Events & Promotions

|

|

GMAT Club Daily Prep

Thank you for using the timer - this advanced tool can estimate your performance and suggest more practice questions. We have subscribed you to Daily Prep Questions via email.

Customized

for You

Track

Your Progress

Practice

Pays

Not interested in getting valuable practice questions and articles delivered to your email? No problem, unsubscribe here.

- Nov 19

12:30 PM EST

-01:30 PM EST

Learn how Keshav, a Chartered Accountant, scored an impressive 705 on GMAT in just 30 days with GMATWhiz's expert guidance. In this video, he shares preparation tips and strategies that worked for him, including the mock, time management, and more - Nov 20

07:30 AM PST

-08:30 AM PST

Learn what truly sets the UC Riverside MBA apart and how it helps in your professional growth - Nov 20

01:30 PM EST

-02:30 PM IST

Learn how Kamakshi achieved a GMAT 675 with an impressive 96th %ile in Data Insights. Discover the unique methods and exam strategies that helped her excel in DI along with other sections for a balanced and high score. - Nov 22

11:00 AM IST

-01:00 PM IST

Do RC/MSR passages scare you? e-GMAT is conducting a masterclass to help you learn – Learn effective reading strategies Tackle difficult RC & MSR with confidence Excel in timed test environment - Nov 23

11:00 AM IST

-01:00 PM IST

Attend this free GMAT Algebra Webinar and learn how to master the most challenging Inequalities and Absolute Value problems with ease. - Nov 24

07:00 PM PST

-08:00 PM PST

Full-length FE mock with insightful analytics, weakness diagnosis, and video explanations! - Nov 25

10:00 AM EST

-11:00 AM EST

Prefer video-based learning? The Target Test Prep OnDemand course is a one-of-a-kind video masterclass featuring 400 hours of lecture-style teaching by Scott Woodbury-Stewart, founder of Target Test Prep and one of the most accomplished GMAT instructors.

