Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

Kudos

Bookmarks

D

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

75%

(hard)

75%

(hard)

Question Stats:

60% (02:11) correct 40%

(02:33)

wrong

40%

(02:33)

wrong  based on 1220

sessions

based on 1220

sessions

History

Date

Time

Result

Not Attempted Yet

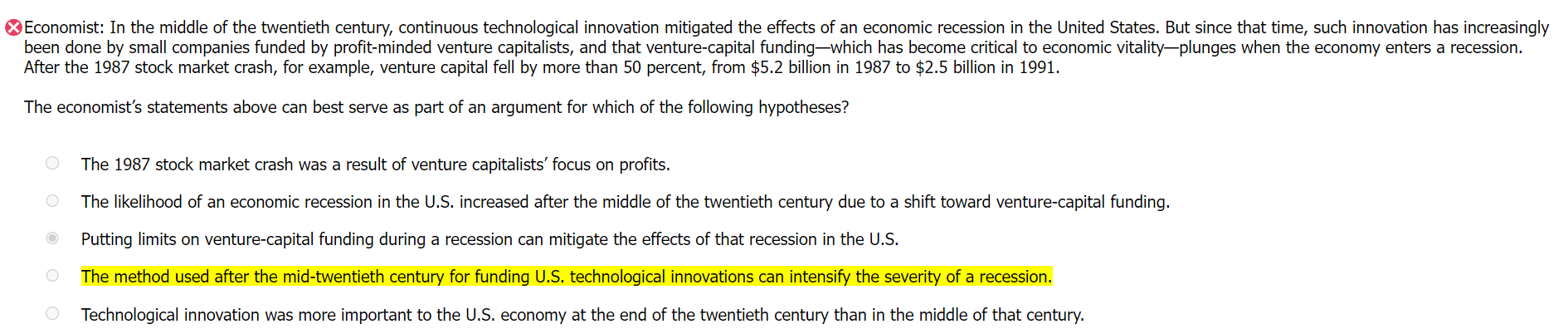

Economist: In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists, and that venture-capital funding—which has become critical to economic vitality—plunges when the economy enters a recession. After the 1987 stock market crash, for example, venture capital fell by more than 50 percent, from $5.2 billion in 1987 to $2.5 billion in 1991.

The economist’s statements above can best serve as part of an argument for which of the following hypotheses?

A. The 1987 stock market crash was a result of venture capitalists’ focus on profits.

B. The likelihood of an economic recession in the U.S. increased after the middle of the twentieth century due to a shift toward venture-capital funding.

C. Putting limits on venture-capital funding during a recession can mitigate the effects of that recession in the U.S.

D. The method used after the mid-twentieth century for funding U.S. technological innovations can intensify the severity of a recession.

E. Technological innovation was more important to the U.S. economy at the end of the twentieth century than in the middle of that century.

GMAT-Club-Forum-r2ssij1i.png [ 110.13 KiB | Viewed 3186 times ]

The economist’s statements above can best serve as part of an argument for which of the following hypotheses?

A. The 1987 stock market crash was a result of venture capitalists’ focus on profits.

B. The likelihood of an economic recession in the U.S. increased after the middle of the twentieth century due to a shift toward venture-capital funding.

C. Putting limits on venture-capital funding during a recession can mitigate the effects of that recession in the U.S.

D. The method used after the mid-twentieth century for funding U.S. technological innovations can intensify the severity of a recession.

E. Technological innovation was more important to the U.S. economy at the end of the twentieth century than in the middle of that century.

Attachment:

GMAT-Club-Forum-r2ssij1i.png [ 110.13 KiB | Viewed 3186 times ]

Kudos

Bookmarks

Explanation

Economist: In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists, and that venture-capital funding—which has become critical to economic vitality—plunges when the economy enters a recession. After the 1987 stock market crash, for example, venture capital fell by more than 50 percent, from $5.2 billion in 1987 to $2.5 billion in 1991.

We see that the passage is made up of factual statements about the effects of technological innovation being funded by venture capitalists.

The economist’s statements above can best serve as part of an argument for which of the following hypotheses?

If statements "serve as part of an argument" for a hypothesis, they support the hypothesis.

So, this question is a Conclusion question, and the correct answer will be a conclusion supported by the passage.

A. The 1987 stock market crash was a result of venture capitalists’ focus on profits.

Regarding "the 1987 stock market crash," the passage says the following:

After the 1987 stock market crash, for example, venture capital fell by more than 50 percent

We see that, unlike what this choice says, the passage says that the crash caused a decrease in venture capital, rather than that venture capitalists caused the crash.

Eliminate.

