Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

Of the individual states listed that experienced at least one bank failure in 2008 and at least 10 bank failures in 2010, no more than 3 states experienced declines in bank failures from 2010 to 2011.: Yes

Across the US states and territories that each experienced more than 45 bank failures in the time frame displayed, less than a third of all bank failures that occurred during the time frame displayed occurred in 2010.: No

The total number of bank failures in the 44 US states and territories included in the table grew from 2009 to 2010.: Yes

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

95%

(hard)

95%

(hard)

Question Stats:

61% (04:06) correct 39%

(04:06)

wrong

39%

(04:06)

wrong  based on 805

sessions

based on 805

sessions

History

Date

Time

Result

Not Attempted Yet

According to the Federal Deposit Insurance Corporation, 43 US states and 1 US territory experienced bank failures from October 1, 2000 through December 31, 2011. The 21 other states or territories grouped together in one row each experienced less than 5 bank failures in the period shown.

For each of the following statements, select Yes if the statement can be shown to be true using the information provided. Otherwise, select No.

Bank failure by year | |||||||

| State/Territory | 2000-06 | 2007 | 2008 | 2009 | 2010 | 2011 | Total |

|---|---|---|---|---|---|---|---|

| Alabama | 0 | 0 | 0 | 3 | 1 | 2 | 6 |

| Arizona | 1 | 0 | 0 | 5 | 4 | 3 | 13 |

| California | 1 | 0 | 5 | 17 | 12 | 4 | 39 |

| Florida | 3 | 0 | 2 | 14 | 29 | 13 | 61 |

| Georgia | 1 | 1 | 5 | 25 | 21 | 23 | 76 |

| Illinois | 3 | 0 | 1 | 21 | 16 | 9 | 50 |

| Kansas | 0 | 0 | 1 | 3 | 3 | 1 | 8 |

| Maryland | 0 | 0 | 0 | 2 | 4 | 0 | 6 |

| Mishigan | 1 | 0 | 1 | 4 | 5 | 2 | 13 |

| Minnesota | 0 | 0 | 1 | 6 | 8 | 2 | 17 |

| Missouri | 0 | 0 | 2 | 3 | 6 | 1 | 12 |

| Nevada | 0 | 0 | 3 | 3 | 4 | 1 | 11 |

| Naw Jarsay | 1 | 0 | 0 | 2 | 1 | 1 | 5 |

| New-York | 1 | 0 | 0 | 1 | 3 | 0 | 5 |

| Ohio | 2 | 1 | 0 | 2 | 2 | 0 | 7 |

| Oregon | 0 | 0 | 0 | 3 | 3 | 0 | 6 |

| Pennsylvania | 1 | 1 | 0 | 1 | 2 | 1 | 6 |

| South Carolina | 0 | 0 | 0 | 0 | 4 | 3 | 7 |

| Texas | 1 | 0 | 2 | 5 | 1 | 1 | 10 |

| Utah | 1 | 0 | 0 | 2 | 3 | 1 | 7 |

| Washington | 0 | 0 | 0 | 3 | 11 | 3 | 17 |

| Wisconsin | 1 | 0 | 0 | 1 | 2 | 3 | 7 |

| 21 other states or territories | 6 | 0 | 2 | 11 | 12 | 12 | 43 |

For each of the following statements, select Yes if the statement can be shown to be true using the information provided. Otherwise, select No.

| Yes | No | |

| Of the individual states listed that experienced at least one bank failure in 2008 and at least 10 bank failures in 2010, no more than 3 states experienced declines in bank failures from 2010 to 2011. | ||

| Across the US states and territories that each experienced more than 45 bank failures in the time frame displayed, less than a third of all bank failures that occurred during the time frame displayed occurred in 2010. | ||

| The total number of bank failures in the 44 US states and territories included in the table grew from 2009 to 2010. |

ShowHide Answer

Official Answer

Of the individual states listed that experienced at least one bank failure in 2008 and at least 10 bank failures in 2010, no more than 3 states experienced declines in bank failures from 2010 to 2011.: Yes

Across the US states and territories that each experienced more than 45 bank failures in the time frame displayed, less than a third of all bank failures that occurred during the time frame displayed occurred in 2010.: No

The total number of bank failures in the 44 US states and territories included in the table grew from 2009 to 2010.: Yes

Kudos

Bookmarks

This is one of those TA questions that requires very careful translation and this is where the technique of strategic pausing comes into picture. Here is the detailed video solution.

