Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth

Kudos

Bookmarks

Dropdown 1: 0900h

Dropdown 2: 1000h

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

55%

(hard)

55%

(hard)

Question Stats:

79% (01:48) correct 21%

(01:31)

wrong

21%

(01:31)

wrong  based on 432

sessions

based on 432

sessions

History

Date

Time

Result

Not Attempted Yet

IMPROVED VERSION OF THIS QUESTION IS HERE: https://gmatclub.com/forum/i29-445720.html

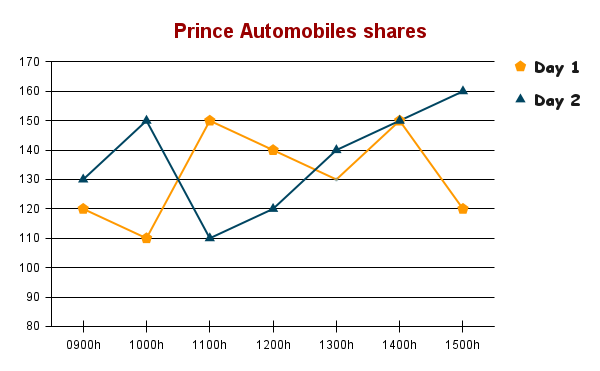

The graph below gives the fluctuation in the price of a share of Prince Automobiles over two days.

Prince Automobiles shares.png [ 20.9 KiB | Viewed 6173 times ]

An Automated Trading System A buys shares of Prince Automobiles at a certain time on Day 1 and sells the entire quantity exactly one hour after that time on Day 2.

Choose the most appropriate option from the dropdown menu below that would make the statement true based on the information provided above.

ATS A should buy the shares at on Day 1 and sell the shares at on Day 2 to maximize the profit per share.

The graph below gives the fluctuation in the price of a share of Prince Automobiles over two days.

Attachment:

Prince Automobiles shares.png [ 20.9 KiB | Viewed 6173 times ]

An Automated Trading System A buys shares of Prince Automobiles at a certain time on Day 1 and sells the entire quantity exactly one hour after that time on Day 2.

Choose the most appropriate option from the dropdown menu below that would make the statement true based on the information provided above.

ATS A should buy the shares at on Day 1 and sell the shares at on Day 2 to maximize the profit per share.

ShowHide Answer

Official Answer

Dropdown 1: 0900h

Dropdown 2: 1000h

Kudos

Bookmarks

answer: 9:00h and 10:00h

ATS A should buy the shares at 0900h on Day 1 and sell the shares at 1000h on Day 2 to maximize the profit per share.

compare the price at T hours vs price at T+1 next day. I wrote it down to avoid confusion

for 9:00 and 13:00 there is profit, rest its same/loss. for 9am the profit is 30 > 13:00 profit is 20

trap here is that we need to meet the constraint that we buy at T hours and sell at T+1 hours

hope that helps

thanks

ATS A should buy the shares at 0900h on Day 1 and sell the shares at 1000h on Day 2 to maximize the profit per share.

compare the price at T hours vs price at T+1 next day. I wrote it down to avoid confusion

for 9:00 and 13:00 there is profit, rest its same/loss. for 9am the profit is 30 > 13:00 profit is 20

trap here is that we need to meet the constraint that we buy at T hours and sell at T+1 hours

hope that helps

thanks

Kudos

Bookmarks

The OA is 900hrs on Day 1 and 1000hrs on Day 2.

Explanation:

It was mentioned in question to maximize the profit and share bought on Day 1 at T hrs must be sold on Day 2 at T+1 hrs.

On finding the maximum positive gap between the data points qualifying the above conditions.

900 hrs on day 1 and 1000 hrs on day 2 is best solution

Posted from my mobile device

Explanation:

It was mentioned in question to maximize the profit and share bought on Day 1 at T hrs must be sold on Day 2 at T+1 hrs.

On finding the maximum positive gap between the data points qualifying the above conditions.

900 hrs on day 1 and 1000 hrs on day 2 is best solution

Posted from my mobile device