Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

abcsayali

Joined: 12 Oct 2022

Last visit: 12 Jul 2025

Posts: 52

Given Kudos: 52

Location: India

Schools: Ross '27 (D) Anderson '27 (A$) HBS '27 (D) Tuck '27 (WL) Booth '27 (D) Stanford '27 (II) Kellog '27 (I) Fuqua '27 (WL) Johnson '27 (II) Tepper '27 (WL)

GMAT Focus 1: 705 Q90 V83 DI82

GRE 1: Q166 V150

Schools: Ross '27 (D) Anderson '27 (A$) HBS '27 (D) Tuck '27 (WL) Booth '27 (D) Stanford '27 (II) Kellog '27 (I) Fuqua '27 (WL) Johnson '27 (II) Tepper '27 (WL)

GMAT Focus 1: 705 Q90 V83 DI82

GRE 1: Q166 V150

Posts: 52

E

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

75%

(hard)

75%

(hard)

Question Stats:

57% (02:02) correct 43%

(02:16)

wrong

43%

(02:16)

wrong  based on 1310

sessions

based on 1310

sessions

History

Date

Time

Result

Not Attempted Yet

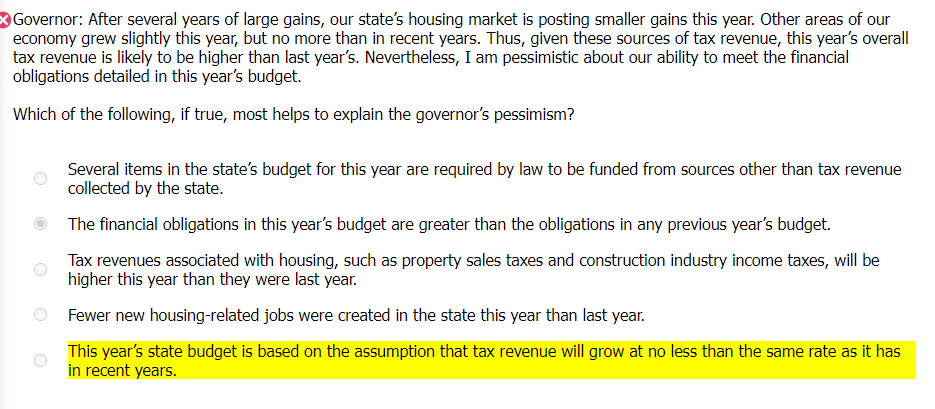

Governor: After several years of large gains, our state’s housing market is posting smaller gains this year. Other areas of our economy grew slightly this year, but no more than in recent years. Thus, given these sources of tax revenue, this year’s overall tax revenue is likely to be higher than last year’s. Nevertheless, I am pessimistic about our ability to meet the financial obligations detailed in this year’s budget.

Which of the following, if true, most helps to explain the governor’s pessimism?

A. Several items in the state’s budget for this year are required by law to be funded from sources other than tax revenue collected by the state.

B. The financial obligations in this year’s budget are greater than the obligations in any previous year’s budget.

C. Tax revenues associated with housing, such as property sales taxes and construction industry income taxes, will be higher this year than they were last year.

D. Fewer new housing-related jobs were created in the state this year than last year.

E. This year’s state budget is based on the assumption that tax revenue will grow at no less than the same rate as it has in recent years.

GMAT-Club-Forum-ottkm4wk.png [ 55.91 KiB | Viewed 2364 times ]

Which of the following, if true, most helps to explain the governor’s pessimism?

A. Several items in the state’s budget for this year are required by law to be funded from sources other than tax revenue collected by the state.

B. The financial obligations in this year’s budget are greater than the obligations in any previous year’s budget.

C. Tax revenues associated with housing, such as property sales taxes and construction industry income taxes, will be higher this year than they were last year.

D. Fewer new housing-related jobs were created in the state this year than last year.

E. This year’s state budget is based on the assumption that tax revenue will grow at no less than the same rate as it has in recent years.

