOTTOM - ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.

Stable Cow - A stock whose TOP is less than 15% and BOTTOM is more than 8%.

Volatile Bull - A stock whose TOP is more than 30% and BOTTOM is less than 10%.

Volatile Bear - A stock whose TOP is less than 10% and BOTTOM is less than -10%.

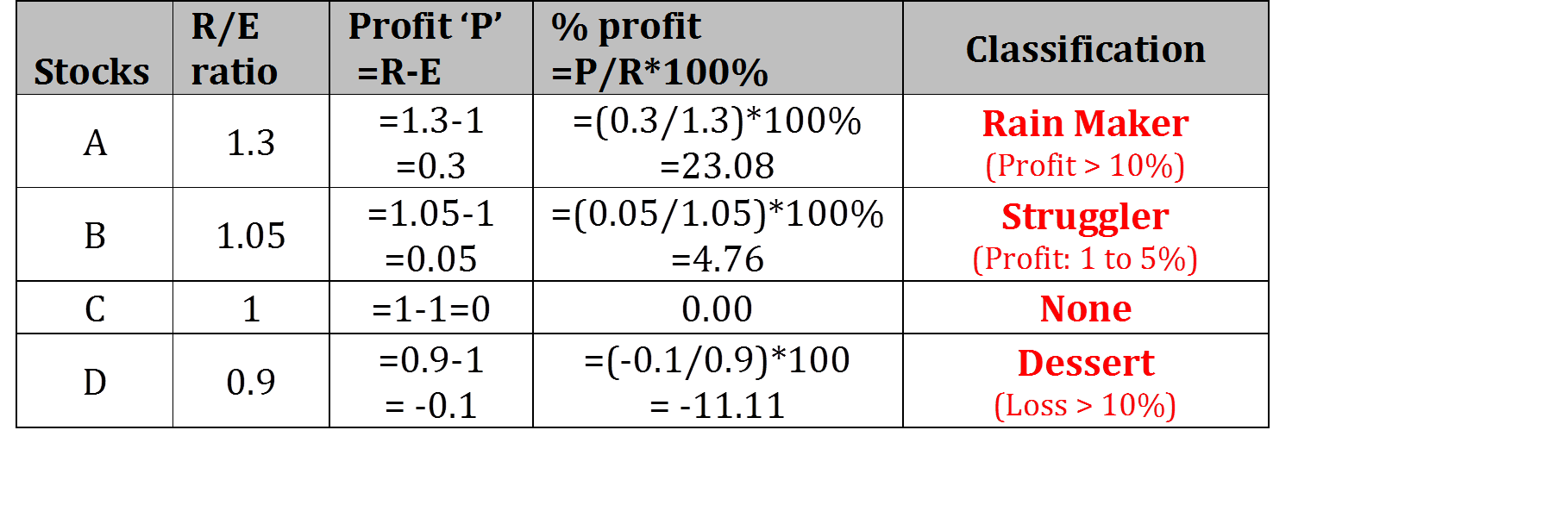

Profit Generation Capability

Struggler - A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)

Dessert - A stock whose issuing company makes a loss of more than 1% of its revenue.

Rain Maker - A stock whose issuing company makes a profit of more than 10% of its revenue.

Stock Valuation Classification

TOP – ‘TOP’ is termed as the mean of daily values of “highest percentage increase in the stock price over last day’s closing price” over a period.

BOTTOM - ‘BOTTOM’ is termed as the mean of daily values of “lowest percentage increase or highest percent decrease, as the case may be, in the stock price over last day’s closing price” over a period.

Stable Cow - A stock whose TOP is less than 15% and BOTTOM is more than 8%.

Volatile Bull - A stock whose TOP is more than 30% and BOTTOM is less than 10%.

Volatile Bear - A stock whose TOP is less than 10% and BOTTOM is less than -10%.

Profit Generation Capability

Struggler - A stock whose issuing company makes a profit between 1% to 5% of its revenue. (Both inclusive)

Dessert - A stock whose issuing company makes a loss of more than 1% of its revenue.

Rain Maker - A stock whose issuing company makes a profit of more than 10% of its revenue.

There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.: No

Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.: No

The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).: No

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

95%

(hard)

95%

(hard)

Question Stats:

55% (03:58) correct 45%

(03:51)

wrong

45%

(03:51)

wrong  based on 220

sessions

based on 220

sessions

History

Date

Time

Result

Not Attempted Yet

1. For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.

| Yes | No | |

| There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications. | ||

| Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP. | ||

| The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5). |

ShowHide Answer

Official Answer

There are exactly two stocks that cannot be classified per both Stock Valuation and Profit Generation Capability classifications.: No

Among the four given stocks, the Volatile Bear-Struggler stock will turn to a Volatile Bull-Struggler stock if there is at the most 20 percentage point increment in its TOP.: No

The expense of the company whose stock is classified as “Rain Maker” is approximately $230 (nearest to $5).: No

CD

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

15%

(low)

15%

(low)

Question Stats:

85% (01:11) correct 15%

(01:36)

wrong

15%

(01:36)

wrong  based on 331

sessions

based on 331

sessions

History

Date

Time

Result

Not Attempted Yet

2. Select the company pair below whose combined revenue to combined expense ratio is the least?

| AC | |

| BC | |

| AB | |

| CD |

Companies whose stocks are classified as Volatile Bear earn more than 5% profit.: No

Company that is classified as Volatile Bull is not the company that earns the highest percentage profit.: No

BOTTOM of the company that is classified as Dessert is not the lowest among all stocks.: Yes

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

55%

(hard)

55%

(hard)

Question Stats:

67% (01:33) correct 33%

(01:36)

wrong

33%

(01:36)

wrong  based on 362

sessions

based on 362

sessions

History

Date

Time

Result

Not Attempted Yet

3. For each of the following statements, select yes if, based on the given information, it must be true, otherwise select no.

| Yes | No | |

| Companies whose stocks are classified as Volatile Bear earn more than 5% profit. | ||

| Company that is classified as Volatile Bull is not the company that earns the highest percentage profit. | ||

| BOTTOM of the company that is classified as Dessert is not the lowest among all stocks. |

ShowHide Answer

Official Answer

Companies whose stocks are classified as Volatile Bear earn more than 5% profit.: No

Company that is classified as Volatile Bull is not the company that earns the highest percentage profit.: No

BOTTOM of the company that is classified as Dessert is not the lowest among all stocks.: Yes

Kudos

Bookmarks

Hi Shalabh,

Very nice set. Got all the answers correct. Do you really think this question is a good representative of GMAT as I have seen such type of questions appear in consulting cases.

Fame

Very nice set. Got all the answers correct. Do you really think this question is a good representative of GMAT as I have seen such type of questions appear in consulting cases.

Fame

Kudos

Bookmarks

fameatop

Hi Fame,

Thank you for the appreciation, and congratulations to you for getting all the correct answers.

Coming to your query, this question is based on the application of column charts that have been widely given in OG 13 (#25, 28, 31, 32, & 34), and GMATPrep, while the bubble chart is tested in GMATPrep (#13). Hope this

helps.

Shalabh