Kudos

Bookmarks

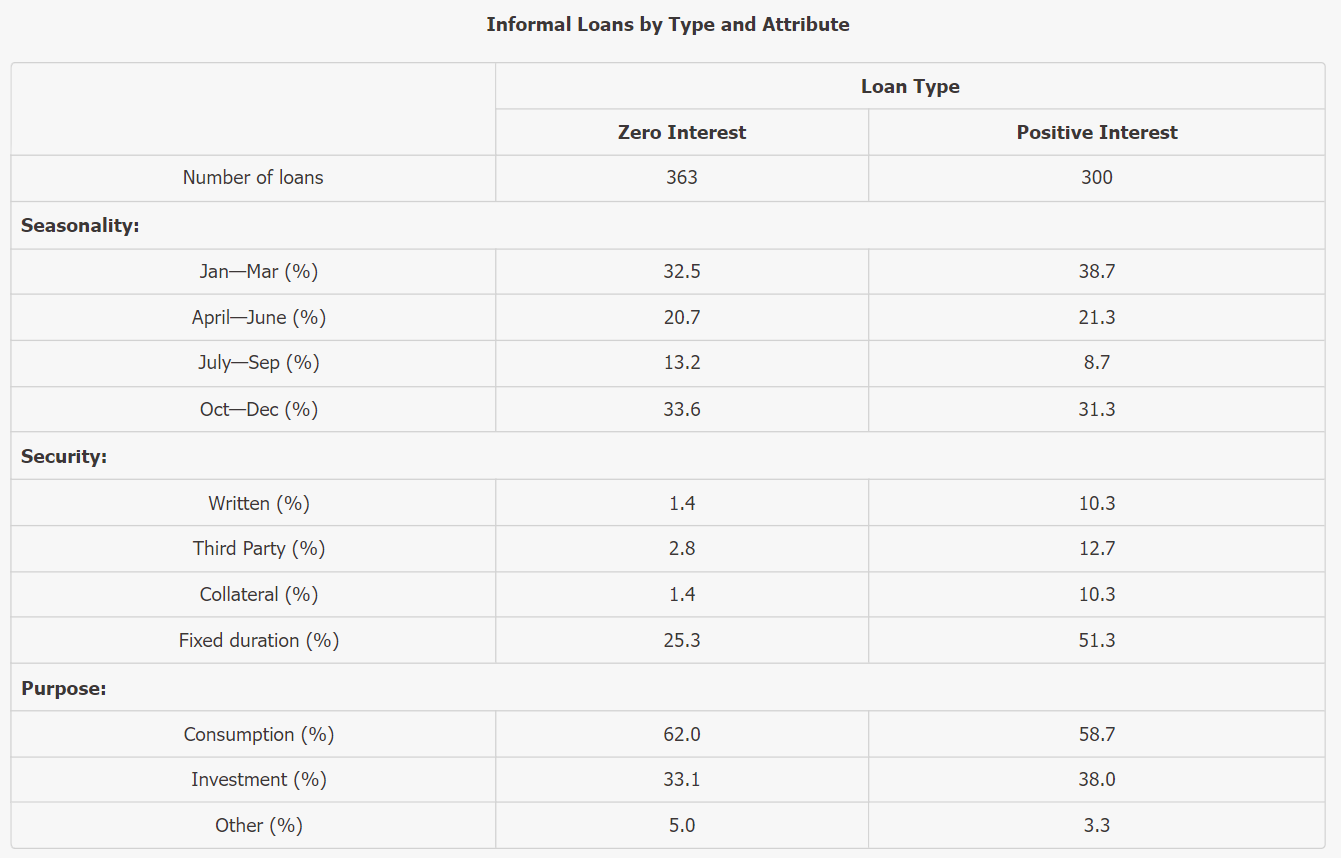

Credit in developing countries can be granted through formal or informal channels. Formal channels include institutions such as banks, credit cooperatives, and government agencies. Loans of this type accrue positive interest and are typically court enforced. Informal credit channels include relatives, friends, community members, moneylenders, rotating savings and credit associations, and informal intermediaries. Loans such as these may or may not accrue positive interest. Loans of either type may be used by the borrower for consumption or investment in a business.

In 1930s rural China, informal credit was sometimes court enforced. However, it was more often self-enforcing, especially in remote areas. With a positive–interest rate loan, the borrower would pay principal and interest. With a zero–interest rate loan, the borrower would repay the principal and provide some non-monetary resource in lieu of interest. For example, the borrower might have supplied land, labor, or draft animal services to the lender.

In 1930s rural China, informal credit was sometimes court enforced. However, it was more often self-enforcing, especially in remote areas. With a positive–interest rate loan, the borrower would pay principal and interest. With a zero–interest rate loan, the borrower would repay the principal and provide some non-monetary resource in lieu of interest. For example, the borrower might have supplied land, labor, or draft animal services to the lender.

Giving up a fixed duration of repayment in exchange for security: No

Giving up interest payments in exchange for security: No

Giving up interest payments in exchange for access to other resources: Yes

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

55%

(hard)

55%

(hard)

Question Stats:

56% (03:13) correct 44%

(03:29)

wrong

44%

(03:29)

wrong  based on 2411

sessions

based on 2411

sessions

History

Date

Time

Result

Not Attempted Yet

ID: 100318

According to the information provided, a lender who offered one of the zero–interest rate loans included in the table would accurately be described as making which of the following trade-offs? Select Yes for each option that applies. Otherwise, select No.

According to the information provided, a lender who offered one of the zero–interest rate loans included in the table would accurately be described as making which of the following trade-offs? Select Yes for each option that applies. Otherwise, select No.

| Yes | No | |

| Giving up a fixed duration of repayment in exchange for security | ||

| Giving up interest payments in exchange for security | ||

| Giving up interest payments in exchange for access to other resources |

ShowHide Answer

Official Answer

Giving up a fixed duration of repayment in exchange for security: No

Giving up interest payments in exchange for security: No

Giving up interest payments in exchange for access to other resources: Yes

The village’s mean annual interest rate in 1935 was greater than 45%.: Yes

The lender anticipated that the borrower would be unable to supply land, labor, or draft animal services in the future.: No

The village’s mean annual interest rate in 1935 was less than 20%.: No

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

45%

(medium)

45%

(medium)

Question Stats:

61% (01:45) correct 39%

(01:50)

wrong

39%

(01:50)

wrong  based on 2485

sessions

based on 2485

sessions

History

Date

Time

Result

Not Attempted Yet

ID: 100319

If one of the loans in the survey is considered at random, with no prior knowledge of the village in which it was issued, which of the following factors would, if known, increase the probability that the loan is a zero–interest rate loan? Select Yes for each option that applies on the basis of the given information. Otherwise, select No.