Significance of Strategic Pausing

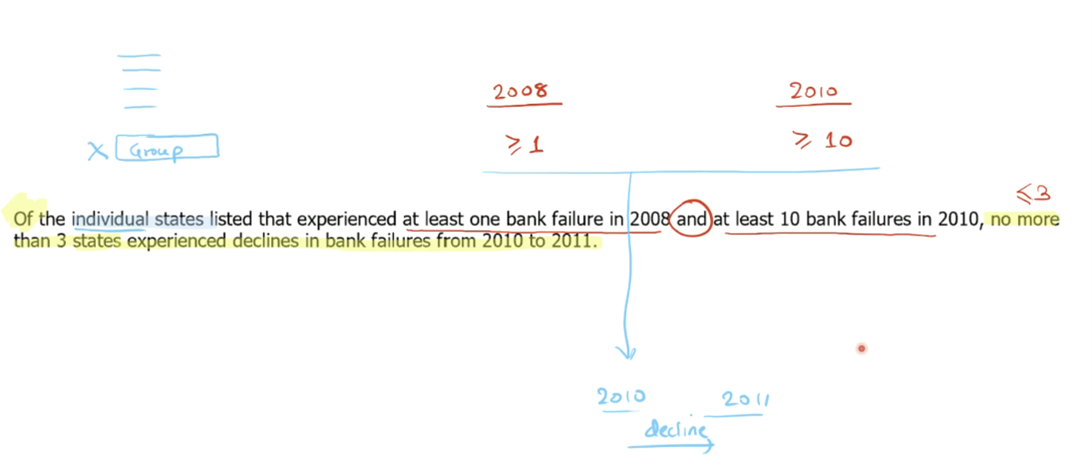

As you watch this video, observe how for each statement, following steps need to be followed. For ready reference, I have provided the outputs for statement 1.

Takeaway: When the statements look very complex, please break them down into smaller chunks and then paraphrase each part in your own words so that you can arrive at the approach to solve that statement.

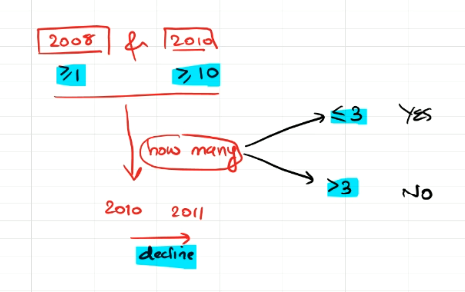

Drawing inferences instead of doing lengthy calculations

Next in this question, statement 3 offers a very interesting strategy for using your inference skills to arrive at the answer instead of doing calculations related to 22 entities. Watch the video from this point onwards for the demonstration of this strategy.

GMAT-Club-Forum-cldp15cr.png [ 97.97 KiB | Viewed 3094 times ]

GMAT-Club-Forum-3jkz6zh0.png [ 45.29 KiB | Viewed 3078 times ]

Significance of Strategic Pausing

As you watch this video, observe how for each statement, following steps need to be followed. For ready reference, I have provided the outputs for statement 1.

- Read the statement by strategically pausing and summarizing in your own words.

- Formulate the approach to answer the statement without looking at the Table but using your thorough understanding of the table since you have understood the dataset with the mindset of ‘owning the dataset’.

- Then look at the table and follow the step by step approach that you derived for the statement.

Takeaway: When the statements look very complex, please break them down into smaller chunks and then paraphrase each part in your own words so that you can arrive at the approach to solve that statement.

Drawing inferences instead of doing lengthy calculations

Next in this question, statement 3 offers a very interesting strategy for using your inference skills to arrive at the answer instead of doing calculations related to 22 entities. Watch the video from this point onwards for the demonstration of this strategy.

Attachment:

GMAT-Club-Forum-cldp15cr.png [ 97.97 KiB | Viewed 3094 times ]

Attachment:

GMAT-Club-Forum-3jkz6zh0.png [ 45.29 KiB | Viewed 3078 times ]

General Discussion

Kudos

Bookmarks

According to the Federal Deposit Insurance Corporation, 43 US states and 1 US territory experienced bank failures from October 1, 2000 through December 31, 2011. The 21 other states or territories grouped together in one row each experienced less than 5 bank failures in the period shown. - Bunuel, I think LESS THAN is incorrect here.

Kindly correct me if i am wrong.

Of the individual states listed that experienced at least one bank failure in 2008 and at least 10 bank failures in 2010, no more than 3 states experienced declines in bank failures from 2010 to 2011. - NO

Across the US states and territories that each experienced more than 45 bank failures in the time frame displayed, less than a third of all bank failures that occurred during the time frame displayed occurred in 2010. - NO

The total number of bank failures in the 44 US states and territories included in the table grew from 2009 to 2010.- NO

Kindly correct me if i am wrong.

Of the individual states listed that experienced at least one bank failure in 2008 and at least 10 bank failures in 2010, no more than 3 states experienced declines in bank failures from 2010 to 2011. - NO

Across the US states and territories that each experienced more than 45 bank failures in the time frame displayed, less than a third of all bank failures that occurred during the time frame displayed occurred in 2010. - NO

The total number of bank failures in the 44 US states and territories included in the table grew from 2009 to 2010.- NO