Attachment:

GMAT-Club-Forum-ottkm4wk.png [ 55.91 KiB | Viewed 2364 times ]

Attachments

download.png [ 55.91 KiB | Viewed 3057 times ]

Kudos

Bookmarks

Governor: After several years of large gains, our state’s housing market is posting smaller gains this year. Other areas of our economy grew slightly this year, but no more than in recent years. Thus, given these sources of tax revenue, this year’s overall tax revenue is likely to be higher than last year’s. Nevertheless, I am pessimistic about our ability to meet the financial obligations detailed in this year’s budget.

The governor says the following:

given these sources of tax revenue, this year’s overall tax revenue is likely to be higher than last year’s

Then, the governor says the following:

I am pessimistic about our ability to meet the financial obligations detailed in this year’s budget.

The governor's pessimism is a little surprising since, if tax revenue is likely to be higher this year than it was last year, then one might think that the governor would be confident that the state can meet its financial obligations, but the governor isn't confident. Rather, the governor appears to believe that its unlikely that the state will be able to meet them.

Which of the following, if true, most helps to explain the governor’s pessimism?

This question is a Resolve the Paradox or Best Explains question, and the correct answer will explain or help to explain why the governor is pessimistic about the state's ability to meet its financial obligations.

A. Several items in the state’s budget for this year are required by law to be funded from sources other than tax revenue collected by the state.

We have to be careful not to make up an unsupported story about why this choice explains the governor's pessimism. After all, we could decide that this choice explains why the governor is pessimistic because we could get the impression that this choice indicates that the state's inability to meet its obligations will result from issues related to funding from sources other than tax revenue.

However, that story isn't supported. After all, this choice doesn't say that there are issues related to the sources other than tax revenue. So, we have no reason to believe there are.

So, this choice doesn't explain the governor's pessimism.

Eliminate.

B. The financial obligations in this year’s budget are greater than the obligations in any previous year’s budget.

This choice doesn't explain the governor's pessimism. After all, while, as this choice says, the financial obligations in this year’s budget are greater than the obligations in any previous year’s budget, it's also true that tax revenue "is likely to be higher this year than it was last year." So, it may also be that tax revenue will be greater than in any previous year.

So, this choice doesn't explain why the governor is pessimistic.

Eliminate.

C. Tax revenues associated with housing, such as property sales taxes and construction industry income taxes, will be higher this year than they were last year.

There are two reasons to eliminate this choice.

The first is that it basically restates something we already know, which is that tax revenue is expected to increase this year.

The second is that the fact that the revenues mentioned by this choice will be higher this year than they were last year clearly is not a reason to be pessimistic about the ablity of the state to meet its financial obligations.

Eliminate.

D. Fewer new housing-related jobs were created in the state this year than last year.

Notice that this choice says that fewer housing-related jobs were created in the state this year.

Of course, what that means is that at least some new housing-related jobs were created.

The fact that new jobs were created is not on its own a reason to be pessimistic about the state's ability to meet its financial obligations.

Eliminate.

E. This year’s state budget is based on the assumption that tax revenue will grow at no less than the same rate as it has in recent years.

This choice explains the governor's pessimism.

After all, the passage states that "our state’s housing market is posting smaller gains this year" and that "Other areas of our economy grew slightly this year, but no more than in recent years." It then goes on to describe the housing market and other areas of the economy as "sources of tax revenue."

So, we see that one source of tax revenue, "our state's housing market" is growing less than in previous years and that other sources grew "no more than in previous years." So, overall, the sources of tax revenue will likely grow less than in previous years meaning that tax revenue itself will likely grow at "less than the same rate it has in previous years."

Thus, tax revenue will likely grow less than the budget assumed it would, and therefore, the state is unlikely to meet its financial obligations.

Keep.

Correct answer: E

The governor says the following:

given these sources of tax revenue, this year’s overall tax revenue is likely to be higher than last year’s

Then, the governor says the following:

I am pessimistic about our ability to meet the financial obligations detailed in this year’s budget.

The governor's pessimism is a little surprising since, if tax revenue is likely to be higher this year than it was last year, then one might think that the governor would be confident that the state can meet its financial obligations, but the governor isn't confident. Rather, the governor appears to believe that its unlikely that the state will be able to meet them.

Which of the following, if true, most helps to explain the governor’s pessimism?

This question is a Resolve the Paradox or Best Explains question, and the correct answer will explain or help to explain why the governor is pessimistic about the state's ability to meet its financial obligations.