B. The likelihood of an economic recession in the U.S. increased after the middle of the twentieth century due to a shift toward venture-capital funding.

This choice is pretty tricky. In fact, I initially thought it might be correct, but here's what's going on.

This choice may seem to be supported by the passage since the passage says the following:

In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists

Seeing that contrast between what occurred "in the middle of the twentieth century" and what has occurred "since that time" with innovation increasingly "done by small companies funded by ... venture capitalists," we could get the impression that this choice is correct.

At the same time, we have to notice some key things in the passage.

The first thing we have to notice is that it says, "In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession." Something that "mitigated the effects" of a recession didn't prevent a recession from occurring. Mitigating something is making it less problematic than it would have been, not preventing it.

The second is that the passage says, "venture-capital funding—which has become critical to economic vitality—plunges when the economy enters a recession." Notice that this issue doesn't arise unless the economy "enters a recession." So, the issue is not that venture-capital funding causes recessions. The issue is that venture capital funding plunges when a recession occurs.

Simply put, the passage doesn't say that what occurred in the middle of the twentieth century prevented recessions or that venture capital causes recessions to be more likely.

Thus, nothing the passage says indicates that "The likelihood of an economic recession in the U.S. increased after the middle of the twentieth century due to a shift toward venture-capital funding."

Eliminate.

C. Putting limits on venture-capital funding during a recession can mitigate the effects of that recession in the U.S.

Notice that the passage doesn't say that recessions are worse because there's too much venture-capital funding during a recession. It indicates that recessions are worse because "venture-capital funding ... plunges when the economy enters a recession." In other words, the issue is that there's less venture-capital funding during a recession.

So, the passage indicates that, contrary to what this choice says, putting limits on venture-capital funding during a recession wouldn't help at all. It could even make things worse.

Elimimate.

D. The method used after the mid-twentieth century for funding U.S. technological innovations can intensify the severity of a recession.

We might be tempted to eliminate this choice because it doesn't mention "venture-capital funding."

Notice, however, that "The method used after the mid-twentieth century for funding U.S. technological innovations" mentioned by this choice matches perfectly with "venture-capital funding" in the passage. After all, the passage says, "since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists."

So, we can presume that "the method" mentioned in this choice is "venture-capital."

So, does the passage support the idea that venture capital "can intensify the severity of a recession"? Yes it does. After all it says the following:

In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists.

We see that the passage uses the contrast word "but" to communicate that, because of innovation being funded by venture capitalists, innovation no longer mitigates the effects of a recession. Then, the statements that follow explain why.

So, this choice is logically supported by the passage.

Keep.

E. Technological innovation was more important to the U.S. economy at the end of the twentieth century than in the middle of that century.

This choice may seem correct because, according to the passage, there has been a change in the relationship between innovation and the economy. That change is that, in the middle of the twentieth century, innovation mitigated the effects of a recession, but now it doesn't.

At the same time, this choice is not supported by the passage and even in a way is contrary to what the passage implies. After all, the fact that innovation no longer mitigates recessions the way it did doesn't mean it's less important. In fact, what the passage says suggests that innovation is still important and therefore could still mitigate recessions but doesn't because of how it's funded.

Eliminate.

Correct answer: D

Economist: In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists, and that venture-capital funding—which has become critical to economic vitality—plunges when the economy enters a recession. After the 1987 stock market crash, for example, venture capital fell by more than 50 percent, from $5.2 billion in 1987 to $2.5 billion in 1991.

We see that the passage is made up of factual statements about the effects of technological innovation being funded by venture capitalists.

The economist’s statements above can best serve as part of an argument for which of the following hypotheses?

If statements "serve as part of an argument" for a hypothesis, they support the hypothesis.

So, this question is a Conclusion question, and the correct answer will be a conclusion supported by the passage.

A. The 1987 stock market crash was a result of venture capitalists’ focus on profits.

Regarding "the 1987 stock market crash," the passage says the following:

After the 1987 stock market crash, for example, venture capital fell by more than 50 percent

We see that, unlike what this choice says, the passage says that the crash caused a decrease in venture capital, rather than that venture capitalists caused the crash.

Eliminate.

B. The likelihood of an economic recession in the U.S. increased after the middle of the twentieth century due to a shift toward venture-capital funding.

This choice is pretty tricky. In fact, I initially thought it might be correct, but here's what's going on.

This choice may seem to be supported by the passage since the passage says the following:

In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists

Seeing that contrast between what occurred "in the middle of the twentieth century" and what has occurred "since that time" with innovation increasingly "done by small companies funded by ... venture capitalists," we could get the impression that this choice is correct.

At the same time, we have to notice some key things in the passage.

