Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

Manifesting710

GMAT Focus 1: 615 Q83 V83 DI75

Posts: 35

Kudos

Bookmarks

A

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

35%

(medium)

35%

(medium)

Question Stats:

78% (01:37) correct 22%

(02:04)

wrong

22%

(02:04)

wrong  based on 718

sessions

based on 718

sessions

History

Date

Time

Result

Not Attempted Yet

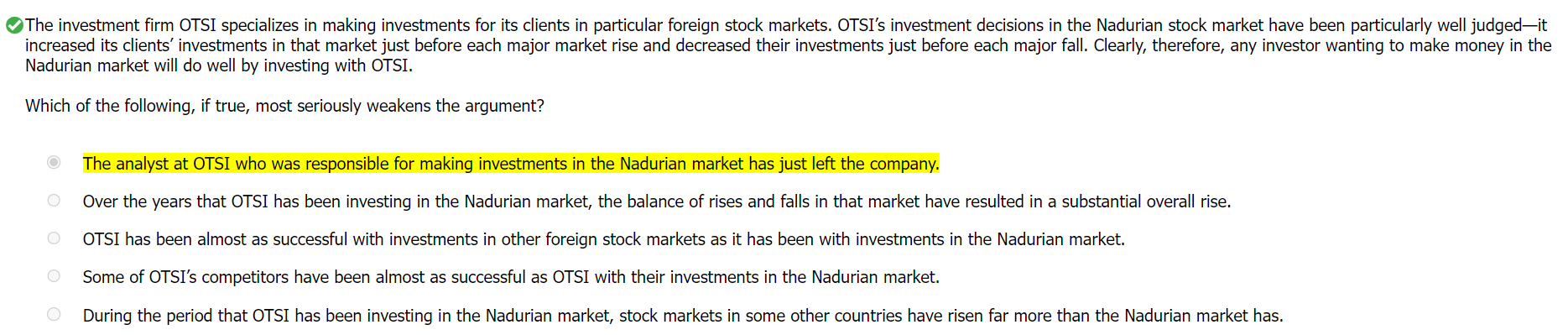

The investment firm OTSI specializes in making investments for its clients in particular foreign stock markets. OTSI’s investment decisions in the Nadurian stock market have been particularly well judged—it increased its clients’ investments in that market just before each major market rise and decreased their investments just before each major fall. Clearly, therefore, any investor wanting to make money in the Nadurian market will do well by investing with OTSI.

Which of the following, if true, most seriously weakens the argument?

A. The analyst at OTSI who was responsible for making investments in the Nadurian market has just left the company.

B. Over the years that OTSI has been investing in the Nadurian market, the balance of rises and falls in that market have resulted in a substantial overall rise.

C. OTSI has been almost as successful with investments in other foreign stock markets as it has been with investments in the Nadurian market.

D. Some of OTSI’s competitors have been almost as successful as OTSI with their investments in the Nadurian market.

E. During the period that OTSI has been investing in the Nadurian market, stock markets in some other countries have risen far more than the Nadurian market has.

GMAT-Club-Forum-upud80aa.png [ 106.83 KiB | Viewed 1995 times ]

Which of the following, if true, most seriously weakens the argument?

A. The analyst at OTSI who was responsible for making investments in the Nadurian market has just left the company.

B. Over the years that OTSI has been investing in the Nadurian market, the balance of rises and falls in that market have resulted in a substantial overall rise.

C. OTSI has been almost as successful with investments in other foreign stock markets as it has been with investments in the Nadurian market.

D. Some of OTSI’s competitors have been almost as successful as OTSI with their investments in the Nadurian market.

E. During the period that OTSI has been investing in the Nadurian market, stock markets in some other countries have risen far more than the Nadurian market has.

Attachment:

GMAT-Club-Forum-upud80aa.png [ 106.83 KiB | Viewed 1995 times ]

Kudos

Bookmarks

Can someone explain why D is wrong?

Manifesting710

GMAT Focus 1: 615 Q83 V83 DI75

Posts: 35

Kudos

Bookmarks

Vartika2525

Conclusion ; “ Clearly, therefore, any investor wanting to make money in the Nadurian market will do well by investing with OTSI. ”

in my opinion

Since, the conclusion does not state that investing in OTSI is the only option to make money, Option D becomes irrelevant, as

1) we don’t really care about the other companies

2) “ almost as successful as OTSI” still means OTSI is more successful and hence you would make more money through OTSI, even if it’s slightly more

I ended up going with A even tho it was kinda obvious but I felt all the other option ended up strengthening the conclusion or are irrelevant

Posted from my mobile device