A. Several items in the state’s budget for this year are required by law to be funded from sources other than tax revenue collected by the state.

We have to be careful not to make up an unsupported story about why this choice explains the governor's pessimism. After all, we could decide that this choice explains why the governor is pessimistic because we could get the impression that this choice indicates that the state's inability to meet its obligations will result from issues related to funding from sources other than tax revenue.

However, that story isn't supported. After all, this choice doesn't say that there are issues related to the sources other than tax revenue. So, we have no reason to believe there are.

So, this choice doesn't explain the governor's pessimism.

Eliminate.

B. The financial obligations in this year’s budget are greater than the obligations in any previous year’s budget.

This choice doesn't explain the governor's pessimism. After all, while, as this choice says, the financial obligations in this year’s budget are greater than the obligations in any previous year’s budget, it's also true that tax revenue "is likely to be higher this year than it was last year." So, it may also be that tax revenue will be greater than in any previous year.

So, this choice doesn't explain why the governor is pessimistic.

Eliminate.

C. Tax revenues associated with housing, such as property sales taxes and construction industry income taxes, will be higher this year than they were last year.

There are two reasons to eliminate this choice.

The first is that it basically restates something we already know, which is that tax revenue is expected to increase this year.

The second is that the fact that the revenues mentioned by this choice will be higher this year than they were last year clearly is not a reason to be pessimistic about the ablity of the state to meet its financial obligations.

Eliminate.

D. Fewer new housing-related jobs were created in the state this year than last year.

Notice that this choice says that fewer housing-related jobs were created in the state this year.

Of course, what that means is that at least some new housing-related jobs were created.

The fact that new jobs were created is not on its own a reason to be pessimistic about the state's ability to meet its financial obligations.

Eliminate.

E. This year’s state budget is based on the assumption that tax revenue will grow at no less than the same rate as it has in recent years.

This choice explains the governor's pessimism.

After all, the passage states that "our state’s housing market is posting smaller gains this year" and that "Other areas of our economy grew slightly this year, but no more than in recent years." It then goes on to describe the housing market and other areas of the economy as "sources of tax revenue."

So, we see that one source of tax revenue, "our state's housing market" is growing less than in previous years and that other sources grew "no more than in previous years." So, overall, the sources of tax revenue will likely grow less than in previous years meaning that tax revenue itself will likely grow at "less than the same rate it has in previous years."

Thus, tax revenue will likely grow less than the budget assumed it would, and therefore, the state is unlikely to meet its financial obligations.

Keep.

Correct answer: E

General Discussion

Originally posted by 8Harshitsharma on 10 Mar 2024, 02:36.

Last edited by 8Harshitsharma on 10 Mar 2024, 04:25, edited 1 time in total.

Last edited by 8Harshitsharma on 10 Mar 2024, 04:25, edited 1 time in total.

Kudos

Bookmarks

There are treacherous answer choices in this one.

The problem with choice B is that it is uncertain and doesn't clearly explain the governor's pessimism. Why? That's because we don't know how high the financial obligations were in this year's budget. If they were higher than the projected overall tax revenue then the governor's pessimism is justified. However, if the financial obligations were higher than any other year but lower than the projected tax revenue for this year then the governor won't have any reason to be pessimistic. So, this choice is not air tight.

Choice E on the other hand states that the this year's tax budget is based on the assumption that overall tax revenue will grow at the same or even greater rate this year than the previous year and since we already know that the city's housing market will have smaller gains this year. The governor and we can be certain that the obligations won't be met.

The problem with choice B is that it is uncertain and doesn't clearly explain the governor's pessimism. Why? That's because we don't know how high the financial obligations were in this year's budget. If they were higher than the projected overall tax revenue then the governor's pessimism is justified. However, if the financial obligations were higher than any other year but lower than the projected tax revenue for this year then the governor won't have any reason to be pessimistic. So, this choice is not air tight.

Choice E on the other hand states that the this year's tax budget is based on the assumption that overall tax revenue will grow at the same or even greater rate this year than the previous year and since we already know that the city's housing market will have smaller gains this year. The governor and we can be certain that the obligations won't be met.