The first thing we have to notice is that it says, "In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession." Something that "mitigated the effects" of a recession didn't prevent a recession from occurring. Mitigating something is making it less problematic than it would have been, not preventing it.

The second is that the passage says, "venture-capital funding—which has become critical to economic vitality—plunges when the economy enters a recession." Notice that this issue doesn't arise unless the economy "enters a recession." So, the issue is not that venture-capital funding causes recessions. The issue is that venture capital funding plunges when a recession occurs.

Simply put, the passage doesn't say that what occurred in the middle of the twentieth century prevented recessions or that venture capital causes recessions to be more likely.

Thus, nothing the passage says indicates that "The likelihood of an economic recession in the U.S. increased after the middle of the twentieth century due to a shift toward venture-capital funding."

Eliminate.

C. Putting limits on venture-capital funding during a recession can mitigate the effects of that recession in the U.S.

Notice that the passage doesn't say that recessions are worse because there's too much venture-capital funding during a recession. It indicates that recessions are worse because "venture-capital funding ... plunges when the economy enters a recession." In other words, the issue is that there's less venture-capital funding during a recession.

So, the passage indicates that, contrary to what this choice says, putting limits on venture-capital funding during a recession wouldn't help at all. It could even make things worse.

Elimimate.

D. The method used after the mid-twentieth century for funding U.S. technological innovations can intensify the severity of a recession.

We might be tempted to eliminate this choice because it doesn't mention "venture-capital funding."

Notice, however, that "The method used after the mid-twentieth century for funding U.S. technological innovations" mentioned by this choice matches perfectly with "venture-capital funding" in the passage. After all, the passage says, "since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists."

So, we can presume that "the method" mentioned in this choice is "venture-capital."

So, does the passage support the idea that venture capital "can intensify the severity of a recession"? Yes it does. After all it says the following:

In the middle of the twentieth century, continuous technological innovation mitigated the effects of an economic recession in the United States. But since that time, such innovation has increasingly been done by small companies funded by profit-minded venture capitalists.

We see that the passage uses the contrast word "but" to communicate that, because of innovation being funded by venture capitalists, innovation no longer mitigates the effects of a recession. Then, the statements that follow explain why.

So, this choice is logically supported by the passage.

Keep.

E. Technological innovation was more important to the U.S. economy at the end of the twentieth century than in the middle of that century.

This choice may seem correct because, according to the passage, there has been a change in the relationship between innovation and the economy. That change is that, in the middle of the twentieth century, innovation mitigated the effects of a recession, but now it doesn't.

At the same time, this choice is not supported by the passage and even in a way is contrary to what the passage implies. After all, the fact that innovation no longer mitigates recessions the way it did doesn't mean it's less important. In fact, what the passage says suggests that innovation is still important and therefore could still mitigate recessions but doesn't because of how it's funded.

Eliminate.

Correct answer: D

General Discussion

Kudos

Bookmarks

Reccession mitigated by Tech Innovation ( TI )

Tech Innovation ( TI ) currently handled by Venture Capital

Venture Capital ( VC ) is reduced by Recession

If TI were funded by something else other than VC like in 1950s then, ( TI ) they would continue even during phases of recessions and mitigate the effect of recession.

Hence

Ability to mitigate recession is reduced due to current system ( which is correctly stated in choice D )

The likelihood of an economic recession is affected by venture-capital funding ( option B ) is clearly wrong.

Recession will occur at it's own pace but it's affect is mitigated by TI ( which is fueled by VCs in recent times )

The key trick the question plays upon is the confusion between the two terms (This is probably a 700 level question) :

A. Migitates the EFFECT of Recession ( stated in passage )

B. Mitigates the Recession

If we are careless we will assume tech innovation reduce the recession ( which would mean VCs reduce likelihood of Recession - option B which is wrong )

Option D is correct.

Tech Innovation ( TI ) currently handled by Venture Capital

Venture Capital ( VC ) is reduced by Recession

If TI were funded by something else other than VC like in 1950s then, ( TI ) they would continue even during phases of recessions and mitigate the effect of recession.

Hence

Ability to mitigate recession is reduced due to current system ( which is correctly stated in choice D )

The likelihood of an economic recession is affected by venture-capital funding ( option B ) is clearly wrong.

Recession will occur at it's own pace but it's affect is mitigated by TI ( which is fueled by VCs in recent times )

The key trick the question plays upon is the confusion between the two terms (This is probably a 700 level question) :

A. Migitates the EFFECT of Recession ( stated in passage )

B. Mitigates the Recession

If we are careless we will assume tech innovation reduce the recession ( which would mean VCs reduce likelihood of Recession - option B which is wrong )

Option D is correct.