If one of the loans in the survey is considered at random, with no prior knowledge of the village in which it was issued, which of the following factors would, if known, increase the probability that the loan is a zero–interest rate loan? Select Yes for each option that applies on the basis of the given information. Otherwise, select No.

| Yes | No | |

| The village’s mean annual interest rate in 1935 was greater than 45%. | ||

| The lender anticipated that the borrower would be unable to supply land, labor, or draft animal services in the future. | ||

| The village’s mean annual interest rate in 1935 was less than 20%. |

ShowHide Answer

Official Answer

The village’s mean annual interest rate in 1935 was greater than 45%.: Yes

The lender anticipated that the borrower would be unable to supply land, labor, or draft animal services in the future.: No

The village’s mean annual interest rate in 1935 was less than 20%.: No

A greater number of zero–interest rate loans than positive–interest rate loans were negotiated.

Be sure to select an answer first to save it in the Error Log before revealing the correct answer (OA)!

Difficulty:

55%

(hard)

55%

(hard)

Question Stats:

60% (02:03) correct 40%

(02:15)

wrong

40%

(02:15)

wrong  based on 2394

sessions

based on 2394

sessions

History

Date

Time

Result

Not Attempted Yet

ID: 100320

The information in the table and graph most strongly indicates that which one of the following is true of the loans in the table?

The information in the table and graph most strongly indicates that which one of the following is true of the loans in the table?

| A greater number of zero–interest rate loans were negotiated in the village with the highest average annual interest rate than in the village with the second-highest rate. | |

| A greater number of zero–interest rate loans than positive–interest rate loans were negotiated. | |

| At least one zero–interest rate loan of fixed duration was used for consumption. | |

| In more than half of the villages with average annual interest rates ranging from 20% to 30%, zero–interest rate loans predominated. | |

| Among loans that were not zero–interest rate loans, the majority were issued at interest rates of less than 40%. |

ShowHide Answer

Official Answer

A greater number of zero–interest rate loans than positive–interest rate loans were negotiated.

2024-06-03_18-40-38.png [ 71.54 KiB | Viewed 20740 times ]

<br />

GID0675.gif [ 7.79 KiB | Viewed 20557 times ]

Attachment:

2024-06-03_18-40-38.png [ 71.54 KiB | Viewed 20740 times ]

Attachment:

GID0675.gif [ 7.79 KiB | Viewed 20557 times ]

Kudos

Bookmarks

The first Tab talks of type of loans and the next two tabs talk of the loans in 21 villages in 1935 in present northeast China.

Q.1 According to the information provided, a lender who offered one of the zero–interest rate loans included in the table would accurately be described as making which of the following trade-offs?

The first Tab gives us a reason of zer0-interest rate loans, and that is 'With a zero–interest rate loan, the borrower would repay the principal and provide some non-monetary resource in lieu of interest'.

Giving up a fixed duration of repayment in exchange for security..NO

Giving up interest payments in exchange for security..NO

Giving up interest payments in exchange for access to other resources..YES

Hence, No, No, Yes.

Q.2. If one of the loans in the survey is considered at random, with no prior knowledge of the village in which it was issued, which of the following factors would, if known, increase the probability that the loan is a zero–interest rate loan?

We have to look at the graph for the answer. Where does the probability on X-axis exceed 50%? It is at mean value(Y-axis) above 25%.

The village’s mean annual interest rate in 1935 was greater than 45%.... We can check that there are only two dots above 45% in Y-axis, and both these dots correspond to more than 80% on X-axis, so YES

The lender anticipated that the borrower would be unable to supply land, labor, or draft animal services in the future....Rather it is the opposite. Zero-interest loan meant that there will be no monetary transaction, and the interest that could be accrued would be compensated by resources mentioned in the option. Hence NO

The village’s mean annual interest rate in 1935 was less than 20%....There is only one dot and that gives the probability as 23%, which is below the majority mark

Hence, Yes, No, No.

Q.3. The information in the table and graph most strongly indicates that which one of the following is true of the loans in the table?

We have to restrict to the table and the table gives us the following to be true.+. 363 zero-interest vs 300 positive interest

A greater number of zero–interest rate loans than positive–interest rate loans were negotiated.

Q.1 According to the information provided, a lender who offered one of the zero–interest rate loans included in the table would accurately be described as making which of the following trade-offs?

The first Tab gives us a reason of zer0-interest rate loans, and that is 'With a zero–interest rate loan, the borrower would repay the principal and provide some non-monetary resource in lieu of interest'.

Giving up a fixed duration of repayment in exchange for security..NO

Giving up interest payments in exchange for security..NO

Giving up interest payments in exchange for access to other resources..YES

Hence, No, No, Yes.

