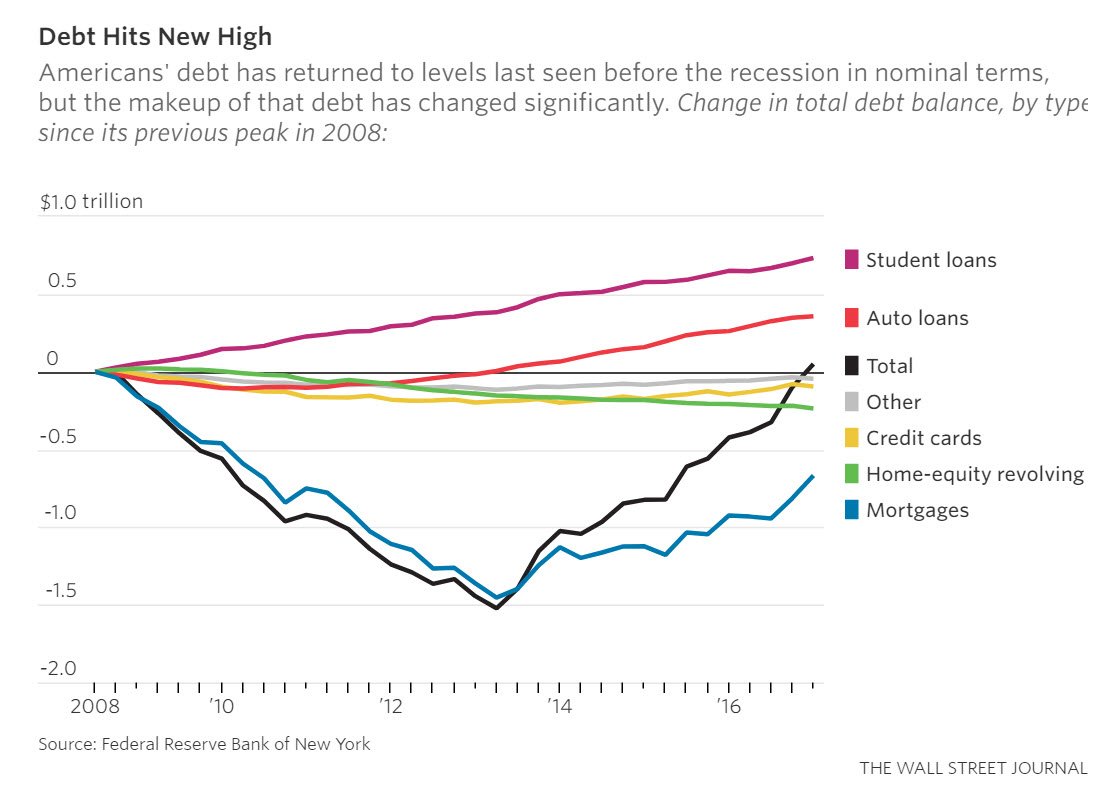

It is going to have to be dealt with in the next 5 years or sooner. I just saw a chart of US Consumer debt over the last 9 years (since the start of the crash).

At first I thought it was fake numbers since Student and other types of debt actually have different qualifications and repayment obligations (in the US anyone who is a US citizen and I am guessing permanent resident can borrow money from the government for education; no matter how bad your credit history is, you are unlikely to be denied). Other loans are much more sensitive.

Anyway, these numbers are in absolutes and they are pretty messed up. On one hand, i understand that a lot of people may have gone back to school between 2008 and 2012 to get at least some kind of employment or do something about their career, but the trend continued in years to come. There is $700 Billion worth of new student load debt out there.... and it is getting harder and harder to pay it back.

This will help for perspective: The New York Fed report said total household debt rose by $149 billion in the first three months of 2017 compared with the prior quarter to a total of $12.725 trillion An increase of $700B seems like a lot but when the total is 12 or 13 Trillion, what's another few billion, right?

Attachment:

consumer debt.jpg [ 110.36 KiB | Viewed 2403 times ]

consumer debt.jpg [ 110.36 KiB | Viewed 2403 times ]