Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 20

10:00 AM EST

-10:30 AM EST

If you’re applying to Columbia, NYU Stern, or Yale SOM, you need more than strong stats. Each school defines “leadership” differently, and your essays must reflect that. Join Sia Admissions founder, Susan Berishaj on November 20th - Nov 20

09:00 PM IST

-10:00 PM IST

Join our free expert-led Essay Workshops to discover how to choose impactful stories, highlight your core values, and align your background with each school’s distinct culture, making every word truly count. - Nov 12

01:00 PM EST

-11:59 PM EST

Get expert MBA strategy, instant essay feedback, and personalized advice on your entire application. Join My Admit Coach, the AI-powered MBA admissions platform built on 10K+ successful application docs for HBS, Stanford GSB, MIT and other top programs. - Nov 19

09:00 AM PST

-10:00 AM PST

What’s in it for you- Live Profile Evaluation Chat Session with Jenifer Turtschnow, CEO ARINGO. Come with your details prepared and ARINGO will share insights! Pre-MBA Role/Industry, YOE, Exam Score, C/GPA, ECs Post-MBA Role/ Industry & School List. - Nov 19

10:00 AM EST

-01:00 PM EST

Get expert MBA strategy, instant essay feedback, and personalized advice on your entire application. Join My Admit Coach, the AI-powered MBA admissions platform built on 10K+ successful application docs for HBS, Stanford GSB, MIT and other top programs. - Nov 19

11:00 AM PST

-12:00 PM PST

Round 2 is here — and it’s your chance to make your MBA dream happen! Join GMAT Club’s LIVE discussion with two top experts from The Red Pen, Gunjan Jhunjhunwala and Natasha Mankikar, as we break down everything you need to know - Nov 21

08:30 AM EST

-09:15 AM EST

Get the inside scoop on what makes Emory’s Goizueta Business School great, learn how you can present a strong MBA application, and connect with an Admissions Director to get your questions answered. - Nov 21

09:30 PM IST

-10:30 PM IST

Learn how to craft powerful, authentic essays by mastering the 3 “WHYs” every top MBA program looks for: Why MBA, Why Now, and Why This School. - Nov 24

08:00 PM PST

-09:00 PM PST

Inquire for a free profile evaluation and guarantee statement for possible admits and scholarships!

Kudos

Bookmarks

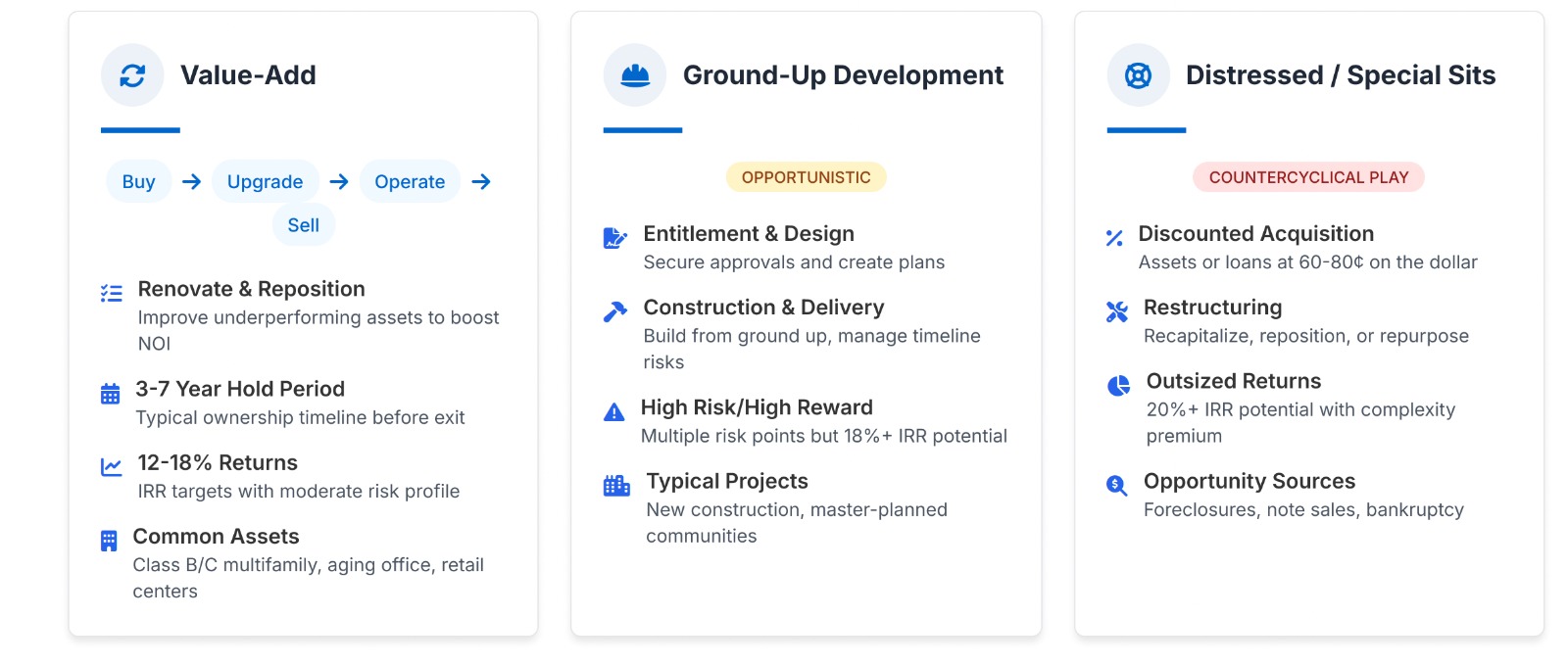

Even in REPE, every firm has its own investment thesis.. You need to have more complex skills if you're aiming for REPE firms focused on Distressed assets

But most of REPE firms are honestly Value-add one

Kudos

Bookmarks

Develooment and REPE have similar trajectories?

Or is one better then other?

Or is one better then other?