Q.2. If one of the loans in the survey is considered at random, with no prior knowledge of the village in which it was issued, which of the following factors would, if known, increase the probability that the loan is a zero–interest rate loan?

We have to look at the graph for the answer. Where does the probability on X-axis exceed 50%? It is at mean value(Y-axis) above 25%.

The village’s mean annual interest rate in 1935 was greater than 45%.... We can check that there are only two dots above 45% in Y-axis, and both these dots correspond to more than 80% on X-axis, so YES

The lender anticipated that the borrower would be unable to supply land, labor, or draft animal services in the future....Rather it is the opposite. Zero-interest loan meant that there will be no monetary transaction, and the interest that could be accrued would be compensated by resources mentioned in the option. Hence NO

The village’s mean annual interest rate in 1935 was less than 20%....There is only one dot and that gives the probability as 23%, which is below the majority mark

Hence, Yes, No, No.

Q.3. The information in the table and graph most strongly indicates that which one of the following is true of the loans in the table?

We have to restrict to the table and the table gives us the following to be true.+. 363 zero-interest vs 300 positive interest

A greater number of zero–interest rate loans than positive–interest rate loans were negotiated.

BongBideshini

Joined: 25 May 2021

Last visit: 16 Nov 2025

Posts: 46

Given Kudos: 58

Location: India

Concentration: Entrepreneurship, Leadership

Schools: HBS '26 Stanford '26 Wharton '26

GPA: 3.8

WE:Engineering (Aerospace and Defense)

Kudos

Bookmarks

Official Answer: Q1

RO1, Giving up a fixed duration or repayment in exchange for security:

Note on the Loan Table tab in the zero-interest column that only 25.3% of zero-interest rate loans had a fixed duration. We can infer that 74.7% of zero-interest loans did not have a fixed duration. But at most 5.6% of zero-interest loans in total had any of the three types of security (and some or all of those loans may have had a fixed duration). Therefore, it would NOT generally be accurate to say that a lender who offered one of the zero-interest loans gave up a fixed duration of repayment in exchange for security.

The correct answer is No.

RO2, Giving up interest payments in exchange for security:

Note on the Loan Table tab in the zero-interest column that at most 5.6% of zero-interest rate loans in total had any of the three types of security (it could be less than 5.6% because some loans might have more than one of the types of security). So, the vast majority of lenders who offered one of the zero-interest rate loans—and therefore gave up interest payments—received no form of security. Therefore, it would NOT be accurate to say that a lender who offered one of the zero-interest loans gave up interest payments in exchange for security.

The correct answer is No.

RO3, Giving up interest payments in exchange for access to other resources:

On the Credit Discussion tab, the second paragraph states that with zero-interest loans, borrowers would repay principal and also provide some non-monetary resource in lieu of interest. Therefore, it would be accurate to say that a lender who offered one of the zero-interest rate loans gave up interest payments in exchange for access to some other resource.

The correct answer is Yes.

Official Answer: Q2

RO1, The village’s mean annual interest rate in 1935 was greater than 45%:

The table on the Loans Table tab indicates that 363 of the loans in the survey were zero-interest rate loans and 300 of the loans in the survey were positive-interest rate loans. Therefore, if a loan in the survey is chosen at random, with no prior knowledge of the village, the probability that the loan is a zero-interest rate loan is approximately 55%. Consider the graph on the Interest Rates tab. There were two villages with mean annual interest rates in 1935 greater than 45%, and in each of them greater than 80% of the loans in the village were zero-interest loans, which is greater than the percentage of all the loans that are zero-interest rate loans. Therefore, if a loan in the survey is considered at random, knowing that the loan was in a village having a mean annual interest rate in 1935 greater than 45% is a factor that increases the probability that the loan is a zero-interest rate loan.

The correct answer is Yes.

RO2, The lender anticipated that the borrower would be unable to supply land, labor, or draft services in the future.

The Credit Discussion tab indicates that in lieu of interest, the lender of a zero-interest rate loan expects to receive from the borrower non-monetary resources such as land, labor, or draft services. Therefore, if a loan in the survey is considered at random, knowing that the borrower would be unable to supply land, labor, or draft services in the future makes it LESS probable that the loan is a zero-interest rate loan.

The correct answer is No.

RO3, The village’s mean annual interest rate in 1935 was less than 20%.

The table on the Loans Table tab indicates that 363 of the loans in the survey were zero-interest rate loans and 300 of the loans in the survey were positive-interest rate loans. Therefore, if a loan in the survey is chosen at random, with no prior knowledge of the village, the probability that the loan is a zero-interest rate loan is approximately 55%. Consider the graph on the Interest Rates tab. There was exactly one village with mean annual interest rates in 1935 less than 20%, and in that village less than 25% of loans were zero-interest rate loans, which is less than the percentage of all the loans that were zero-interest rate loans. Therefore, if a loan in the survey is considered at random, knowing that the loan was in a village having a mean annual interest rate in 1935 that was less than 20% makes it LESS probable that the loan is a zero-interest rate loan.

The correct answer is No.

Official Answer: Q3

The table on the indicates that there were 363 zero-interest rate loans and only 300 positive-interest rate loans.

The correct answer is A greater number of zero-interest rate loans than positive-interest rate loans were negotiated.

RO1, Giving up a fixed duration or repayment in exchange for security:

Note on the Loan Table tab in the zero-interest column that only 25.3% of zero-interest rate loans had a fixed duration. We can infer that 74.7% of zero-interest loans did not have a fixed duration. But at most 5.6% of zero-interest loans in total had any of the three types of security (and some or all of those loans may have had a fixed duration). Therefore, it would NOT generally be accurate to say that a lender who offered one of the zero-interest loans gave up a fixed duration of repayment in exchange for security.

The correct answer is No.

RO2, Giving up interest payments in exchange for security:

Note on the Loan Table tab in the zero-interest column that at most 5.6% of zero-interest rate loans in total had any of the three types of security (it could be less than 5.6% because some loans might have more than one of the types of security). So, the vast majority of lenders who offered one of the zero-interest rate loans—and therefore gave up interest payments—received no form of security. Therefore, it would NOT be accurate to say that a lender who offered one of the zero-interest loans gave up interest payments in exchange for security.

The correct answer is No.

RO3, Giving up interest payments in exchange for access to other resources:

On the Credit Discussion tab, the second paragraph states that with zero-interest loans, borrowers would repay principal and also provide some non-monetary resource in lieu of interest. Therefore, it would be accurate to say that a lender who offered one of the zero-interest rate loans gave up interest payments in exchange for access to some other resource.

The correct answer is Yes.

Official Answer: Q2

RO1, The village’s mean annual interest rate in 1935 was greater than 45%:

The table on the Loans Table tab indicates that 363 of the loans in the survey were zero-interest rate loans and 300 of the loans in the survey were positive-interest rate loans. Therefore, if a loan in the survey is chosen at random, with no prior knowledge of the village, the probability that the loan is a zero-interest rate loan is approximately 55%. Consider the graph on the Interest Rates tab. There were two villages with mean annual interest rates in 1935 greater than 45%, and in each of them greater than 80% of the loans in the village were zero-interest loans, which is greater than the percentage of all the loans that are zero-interest rate loans. Therefore, if a loan in the survey is considered at random, knowing that the loan was in a village having a mean annual interest rate in 1935 greater than 45% is a factor that increases the probability that the loan is a zero-interest rate loan.

The correct answer is Yes.

RO2, The lender anticipated that the borrower would be unable to supply land, labor, or draft services in the future.

The Credit Discussion tab indicates that in lieu of interest, the lender of a zero-interest rate loan expects to receive from the borrower non-monetary resources such as land, labor, or draft services. Therefore, if a loan in the survey is considered at random, knowing that the borrower would be unable to supply land, labor, or draft services in the future makes it LESS probable that the loan is a zero-interest rate loan.

The correct answer is No.

RO3, The village’s mean annual interest rate in 1935 was less than 20%.

The table on the Loans Table tab indicates that 363 of the loans in the survey were zero-interest rate loans and 300 of the loans in the survey were positive-interest rate loans. Therefore, if a loan in the survey is chosen at random, with no prior knowledge of the village, the probability that the loan is a zero-interest rate loan is approximately 55%. Consider the graph on the Interest Rates tab. There was exactly one village with mean annual interest rates in 1935 less than 20%, and in that village less than 25% of loans were zero-interest rate loans, which is less than the percentage of all the loans that were zero-interest rate loans. Therefore, if a loan in the survey is considered at random, knowing that the loan was in a village having a mean annual interest rate in 1935 that was less than 20% makes it LESS probable that the loan is a zero-interest rate loan.

The correct answer is No.

Official Answer: Q3

The table on the indicates that there were 363 zero-interest rate loans and only 300 positive-interest rate loans.

The correct answer is A greater number of zero-interest rate loans than positive-interest rate loans were negotiated.